Whitecap Resources Stock: To Buy or Not to Buy in 2022?

Written by Kay Ng at The Motley Fool Canada

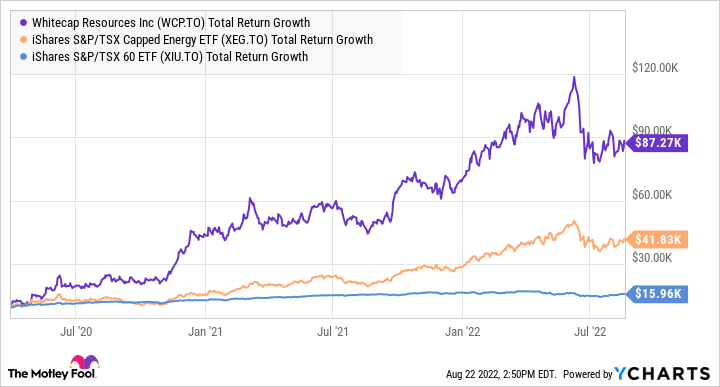

Whitecap Resources (TSX:WCP) stock is an outperformer versus the energy sector. Below is how a $10,000 initial investment grew in different time periods between Whitecap stock and iShares S&P/TSX Capped Energy Index ETF, as an industry proxy.

First, from the pandemic market crash bottom, the energy stock has been roughly a nine-bagger. The energy ETF, in comparison, has been inferior. I also threw in iShares S&P/TSX 60 Index ETF as a Canadian stock market proxy. As the graph illustrates, when the environment is favourable for energy stocks, they can beat the market by strides.

WCP Total Return Level data by YCharts

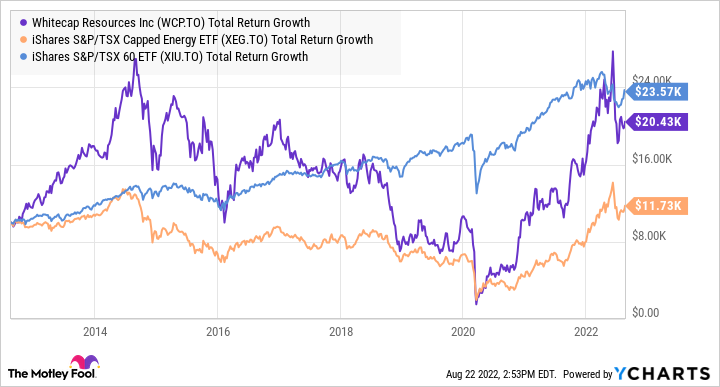

The longer-term performance, over 10 years, show a bigger picture. Specifically, energy stocks have been much more volatile than the Canadian stock market. This suggests that energy business results are much more unpredictable and, therefore, energy stocks require active investing.

WCP Total Return Level data by YCharts

Whitecap Resources stock’s recent business performance

In the first half of the year (H1), the oil-weighted producer’s profits skyrocketed, as energy prices were high. Specifically, it realized crude oil, natural gas liquids, and natural gas prices that were 76%, 82%, and 93% higher year over year.

Funds flow came in 160% higher at $1.18 billion. On a per-share basis, it was 138% higher at $1.88. After accounting for dividends and capital investments, the payout ratio was 34% — about 12% lower than a year ago. The company also cut its net debt by more than half.

Other than reinvesting into the company and paying down debt, the oil stock also doubled its dividend and repurchased shares. WCP ended the second quarter with a debt-to-EBITDA ratio of 0.5 times, which is well within its target of less than or equal to four times. This ratio gives lots of wiggle room for changes in the EBITDA, a cash flow proxy, should we see a meaningful drop in energy prices.

Whitecap Resources stock: To buy or not to buy?

The West Texas Intermediate (WTI) oil price remains at elevated levels — about US$90 per barrel at writing. Management stress tests the price down to US$50 per barrel.

In H1, Whitecap’s average daily production was 132,491 barrels of oil equivalent per day (boe/d), which was almost 25% higher versus H1 2021. It’s further boosting production with acquisitions.

In late June, Whitecap announced the acquisition of XTO Energy Canada for a net purchase price of $1.7 billion in an all-cash transaction. The acquisition will add 32,000 boe/d and should close this quarter.

The XTO assets already generate substantial free funds flow. Management believes it can lead to free funds flow per share accretion of 20% in 2023 and 2024. Production is expected to grow to an optimized 50,000 to 60,000 boe/d over the next three to five years.

At $9.25 per share, the energy stock trades at below three times cash flow. Across 14 analysts, WCP stock’s 12-month stock price target is $15.30. This represents a meaningful 40% discount and 65% near-term upside potential. Additionally, its yield of about 4.8% paid out as monthly eligible dividends is competitive.

Canadian investors who are bullish on energy prices can consider taking a position in Whitecap Resources stock, as it’s on sale, even if you account for a slip in energy prices. Because it’s a high-risk stock, it may be smart to consider actively investing in a non-registered account by aiming to buy and sell opportunistically.

The post Whitecap Resources Stock: To Buy or Not to Buy in 2022? appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Whitecap Resources Inc.?

Before you consider Whitecap Resources Inc., you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2022 ... and Whitecap Resources Inc. wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 27 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/8/22

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

2022

Yahoo Finance

Yahoo Finance