While Rhythm Pharmaceuticals (NASDAQ:RYTM) shareholders have made 125% in 1 year, increasing losses might now be front of mind as stock sheds 3.2% this week

It hasn't been the best quarter for Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) shareholders, since the share price has fallen 19% in that time. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 125% in that time. So it is important to view the recent reduction in price through that lense. The real question is whether the business is trending in the right direction.

While the stock has fallen 3.2% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Rhythm Pharmaceuticals

Given that Rhythm Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Rhythm Pharmaceuticals saw its revenue grow by 174%. That's well above most other pre-profit companies. Meanwhile, the market has paid attention, sending the share price soaring 125% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

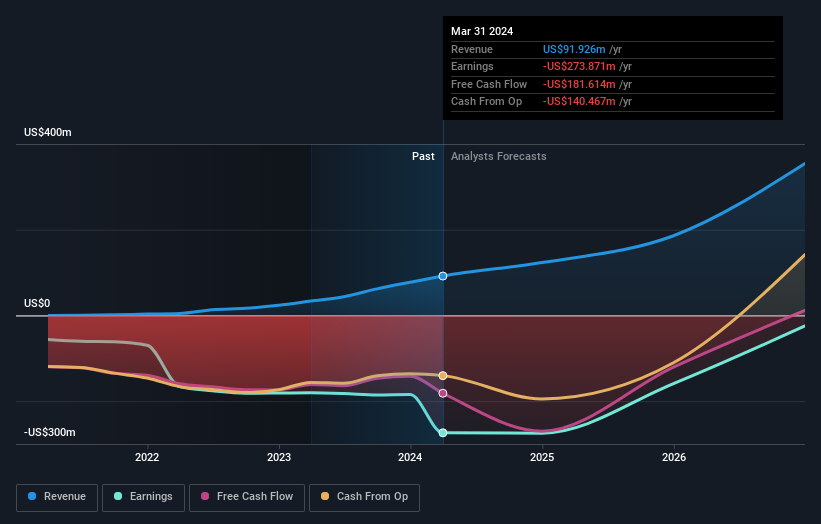

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Rhythm Pharmaceuticals' financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Rhythm Pharmaceuticals has rewarded shareholders with a total shareholder return of 125% in the last twelve months. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Rhythm Pharmaceuticals , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance