Where to Invest $10,000 in June

Written by Brian Paradza, CFA at The Motley Fool Canada

Interest rates are falling in Canada. The Bank of Canada (BOC) recently announced a 0.25% interest rate cut for the first time in years, reducing policy rates to 4.75%. Investors who wish to tactically invest new capital in June 2024 may wish to re-evaluate their medium-term strategies to potentially maximize total returns in a falling interest rate environment.

Are you wondering where to invest $10,000 as interest rates fall? Falling interest rates have historically correlated with higher stock market returns — in general. This could be true for both recessionary and non-recessionary economic regimes. But it’s not just the TSX that may produce exciting returns as the BOC softens its stance. Many more assets could generate positive capital gains for investors ready to make tactical modifications to their portfolios.

Which investment assets perform better as interest rates fall?

Historically, some assets perform better than others in a falling interest rate environment — more so if the market anticipates further rate cuts and no near-term recession down the road.

Most investments negatively impacted by interest rate increases of 2022 should do better as the BOC reverses gears.

Stocks generally do well, and growth stocks, especially the most speculative ones lacking profits and experiencing negative cash flows, may find trading solace following interest rate cuts.

Even better, highly leveraged (heavily borrowed) assets, including Canadian real estate investment trusts (REITs) and utilities, should do well as discount rates and borrowing costs fall.

Further, long-dated, fixed-income assets, including 10-year government bonds, appreciate as discount rates fall with lower interest rates. Large-cap, dividend-paying stocks usually perform well as interest rates decline, mostly for two reasons: discount rates on their dividend cash flows decrease, and their costs of capital fall during periods of declining interest rates.

Within stocks, cyclical sectors may do better as rates fall. Investors may expect technology stocks, real estate, and consumer discretionary stocks to do well following June’s rate cut.

Even better, small-cap stocks may outperform large-caps within a year following an initial rate cut, especially if their earnings improve in the coming years. Most small caps usually have unproven track records, lack profits, and have the vast majority of their derived from future growth opportunities, which are heavily discounted for uncertainty and the time value of money. Reductions in interest rates may reduce discount rates and improve small-cap value estimates.

What to buy with $10,000 this month?

To profit during a declining interest rate environment, investors could buy low-cost exchange-traded funds (ETFs) that passively track small-caps, REITs, long-dated bonds, large-cap dividend stocks, and other targeted indices to maintain wide diversification.

For example, iShares S&P/TSX SmallCap Index ETF (TSX:XCS) has already delivered a 9.8% year-to-date gain that widely outperforms the broader TSX’s 4.4% capital gain so far this year. Blackrock, the professional fund manager, charges a low 0.55% management fee per annum to the ETF, and investors incur a low management expense ratio of 0.6% or just $6 per every $1,000 invested each year.

Canadian small caps are hot in 2024, and a $10,000 investment could capture some of the ETF’s positive momentum if rates fall further.

Further, Canadian REITs could continue to recover from multi-year losses if the BOC cut rates further. Income-oriented investors with a medium-term (two- to five-year) horizon may load up on beaten-down REITs in June, lock in some respectable distribution yields, and anticipate positive capital gains as property values recover.

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN) is a top-quality REIT that currently trades at double-digit discounts to its net asset value (NAV), despite maintaining strong portfolio occupancy rates, low leverage, and expecting positive same-property net operating income growth in 2024 as it renews expiring leases at higher market rates. Current portfolio rental rates for Canadian industrial REITs have remained significantly below market rates since the pandemic. I’m bullish on Canada’s two largest industrial REITs for 2024.

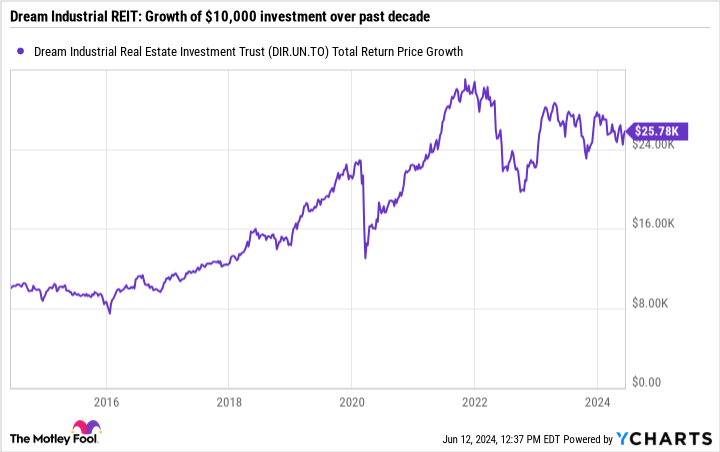

Interestingly, regardless of some weakness induced by historic rate hikes of 2022, a $10,000 investment in Dream Industrial REIT units 10 years ago could have grown to nearly $26,000 today, with distribution reinvestment.

DIR.UN Total Return Price data by YCharts

A similar-sized investment in June could generate almost $560 per annum, paid as monthly distributions, while units could rise again with recovering Canadian real estate prices.

The post Where to Invest $10,000 in June appeared first on The Motley Fool Canada.

Should you invest $1,000 in Dream Industrial REIT right now?

Before you buy stock in Dream Industrial REIT, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dream Industrial REIT wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $17,363.76!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 26 percentage points since 2013*.

See the 10 stocks * Returns as of 6/3/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Dream Industrial Real Estate Investment Trust and Granite Real Estate Investment Trust. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance