What's in Store for Commercial Metals (CMC) in Q3 Earnings?

Commercial Metals Company CMC is scheduled to report third-quarter fiscal 2024 results on Jun 20, before the opening bell.

Q1 Estimates

The Zacks Consensus Estimate for fiscal third-quarter revenues is pegged at $2.01 billion, indicating a 14.5% decline from the prior-year quarter’s reported figure. The same for earnings is pegged at $1.00 per share, implying a 50.5% decline from the year-ago period’s actual.

Q2 Performance

In the last reported quarter, the company’s top and bottom lines surpassed the Zacks Consensus Estimate. Earnings and revenues declined year over year. The company has a trailing four-quarter average earnings surprise of 10.3%.

Key Factors to Consider

The demand for Commercial Metals’ finished steel products in North America has been strong. Downstream bid volumes, which are significant indicators of the construction project pipeline, have been improving and are expected to have led to higher backlog levels. Demand from the industrial end markets is likely to have been stable.

Volumes in Europe are expected to have been impacted by the weak market conditions. In response to market imbalances, the Polish long steel industry has significantly reduced production and inventory levels. This is expected to have dented the company’s margin in the quarter under review.

Our model expects the North America Steel Group segment to generate $1.6 billion in revenues in the fiscal third quarter, indicating a year-over-year dip of 12.1%. The estimate for the segment’s adjusted EBITDA is pegged at $224 million.

The estimate for Europe Steel Group segment’s revenues is pegged at $239 million, indicating a 27.8% year-over-year decline . Our model expects the segment’s adjusted EBITDA to be a negative $0.1 million.

Our model expects the Emerging Businesses Group segment to generate $162 million in revenues in the fiscal third quarter, indicating a year-over-year dip of 14.3%. The estimate for the segment’s adjusted EBITDA is pegged at $29.7 million.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Commercial Metals this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Commercial Metals is 0.00%.

Zacks Rank: Commercial Metals currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

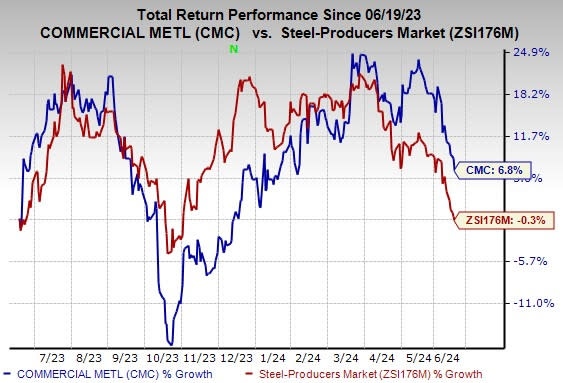

Price Performance

Commercial Metal’s shares have gained 6.8% in the past year against the industry’s 0.3% fall.

Image Source: Zacks Investment Research

Stocks Worth a Look

Here are some stocks, which have the right combination of elements to post an earnings beat in their upcoming releases.

Agnico Eagle Mines Limited AEM is expected to report second-quarter 2024 results soon. The company has an Earnings ESP of +1.24% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for AEM’s fiscal second-quarter earnings is pegged at 81 cents per share. The same for revenues is pegged at $1.72 billion. AEM has a trailing four-quarter average surprise of 16.5%.

Dow Inc. DOW is expected to report second-quarter 2024 results on Jul 25. The company has an Earnings ESP of +14.86% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for DOW’s second-quarter earnings is pegged at 75 cents per share. The same for revenues is pegged at $11 billion. DOW has a trailing four-quarter average surprise of 11.4%.

Reliance, Inc. RS is expected to report second-quarter 2024 results on Jul 25. The company has an Earnings ESP of +0.14% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for RS’s second-quarter earnings is pegged at $4.74 per share. The same for revenues is pinned at $3.60 billion. It has a trailing four-quarter average surprise of 4.5%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance, Inc. (RS) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance