What's in the Offing for Stanley Black (SWK) in Q1 Earnings?

Stanley Black & Decker, Inc. SWK is scheduled to release first-quarter 2023 results on May 4, before the market open.

The Zacks Consensus Estimate for Stanley Black’s first-quarter earnings has remained steady in the past 60 days. SWK delivered better-than-expected results thrice in the last four quarters and missed the mark once, the earnings surprise being 20.6%, on average.

Let’s see how things are shaping up for Stanley Black this earnings season.

Factors to Note

A soft demand environment is likely to have hurt SWK’s first-quarter performance. A decrease in the construction of new houses and remodeling activity is likely to have weighed on volumes.

Given Stanley Black’s substantial international presence, foreign-currency headwinds are expected to have affected its top line in the to-be-reported quarter. The Zacks Consensus Estimate for SWK’s revenues in the first quarter suggests a 10% decline from the year-ago quarter’s reported number. We expect revenues to fall 11.4% from the year-ago period’s reported figure.

The Tools & Outdoor segment is expected to have put up a weak show due to reduced retail and consumer demand and the resultant softness in volumes. The Zacks Consensus Estimate for the Tools & Outdoor segment’s revenues indicates a 12.5% decrease from the year-ago reported figure. Our estimate for the segment’s revenues in the first quarter indicates a 12.1% decline from the year-ago reported number.

However, SWK’s Industrial segment is expected to have benefited from strong backlogs and healthy demand for aerospace fasteners. The ongoing recovery in commercial OEM production and strength in the Engineered Fastening business is also expected to have aided the unit’s performance.

Cost-control measures are expected to have supported Stanley Black’s margin performance and driven its bottom line.

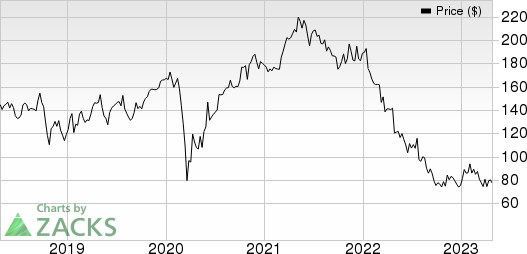

Stanley Black & Decker, Inc. Price and EPS Surprise

Stanley Black & Decker, Inc. price-eps-surprise | Stanley Black & Decker, Inc. Quote

What Does the Zacks Model Say?

Our proven model does not conclusively predict an earnings beat for SWK this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as elaborated below.

Earnings ESP: SWK has an Earnings ESP of +6.85% as the Most Accurate Estimate is pegged at a loss of 68 cents, lesser than the Zacks Consensus Estimate of a loss of 73 cents. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: SWK presently carries a Zacks Rank #5 (Strong Sell).

Highlights of Q4 Earnings

Stanley Black incurred a loss of 10 cents per share in the fourth quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of 33 cents. However, the bottom line decreased 104.7% from the year-ago quarter’s earnings of $2.14. Stanley Black’s net sales were $3,986.8 million, reflecting year-over-year growth of 0.1%. Its top line beat the consensus estimate of $3,860 million.

Stocks to Consider

Here are some companies within the broader Industrial Products sector, which according to our model, have the right combination of elements to beat on earnings this reporting cycle.

A. O. Smith Corporation AOS has an Earnings ESP of +10.19% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is scheduled to release first-quarter 2023 results on Apr 27. AOS’ earnings have surpassed the Zacks Consensus Estimate in three of the preceding four quarters while matching in one, the average beat being 3.2%.

Illinois Tool Works ITW has an Earnings ESP of +1.05% and a Zacks Rank of 3. The company is slated to release first-quarter 2023 results on May 2.

Illinois Tool’s earnings have surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 0.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance