What's in the Cards for Northern Trust's (NTRS) Q2 Earnings?

Northern Trust Corporation’s NTRS second-quarter results, scheduled for a Jul 24 release, are expected to reflect a year-over-year fall in earnings, while revenues might increase.

Northern Trust uses a lag effect to calculate its corporate custody and investment management fees, i.e. the computations are based on the prior-quarter end valuations. Since the performance of equity markets was strong in the second quarter, the company will likely be able to register growth in custody, servicing and management fees.

Notably, the company provides majority of its asset-management services through the C&IS unit, which generates more than 50% of total revenues. A rise in revenues in this segment will boost the company’s overall revenues. Further, the Zacks Consensus Estimate of $1.5 billion for the to-be-reported quarter’s sales reflects a year-over-year rise of 0.04%.

Per the Zacks Consensus Estimate, the C&I segment’s custody and fund administration fees are likely to flare up 3.2% sequentially to $387 million. Furthermore, investment management and securities lending revenues are projected to be up 3.8% and 4.2% sequentially, respectively.

Therefore, with steady performance of its components, total C&I trust, investment and other servicing fees are likely to escalate 3% sequentially to $551 million.

Let’s have a look at what our quantitative model predicts:

Northern Trust does not has the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Northern Trust is +0.42%.

Zacks Rank: Northern Trust’s currently carries a Zacks Rank of 5, which decreases the predictive power of ESP.

It should be noted that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement.

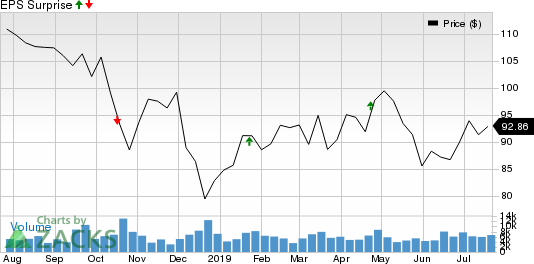

Northern Trust Corporation Price and EPS Surprise

Northern Trust Corporation price-eps-surprise | Northern Trust Corporation Quote

Here are the other factors that might influence the company’s Q2 performance:

Controlled Expenses: With Northern Trust’s cost-saving initiatives underway, expenses in the quarter are anticipated to be under control.

Foreign Exchange Trading Revenues to Remain Low: Given the lower foreign exchange (“FX”) trading volatility and reduced volumes in the April-June quarter, the company’s revenues from FX trading might remain low for the quarter.

Net Interest Income (NII) Might Disappoint: A soft lending scenario during the to-be-reported quarter is predicted to impede growth in net interest income (NII) to an extent. Particularly, weakness in revolving home equity loans, commercial and industrial (C&I), and commercial real estate loans might offset growth in consumer loans. Moreover, the company’s net interest margin might be affected due to the yield-curve flattening, the Fed’s accommodative policy stance and steadily rising deposit betas.

Notably, average earnings assets are likely to decrease, thus, unfavorably impacting the company’s NII. The consensus estimate of $108.5 billion reflects a 2.3% sequential decline in earning assets.

Further, activities of the company during the quarter under review were inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for earnings of $1.68 remained unchanged over the last seven days. The figure also reflects a year-over-year decline of 2.3%.

Stocks That Warrant a Look

Here are some stocks you may want to consider, as according to our model these have the right combination of elements to post an earnings beat this quarter.

Ares Capital Corporation ARCC is slated to release results on Jul 30. The company has an Earnings ESP of +1.02% and carries a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Franklin Resources, Inc. BEN is +0.13% and the stock flaunts a Zacks Rank of 1. The company is scheduled to report quarterly numbers on Jul 30.

TD Ameritrade Holding Corporation AMTD has an Earnings ESP of +0.03% and holds a Zacks Rank of 3. It is set to report June quarter-end results on Jul 22.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance