What's in the Cards for Annaly (NLY) This Earnings Season?

Annaly Capital Management Inc. NLY is scheduled to report first-quarter 2024 results on Apr 24, after market close. The company’s results are expected to reflect a decline in earnings from the year-ago reported figure. However, net interest income (NII) is expected to have increased.

In the last reported quarter, the mortgage real estate investment trust (mREIT) posted earnings available for distribution per share of 68 cents, which surpassed the Zacks Consensus Estimate of 64 cents. Annaly registered year-over-year declines in book value per share , while the average yield on interest-earning assets improved.

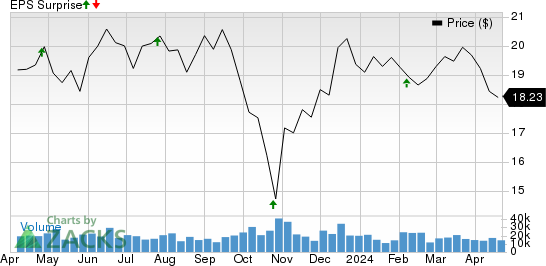

NLY’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 6.16%. The graph below depicts this surprise history:

Annaly Capital Management Inc Price and EPS Surprise

Annaly Capital Management Inc price-eps-surprise | Annaly Capital Management Inc Quote

Let us see how things have shaped up prior to the first-quarter earnings announcement.

In the quarter under review, agency MBS spreads were relatively stable. This is expected to have driven NLY’s tangible book value.

In the first quarter, the 30-year fixed-mortgage rates increased to 6.79% from 6.61% as of the fourth-quarter 2023 end, indicating low prepayment speed. The climb in mortgage rates, which kept home buyers on the sidelines, led to a smaller origination market, both purchase and refinancing, than the prior-year quarter.

Also, while the Fed paused interest rate hikes in first-quarter 2024, interest rates remained at a 22-year high of 5.25-5.5%.

Hence, due to high interest rates and low prepayment speed, the company’s MSR portfolio is likely to have improved, thereby driving servicing fees. The Zacks Consensus Estimate for net servicing income of $95 million indicates a sequential increase of 9.2%.

Lower levels of refinancing are anticipated to have reduced prepayment speed and alleviated pressure from Annaly’s MBS holdings. This is expected to have reduced net premium amortization in the first quarter, offering scope for growth in interest income and average asset yield.

The consensus estimate for first-quarter NII of $320 million indicates a substantial rise from the year-ago reported figure.

Nonetheless, given the high interest rates in the quarter, the company is expected to have seen higher funding costs. This is likely to have increased costs of interest-bearing liabilities for NLY in the first quarter.

Lastly, the company’s activities in the first quarter were inadequate to gain analysts’ confidence. Consequently, the Zacks Consensus Estimate for first-quarter earnings has been revised marginally downward to 64 cents in a month. This indicates a year-over-year decline of 21%.

Earnings Whispers

Our proven model does not show that an earnings beat is likely for NLY this time around. This is because the company does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Earnings ESP: Annaly has an Earnings ESP of -7.33%.

Zacks Rank: NLY currently carries a Zacks Rank of 4 (Sell).

Stocks Worth a Look

Two stocks from the broader REIT sector, which you may want to consider, as our model shows that these have the right combination of elements to report a surprise this time around, are Welltower WELL and Public Storage PSA.

Welltower is scheduled to report quarterly numbers on Apr 29. WELL presently has an Earnings ESP of +1.53% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Public Storage is slated to report quarterly numbers on Apr 30. PSA currently has an Earnings ESP of +1.12% and a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance