What profit margins reveal about the market

Note: A version of this article was published at TKer.co.

Stocks ticked higher last week, with the S&P 500 rising 0.4% to close at 4,327.78. The index is now up 12.7% year to date, up 21% from its Oct. 12, 2022, closing low of 3,577.03, and down 9.8% from its Jan. 3, 2022, record closing high of 4,796.56.

Q3 earnings season kicked off this past week on a bullish note, with big banks like JPMorgan and Citigroup announcing better-than-expected financial results.

According to FactSet, analysts expect S&P 500 companies to report a second consecutive quarter of earnings growth following a brief earnings recession.

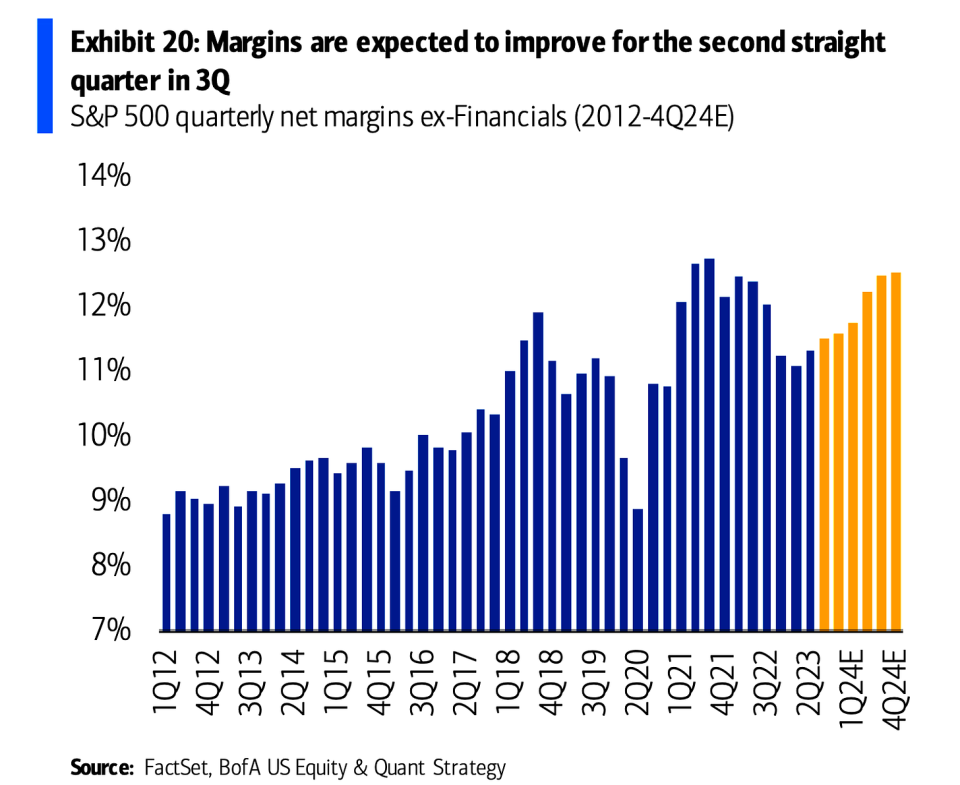

Perhaps the most controversial assumption embedded in these earnings forecasts is the expectation that profit margins will expand again.

Historically high profit margins have been a controversial issue in recent years.

As inflation rates surged in 2021, analysts were convinced rising costs would crush profit margins. But the opposite happened: Profit margins actually rose to record levels. During this period, many companies were able to pass higher costs to their customers through higher prices. Combined with improved operating efficiencies, this dynamic led to record profits. It was a reminder that it’s "dangerous to underestimate Corporate America."

Surprising to some, high profit margins have persisted. And after a modest dip in recent quarters, profit margin expansion resumed in Q2.

How were margins in Q3, and what’s management’s outlook for margins in the quarters and years to come?

Almost every major macroeconomic narrative in one way or another is reflected in margins.

Demand: If customer demand is weak, companies may cut prices to move volume, which is bad for margins. If volumes fall, margins may also fall if companies can’t quickly adjust costs.

Inflation: If the unit cost of goods falls, then companies may benefit from a margin tailwind. However, companies would offset this tailwind if they also cut prices.

Labor: If workers have leverage, they may demand higher wages, which could pressure margins if companies aren’t able to pass those higher costs on to their customers.

Capex, AI: If companies have been upgrading their equipment and workflows, the improved productivity should manifest as higher profit margins.

Interest rates: Interest rates have been on the rise. If companies rely on short-term debt or they’ve had to recently refinance long-term debt, then their interest expenses may be up, which should pressure net margins. But it’s also worth remembering that many companies sit on a healthy amount of cash, which is likely generating an increasing amount of interest income.

While a lot of attention is paid on earnings "beats" and "misses," the role of profit margins in the bottom line results may be far more telling.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

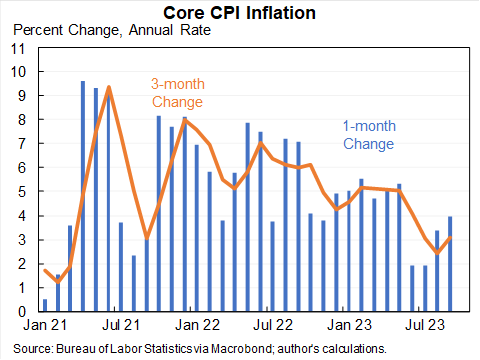

Inflation is cooling. The Consumer Price Index (CPI) in September was up 3.7% from a year ago. Adjusted for food and energy prices, core CPI was up 4.1%, the lowest since September 2021.

On a month-over-month basis, CPI was up 0.4%, driven by a 1.5% rise in energy prices. Core CPI was up 0.3%.

On an annualized basis, monthly core CPI was up 3.9%. On a three-month annualized basis, it was 3.1%.

The bottom line is that while inflation rates have been trending lower, many measures continue to be above the Federal Reserve’s target rate of 2%.

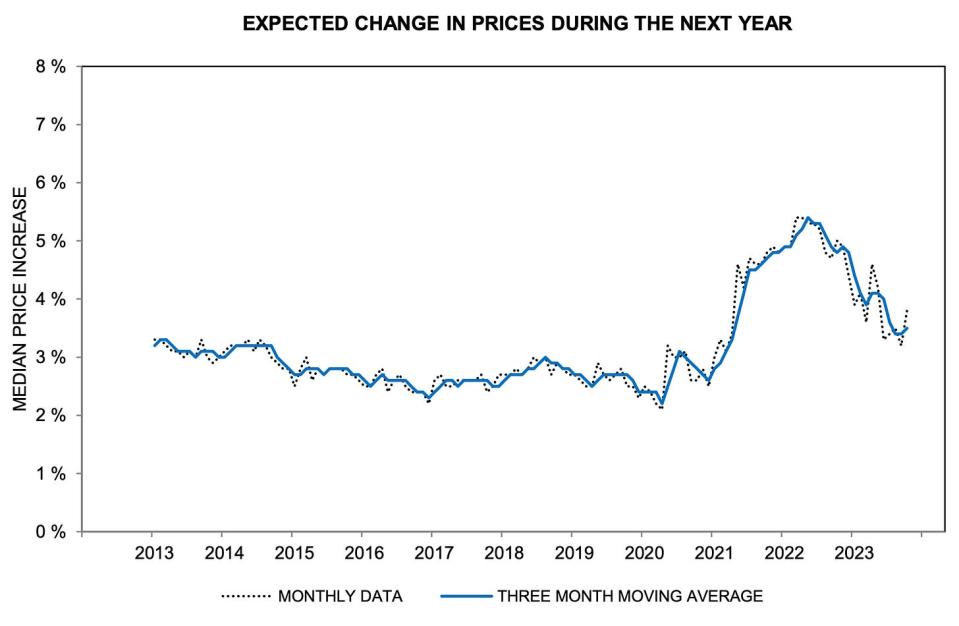

Inflation expectations are mixed. The New York Fed’s September Survey of Consumer Expectations was mixed. From their report: "Median inflation expectations increased by 0.1 and 0.2 percentage points at the one- and three-year-ahead horizons to 3.7% and 3.0%, respectively. In contrast, median inflation expectations decreased by 0.2 percentage point to 2.8% at the five-year-ahead horizon."

From the University of Michigan’s October Survey of Consumers: "Year-ahead inflation expectations rose from 3.2% last month to 3.8% this month. The current reading is the highest since May 2023 and remains well above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations edged up from 2.8% last month to 3.0% this month, again staying within the narrow 2.9-3.1% range for 25 of the last 27 months. Long-run inflation expectations remain elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic."

Gas prices fall. From AAA: "Domestic pump prices maintained their daily decline despite the uncertainty rippling through the oil market in the days since Hamas terrorists attacked Israel. Oil prices have risen a few dollars per barrel this week, but that is far from the roughly $40 per barrel temporary spike following last year’s Russian invasion of Ukraine. The critical difference is that Russia is a significant oil producer, while Israel and the Palestinian territories are not. The national average for a gallon of gas fell 12 cents since last week to $3.64."

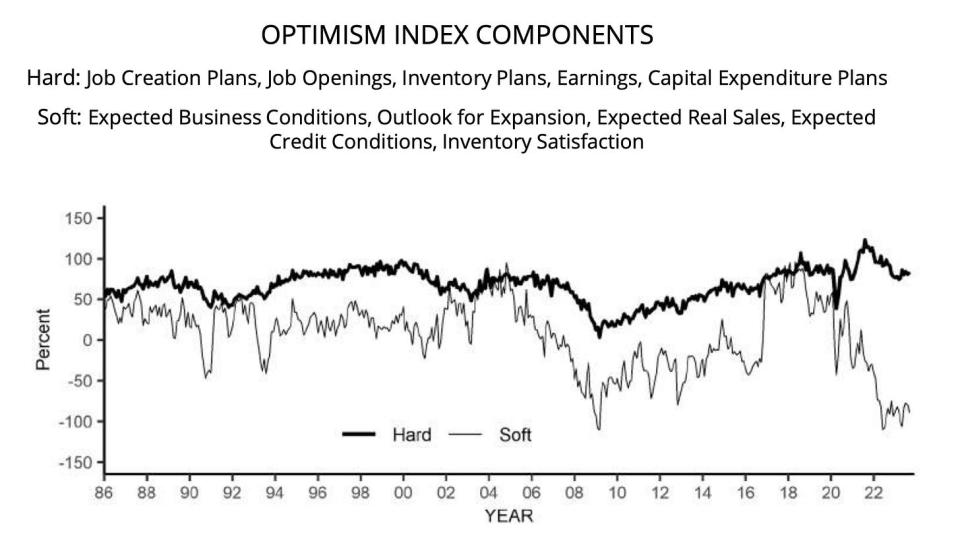

Small business optimism ticks lower. The NFIB’s Small Business Optimism Index declined in September.

Importantly, the more tangible "hard" components of the index continue to hold up much better than the more sentiment-oriented "soft" components.

Keep in mind that during times of stress, soft data tends to be more exaggerated than actual hard data.

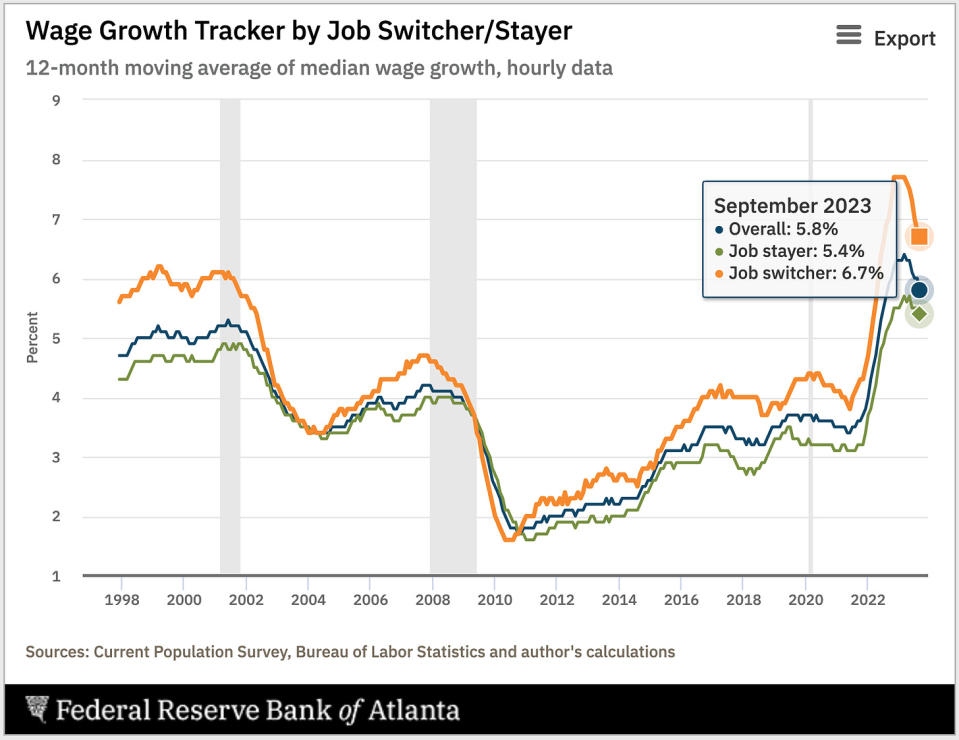

Job switchers lose pay advantage. According to the Atlanta Fed’s wage growth tracker, the gap wage growth between those who switch jobs and those who stay at their jobs continues to close. Job switchers saw 6.7% wage growth in the 12 months ending in September, whereas job stayers saw 5.4% growth during the period.

Many workers are on strike. From BofA: "Most strikes in 40 years could mean higher wages & lower margins: 420,000 US workers have gone on strike in 2023. The number could rise to 545,000, a 40-year record, if the UAW strikes expand. Direct and indirect labor costs account for 76% of company costs."

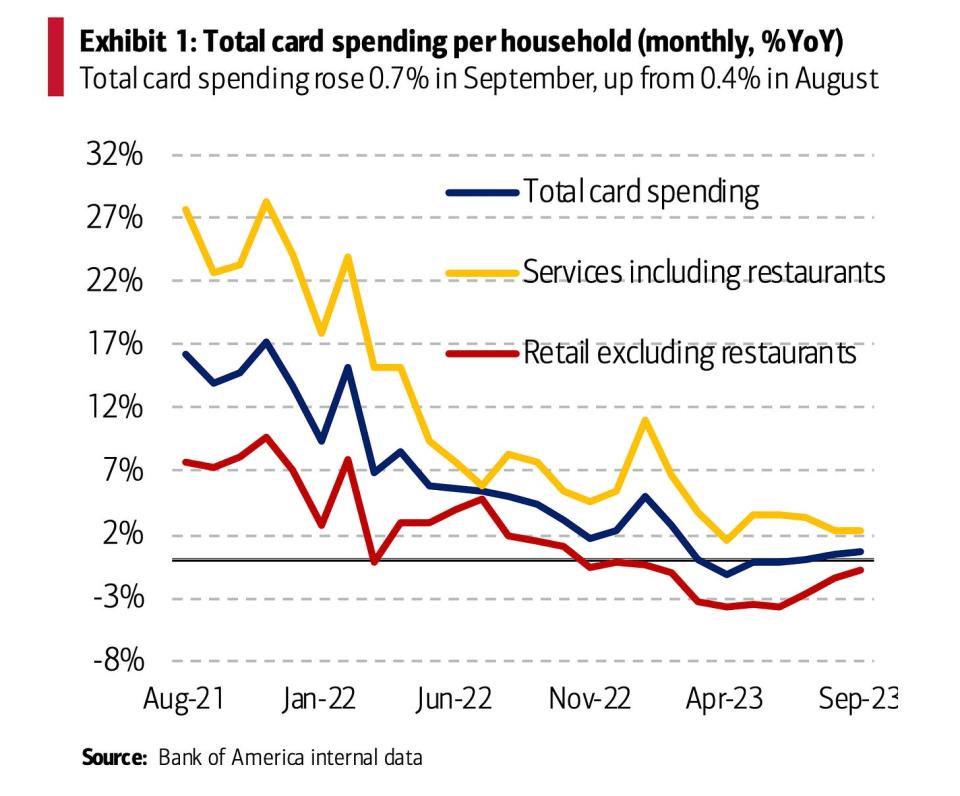

Spending is holding up, according to credit card data. From BofA: "Consumer spending has been fairly flat over the last two months. Seasonally adjusted total card spending rose 0.2% month-over-month, reversing the 0.2% decline in August. Total card spending per household was up 0.7% year-over-year in September, compared to 0.4% in August, according to Bank of America internal data."

From JPMorgan: "As of 06 Oct 2023, our Chase Consumer Card spending data (unadjusted) was 1.5% above the same day last year. Based on the Chase Consumer Card data through 06 Oct 2023, our estimate of the US Census September control measure of retail sales m/m is 0.21%."

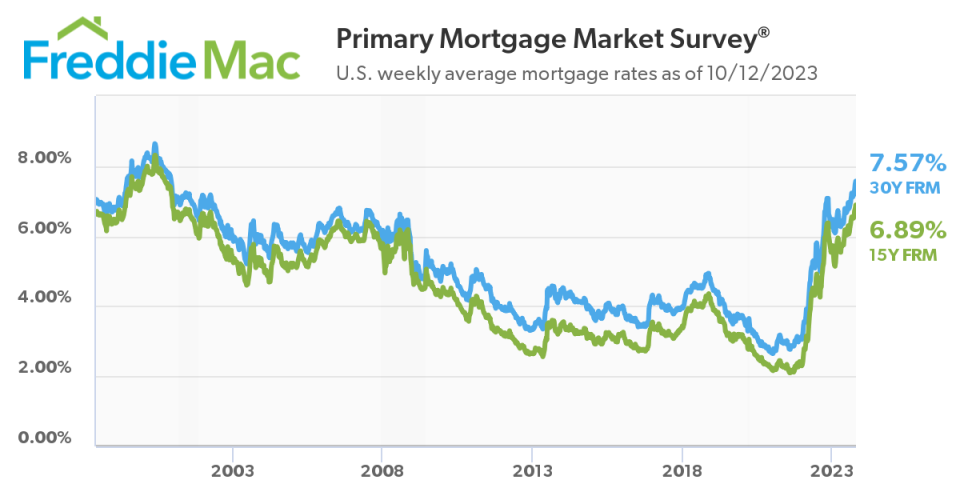

Mortgage rates continue to rise. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 7.57%, the highest level since December 2000. From Freddie Mac: "For the fifth consecutive week, mortgage rates rose as ongoing market and geopolitical uncertainty continues to increase. The good news is that the economy and incomes continue to grow at a solid pace, but the housing market remains fraught with significant affordability constraints. As a result, purchase demand remains at a three-decade low."

Unemployment claims flat. Initial claims for unemployment benefits stood at 207,000 during the week ending Oct. 7, unchanged from the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

More unprofitable firms, but they represent a small share of sales. From Goldman Sachs: "The number of unprofitable firms has risen in recent decades, reaching almost 50% of all publicly-listed companies in 2022 (Exhibit 7, left). The share of business activity that they account for is much smaller but still an economically meaningful 10% of total business revenues (Exhibit 7, right)."

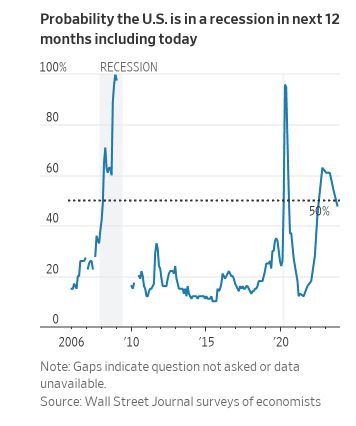

Economists think a recession is unlikely. From WSJ: "In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year."

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 5.1% rate in Q3.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity, given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article was published at TKer.co.

Yahoo Finance

Yahoo Finance