What banking turmoil could mean for business and consumer lending activity

A version of this post was originally published on TKer.co

Stocks climbed last week, with the S&P 500 rising 0.8%. The index is now up 7.8% year to date, up 15.7% from its October 12 closing low of 3,577.03, and down 13.7% from its January 3, 2022 closing high of 4,796.56.

Concerns about the banking system have been top of mind in recent weeks.

The worries specifically pertain to what banking turmoil means for business and consumer lending activity.

"The banking situation is distinct from 2008 as it has involved far fewer financial players and fewer issues that need to be resolved, but financial conditions will likely tighten as lenders become more conservative, and we do not know if this will slow consumer spending," JPMorgan CEO Jamie Dimon said on Friday.

The availability of loans and the cost of those loans are critical for consumer and business activity alike. Read more about that here and here.

While we have yet to fully understand how these financial conditions are evolving, the early survey data have been less than encouraging.

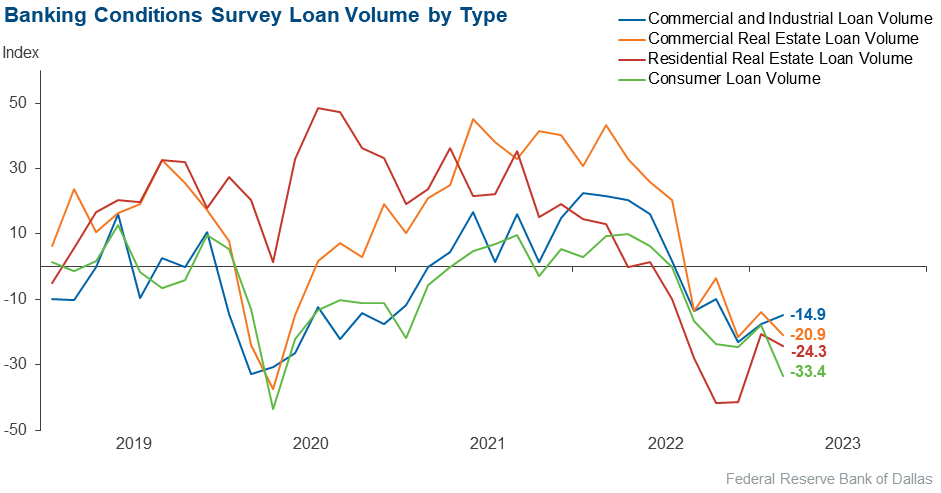

The Dallas Fed’s March Banking Conditions Survey — which covers banks in Texas, New Mexico, and Louisiana — suggests things aren’t looking great from the banking side. From the report (emphasis added):

Loan demand declined for the fifth period in a row as bankers in the March survey reported worsening business activity. Loan volumes fell, driven largely by a sharp contraction in consumer loans. Loan nonperformance increased slightly overall, with the only notable rise over the past six weeks coming from consumer lending. Credit standards and terms continued to tighten sharply, and marked rises in loan pricing were also noted over the reporting period. Banking outlooks continued to deteriorate, with contacts expecting a contraction in loan demand and business activity and an increase in nonperforming loans over the next six months. Some contacts cited waning consumer confidence from recent financial instability as a concern.

Small businesses have taken notice. Here’s the NFIB’s March Small Business Economic Trends report (emphasis added):

Two percent of owners reported that all their borrowing needs were not satisfied (down 1 point). Twenty-nine percent reported all credit needs met (up 4 points) and 59% said they were not interested in a loan (down 3 points). A net 9% reported their last loan was harder to get than in previous attempts (up 4 points). Three percent reported that financing was their top business problem (up 1 point). A net 26% of owners reported paying a higher rate on their most recent loan, up 2 points from February. The average rate paid on short maturity loans was 7.8%, 0.1 percentage points below February’s highest level (also in November) since March 2008. Thirty percent of all owners reported borrowing on a regular basis (unchanged).

(Source: NFIB)

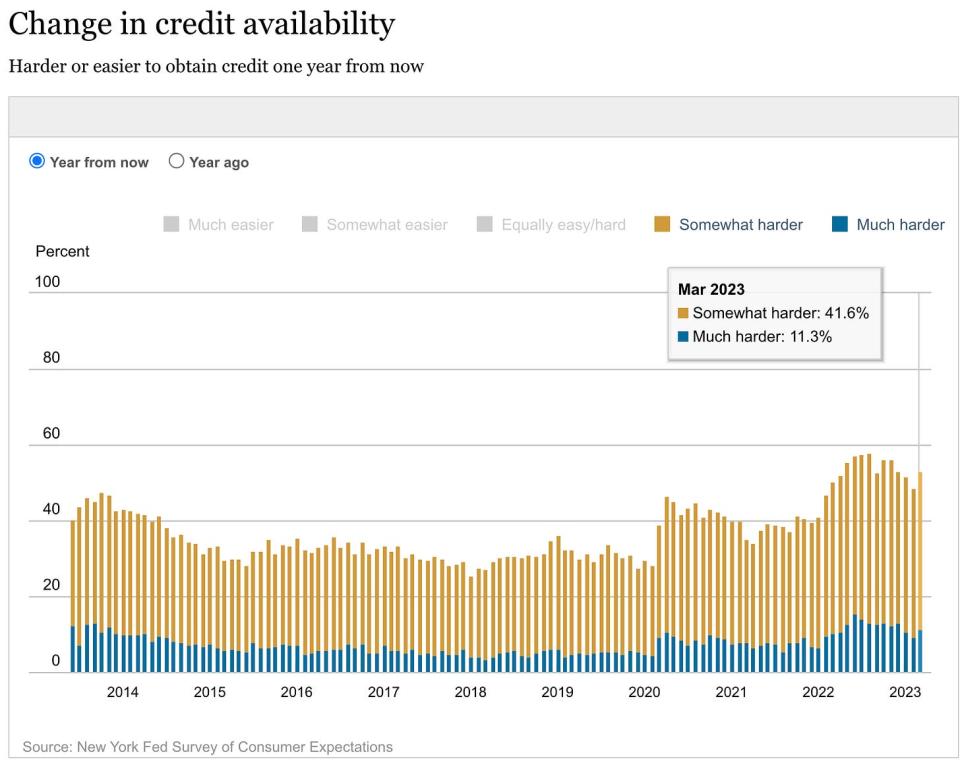

Consumers noticed too. Here’s The New York Fed’s March Survey of Consumer Expectations:

Perceptions of credit access compared to a year ago deteriorated in March, with the share of households reporting it is harder to obtain credit than one year ago rising and reaching a series high…

Consumers don’t expect the situation to get better either. From the New York Fed:

…Respondents were more pessimistic about future credit availability as well, with the share of households expecting it will be harder to obtain credit a year from now also rising.

"We believe that the tightening supply of credit for households should reduce consumer spending and hence price pressures in the future," Nomura senior economist Aichi Amemiya wrote on Monday.

And as you’ll see in TKer’s review of the macro crosscurrents below, March data on spending and prices have already cooled.

Zooming out

The degree to which lending standards tighten and costs go up will determine how severely consumers and businesses are impacted by what’s been happening in the banking system.

Because we have yet to fully understand all of this, we certainly can’t rule out the possibility things could turn out okay, especially as it’s been a while since we’ve heard about another major bank dealing with financial issues.

And while the odds of a recession may be up, the economy continues to be bolstered by some big tailwinds — including the fact that consumer and business finances are in great shape.

New data from BofA last week show consumers continue to have a lot of borrowing capacity.

"The good news is that consumers still have financial buffers as suggested by lower credit card utilization rates compared to 2019," BofA analysts wrote.

To Ameniya’s point about price pressures, keep in mind that the tighter credit conditions stemming from the banking turmoil are arguably in line with the Federal Reserve’s efforts to lower inflation.

All that said, any development regarding borrowing and lending bears watching as the stakes are high.

"The U.S. economy continues to be on generally healthy footings — consumers are still spending and have strong balance sheets, and businesses are in good shape," Dimon said. "However, the storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks."

Related from TKer:

9 stock market charts to consider as earnings season kicks off 📊

As if the economic outlook weren't already hard to predict... 🤦🏻♂️

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

🎈 Inflation cools. The Consumer Price Index (CPI) in March was up 5.0% from a year ago, down from 6.0% in February. This was the smallest annual increase since May 2021. Adjusted for food and energy prices, core CPI was up 5.6%, up marginally from 5.5% the month prior.

On a month-over-month basis, CPI was up 0.1% as food prices were flat and energy prices fell 3.5% during the period. Core CPI was up 0.4%, down from 0.5% the month prior.

If you annualize the three-month trend in the monthly figures, CPI is rising at a 3.8% rate and core CPI is climbing at a 5.1% rate.

The bottom line is that while inflation rates have been trending lower, they continue to be above the Federal Reserve’s target rate of 2%.

For more on the implications of cooling inflation, read: The bullish 'goldilocks' soft landing scenario that everyone wants 😀.

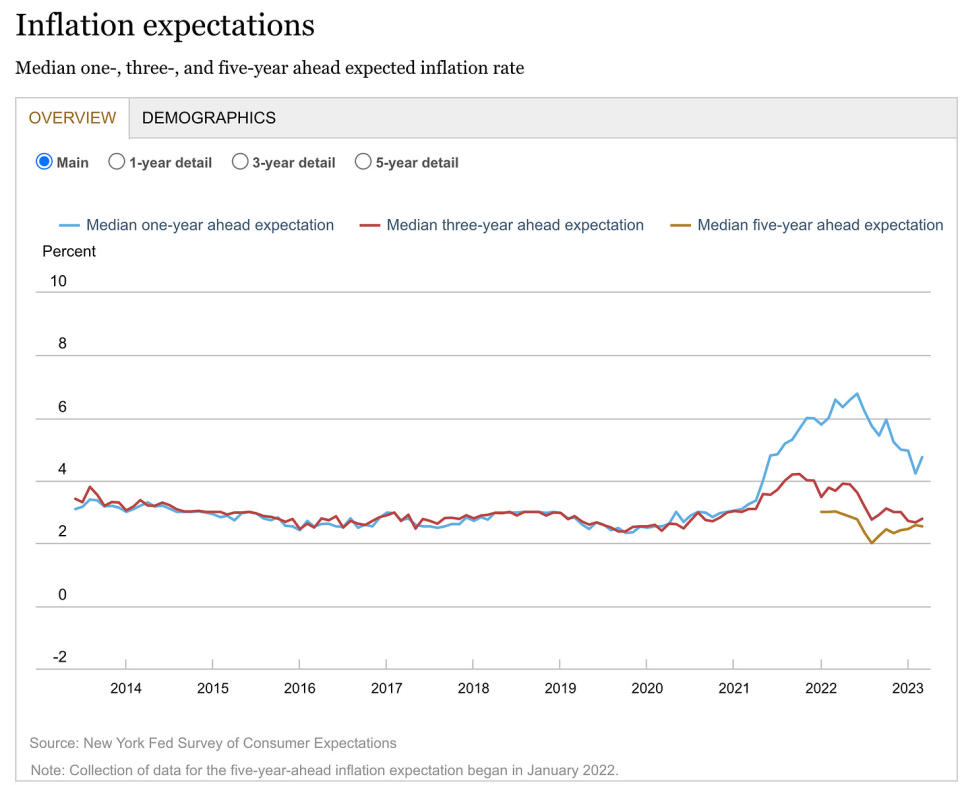

🤷🏻♂️ Consumers’ outlook for inflation gets worse. From the New York Fed’s March Survey of Consumer Expectations: "Median inflation expectations increased by 0.5 percentage point at the one-year-ahead horizon to 4.7%, marking the first increase in the series since October 2022. Median inflation expectations increased by 0.1 percentage point at the three-year-ahead horizon to 2.8%, but decreased by 0.1 percentage point at the five-year-ahead horizon to 2.5%."

Similarly, the University of Michigan’s April Survey of Consumers found: "Year-ahead inflation expectations rose from 3.6% in March to 4.6% in April. These expectations have been seesawing for four consecutive months, alternating between increases and decreases."

(Source: University of Michigan)

💼 Unemployment claims rise. Initial claims for unemployment benefits — the most up-to-date of the major labor market stats — climbed to 239,000 during the week ending April 8, up from 228,000 the week prior. While the number remains near levels seen during periods of economic expansion, it has been creeping higher.

From JPMorgan’s Michael Hanson: "A rising trajectory in claims took hold last month, and the four-week moving average has moved up to 240,000, a level roughly 10% above the 4Q22 average. As initial claims often are an early indication of a sharp break in economic activity, this move up bears watching. A stabilization in initial claims close to its current level would be consistent with a forecasted downshift in US growth this quarter and next. A sustained move well above 250k in the coming months would send a signal that the economy is sliding into recession."

💼 Small business hiring plans cool. From the NFIB’s March Small Business Economic Trends report: "Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 15% planning to create new jobs in the next three months, down 2 points from February and 17 points below its record high reading of 32 reached in August 2021."

(Source: NFIB)

Still, most companies are struggling to fill open positions. From the NFIB: "Overall, 59% reported hiring or trying to hire in March, down 1 point from February. Fifty-three percent (90% of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (down 1 point). Twenty-six percent of owners reported few qualified applicants for their open positions (down 4 points) and 27% reported none (up 3 points)."

(Source: NFIB)

For more on low unemployment, read: The labor market is simultaneously hot 🔥, cooling 🧊, and kinda problematic 😵💫.

🛍️ Spending cools, but it’s not collapsing. According to Census Bureau data, retail sales in March declined 1.0% to $691.7 billion.

Excluding autos and gas, sales were down a modest 0.3% as gains in online retail, health and personal care, restaurants and bars, and sporting goods were more than offset by declines in department stores, electronics, building materials, clothes, and furniture.

From Capital Economics’ Paul Ashworth: "Overall, not quite as bad as we had expected. Thanks to the strong January, first-quarter real consumption growth should be close to 4.5%, with GDP growth at 1.8%, which might be enough to persuade the Fed to hike by a final 25bp in early May."

🏭 Industrial activity picks up. Industrial production rose 0.4% in March as an 8.4% jump in utilities more than offset a 0.5% decline in manufacturing output.

(Source: Federal Reserve)

🏛️ Fed official says work not yet done. From Federal Reserve Governor Christopher Waller’s speech on Friday: "Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further."

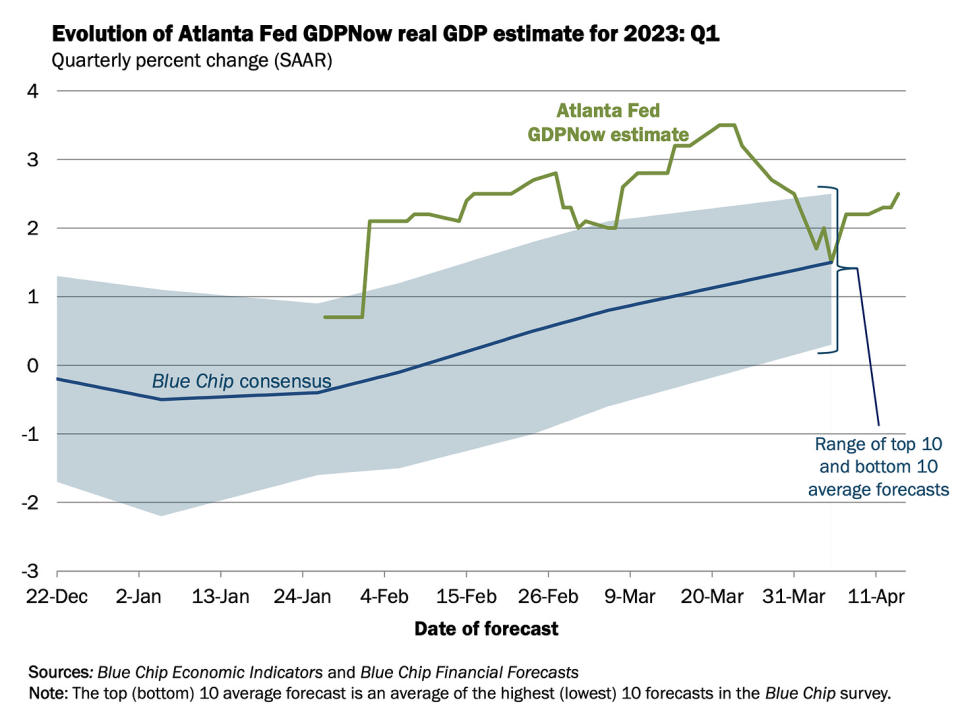

📈 Near-term GDP growth estimates remain rosy. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.5% rate in Q1. While the model’s estimate is off its high, it’s nevertheless up considerably from its initial estimate of 0.7% growth as of January 27.

Putting it all together 🤔

Despite recent banking tumult, we continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started." And on March 22, the Fed signaled that the end of interest rate hikes is near.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tighter financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations).

All of this means the market beatings may continue for the time being, and the risk the economy sinks into a recession will be relatively elevated.

At the same time, it’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the the previous TKer macro crosscurrents

For more on why this is an unusually unfavorable environment for the stock market, read: The market beatings will continue until inflation improves 🥊

For a closer look at where we are and how we got here, read: The complicated mess of the markets and economy, explained 🧩

TKer’s best insights about the stock market 📈

Here’s a roundup of some of TKer’s most talked-about paid and free newsletters about the stock market. All of the headlines are hyperlinked to the archived pieces.

10 truths about the stock market 📈

The stock market can be an intimidating place: It’s real money on the line, there’s an overwhelming amount of information, and people have lost fortunes in it very quickly. But it’s also a place where thoughtful investors have long accumulated a lot of wealth. The primary difference between those two outlooks is related to misconceptions about the stock market that can lead people to make poor investment decisions.

Stomach-churning stock market sell-offs are normal🎢

Investors should always be mentally prepared for some big sell-offs in the stock market. It’s part of the deal when you invest in an asset class that is sensitive to the constant flow of good and bad news. Since 1950, the S&P 500 has seen an average annual max drawdown (i.e., the biggest intra-year sell-off) of 14%.

How stocks performed when the yield curve inverted ⚠️

There’ve been lots of talk about the "yield curve inversion," with media outlets playing up that this bond market phenomenon may be signaling a recession. Admittedly, yield curve inversions have a pretty good track record of being followed by recessions, and recessions usually come with significant market sell-offs. But experts also caution against concluding that inverted yield curves are bulletproof leading indicators.

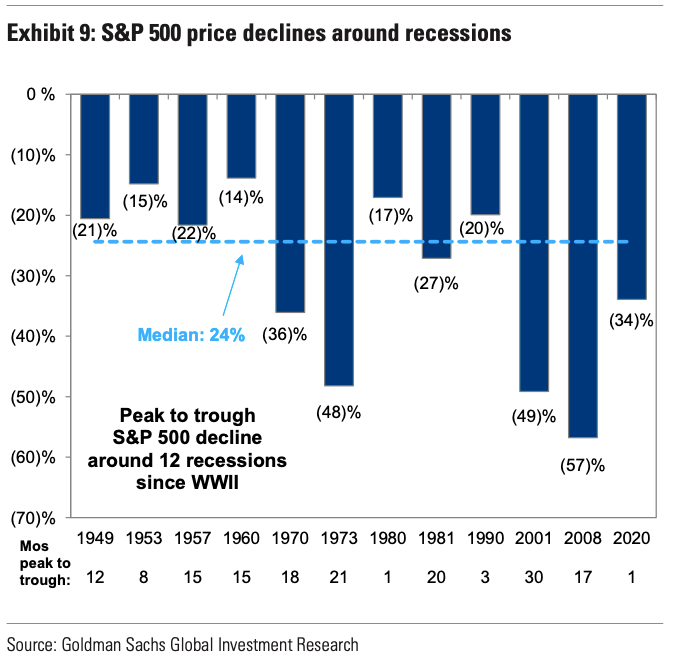

How the stock market performed around recessions 📉📈

Every recession in history was different. And the range of stock performance around them varied greatly. There are two things worth noting. First, recessions have always been accompanied by a significant drawdown in stock prices. Second, the stock market bottomed and inflected upward long before recessions ended.

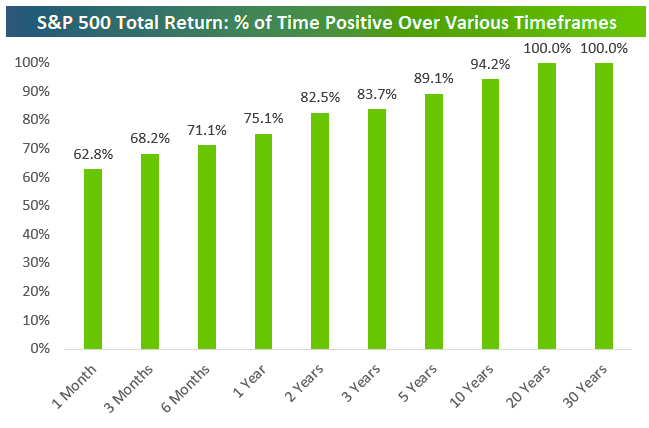

In the stock market, time pays ⏳

Since 1928, the S&P 500 generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds. When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.

(Source: Bespoke Investment Group via TKer)

The makeup of the S&P 500 is constantly changing 🔀

Passive investing is a concept usually associated with buying and holding a fund that tracks an index. And no passive investment strategy has attracted as much attention as buying an S&P 500 index fund. However, the S&P 500 — an index of 500 of the largest U.S. companies — is anything but a static set of 500 stocks.

(Source: S&P Dow Jones indices via TKer)

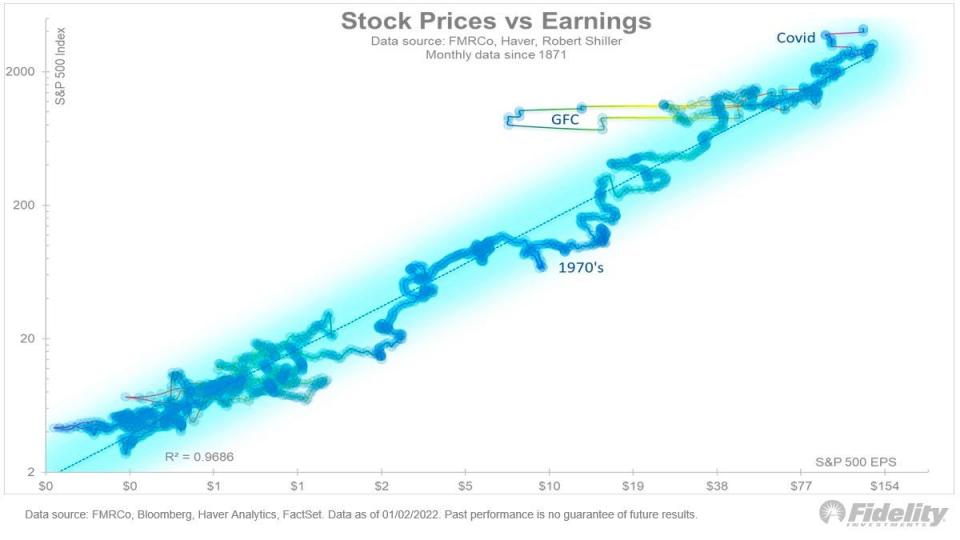

The key driver of stock prices: Earnings💰

For investors, anything you can ever learn about a company matters only if it also tells you something about earnings. That’s because long-term moves in a stock can ultimately be explained by the underlying company’s earnings, expectations for earnings, and uncertainty about those expectations for earnings. Over time, the relationship between stock prices and earnings have a very tight statistical relationship.

When the Fed-sponsored market beatings could end 📈

At some point in the future, we’ll learn a new bull market in stocks has begun. Before we can get there, the Federal Reserve will likely have to take its foot off the neck of financial markets. If history is a guide, then the market should bottom weeks or months before we get that signal from the Fed.

What a strong dollar means for stocks 👑

While a strong dollar may be great news for Americans vacationing abroad and U.S. businesses importing goods from overseas, it’s a headwind for multinational U.S.-based corporations doing business in non-U.S. markets.

(Source: FactSet via TKer)

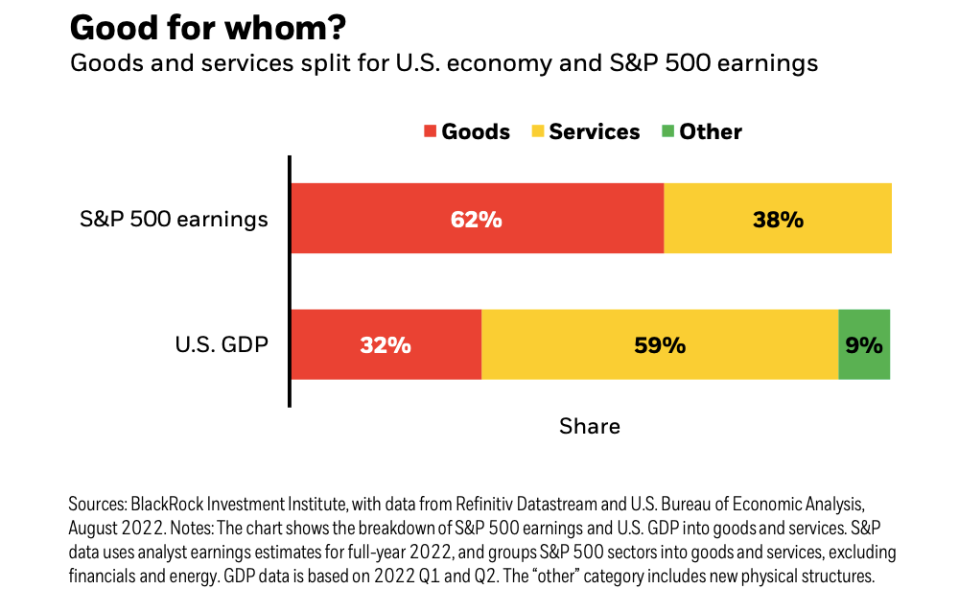

Economy ≠ Stock Market 🤷♂️

The stock market sorta reflects the economy. But also, not really. The S&P 500 is more about the manufacture and sale of goods. U.S. GDP is more about providing services.

Stanley Druckenmiller's No. 1 piece of advice for novice investors 🧐

…you don't want to buy them when earnings are great, because what are they doing when their earnings are great? They go out and expand capacity. Three or four years later, there's overcapacity and they're losing money. What about when they're losing money? Well, then they’ve stopped building capacity. So three or four years later, capacity will have shrunk and their profit margins will be way up. So, you always have to sort of imagine the world the way it's going to be in 18 to 24 months as opposed to now. If you buy it now, you're buying into every single fad every single moment. Whereas if you envision the future, you're trying to imagine how that might be reflected differently in security prices.

Peter Lynch made a remarkably prescient market observation in 1994 🎯

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years… The next 500 points, the next 600 points — I don’t know which way they’ll go… They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.

Warren Buffett's 'fourth law of motion' 📉

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, "I can calculate the movement of the stars, but not the madness of men." If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

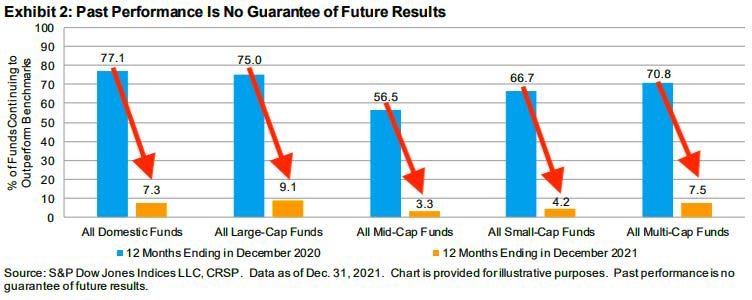

'Past performance is no guarantee of future results,' charted 📊

S&P Dow Jones Indices found that funds beat their benchmark in a given year are rarely able to continue outperforming in subsequent years. According to their research, 29% of 791 large-cap equity funds that beat the S&P 500 in 2019. Of those funds, 75% beat the benchmark again in 2020. But only 9.1%, or 21 funds, were able to extend that outperformance streak into 2021.

One stat shows how hard it is to pick market-beating stocks 🎲

Picking stocks in an attempt to beat market averages is an incredibly challenging and sometimes money-losing effort. In fact, most professional stock pickers aren’t able to do this on a consistent basis. One of the reasons for this is that most stocks don’t deliver above-average returns. According to S&P Dow Jones Indices, only 22% of the stocks in the S&P 500 outperformed the index itself from 2000 to 2020. Over that period, the S&P 500 gained 322%, while the median stock rose by just 63%.

A version of this post was originally published on TKer.co

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Yahoo Finance

Yahoo Finance