The Wharf (Holdings) Ltd's Dividend Analysis

Insight into The Wharf (Holdings) Ltd's Upcoming Dividend and Financial Health

The Wharf (Holdings) Ltd (WARFY) recently announced a dividend of $0.05 per share, payable on 2024-05-10, with the ex-dividend date set for 2024-04-09. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into The Wharf (Holdings) Ltd's dividend performance and assess its sustainability.

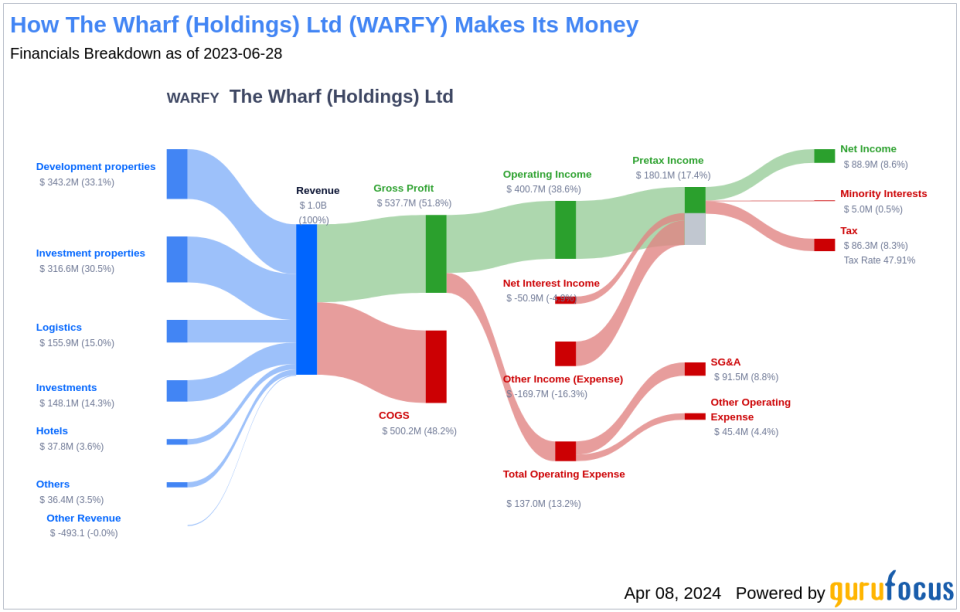

What Does The Wharf (Holdings) Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

The Wharf (Holdings) Ltd operates through various segments, including investment properties, development properties, hotels, logistics, and investments. The company's primary focus is on property leasing, development, and management, with a significant presence in Mainland China. The diverse portfolio and strategic segment positioning allow The Wharf (Holdings) Ltd to tap into different revenue streams, which is crucial for maintaining a stable dividend payout.

A Glimpse at The Wharf (Holdings) Ltd's Dividend History

The Wharf (Holdings) Ltd has been a consistent player in the dividend game, with regular payments traced back to 2013. The company has chosen a bi-annual distribution strategy, which has been well-received by investors looking for periodic income. Tracking the historical trends of the company's Dividends Per Share provides valuable insights into its dividend reliability.

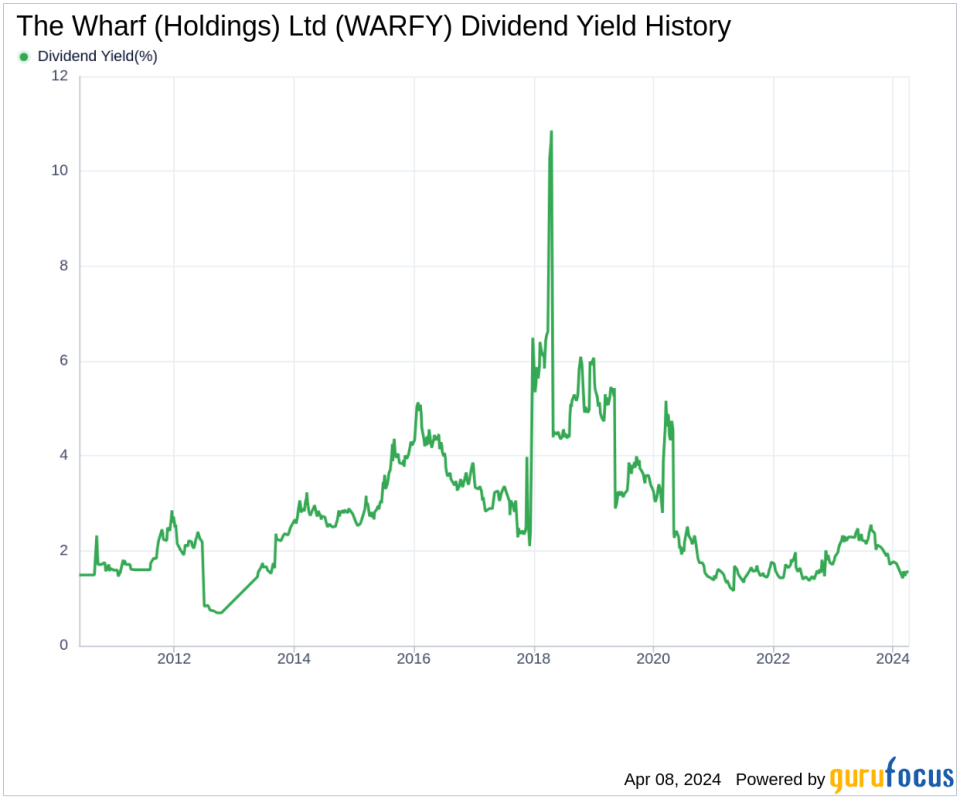

Breaking Down The Wharf (Holdings) Ltd's Dividend Yield and Growth

The Wharf (Holdings) Ltd currently sports a trailing dividend yield of 1.56% and mirrors this with a forward dividend yield of the same percentage. This parallel suggests that investors can expect a steady dividend payout in the coming year. However, the company's dividend growth rate over the past three, five, and ten years shows a decline, with the most recent five-year growth rate averaging -30.40% per year. Despite this, the 5-year yield on cost stands at approximately 0.25%, which is a metric to consider for long-term investors.

The Sustainability Question: Payout Ratio and Profitability

Assessing the sustainability of The Wharf (Holdings) Ltd's dividend involves examining the dividend payout ratio, which currently stands at 0.54. This ratio is within a reasonable range, indicating that the company retains enough of its earnings for growth and to cushion any financial setbacks. The Wharf (Holdings) Ltd's profitability rank is 6 out of 10, reflecting fair profitability and a history of net profit in 9 out of the past 10 years.

Growth Metrics: The Future Outlook

The Wharf (Holdings) Ltd's growth rank also sits at 6 out of 10, suggesting a fair growth outlook. However, the company's revenue per share and growth rates indicate that it is underperforming compared to a majority of global competitors. Similarly, the 3-year EPS growth rate and the 5-year EBITDA growth rate both lag behind a significant portion of global peers, which could be a concern for the sustainability of future dividends.

Concluding Thoughts on The Wharf (Holdings) Ltd's Dividend Fortitude

In conclusion, while The Wharf (Holdings) Ltd offers a forthcoming dividend that may appeal to income-focused investors, the declining dividend growth rate and underwhelming growth metrics warrant a cautious approach. Investors should consider the company's ability to sustain its dividends in light of its payout ratio, profitability, and long-term growth potential. For those seeking to diversify their portfolio with high-dividend yield stocks, GuruFocus Premium provides an invaluable High Dividend Yield Screener. Will The Wharf (Holdings) Ltd's financial strategies bolster its dividend outlook, or is a strategic reevaluation necessary to ensure future growth and stability?

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance