WestRock's (WRK) Merger With Smurfit Kappa Gets Shareholders Nod

WestRock Company WRK announced that its shareholders have approved its pending merger with Smurfit Kappa Group Plc SMFKY at a special shareholder meeting. This comes just after the news that Smurfit Kappa’s shareholders have also voted in favor of the tie-up. WRK’s shares gained 2% on the news.

On Sep 13, 2023, WestRock and Smurfit Kappa Group announced that they have agreed to merge and create Smurfit WestRock, which is expected to be one of the world’s largest paper and packaging companies with a worth of around $20 billion.

Smurfit WestRock will have an unmatched geographic reach spanning 42 countries. Given this scale, and equipped with WRK and SMFKY’s highly complementary portfolios and innovative sustainability capabilities, the merged entity is likely to be the preferred packaging partner for companies and customers across the globe.

WestRock and Smurfit Kappa’s combined last twelve months’ revenues and adjusted EBITDA were around $34 billion and $5.5 billion, respectively (as of 30 Jun 2023). The combination will lead to improved operating efficiency and increased returns across more than 500 converting operations and 67 mills. It is projected to result in annual pre-tax run-rate cost synergies of more than $400 million in the first year following its completion.

Following the receipt of approval of shareholders of both WestRock and Smurfit Kappa, the deal now remains subject to other customary closing conditions. It is expected to close in the second quarter of 2024.

Smurfit WestRock would be incorporated and domiciled in Ireland with global headquarters in Dublin, Ireland, while North and South American operations will be headquartered in Atlanta, GA. It will seek a New York listing with a standard listing on the London Stock Exchange.

Per the agreement, WestRock shareholders will receive one Smurfit WestRock share and $5 cash. This is equivalent to $43.51 per share, the closing share price of Smurfit Kappa’s shares on Sep 11, 2023. Smurfit Kappa shareholders will receive one new share. SMFKY will own approximately 50.4% of Smurfit WestRock and the balance 49.6% will be held by WRK.

WestRock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

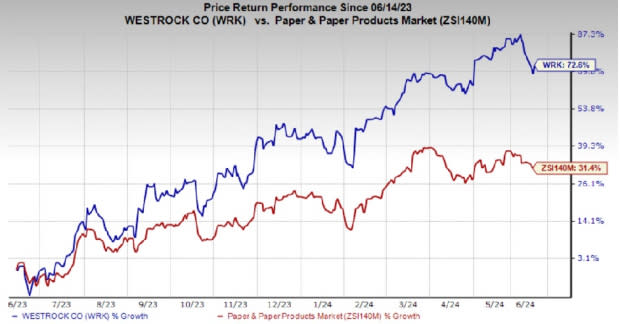

Price Performance

Shares of WestRock have gained 72.6% in the past year compared with the industry’s 31.4% growth.

Image Source: Zacks Investment Research

Rise in M&As in the Industry

Both WRK and SMFKY are significant players in the Paper and Related Products industry. Increasing packaging requirements, due to a rising trend in e-commerce activities and steady demand from consumer-oriented end markets, such as food and beverages, and healthcare, are envisioned to support the industry. The growing preference for paper as a sustainable and eco-friendly packaging option due to environmental concerns will act as a key driver for this industry going forward.

The companies are working on boosting their capacity to capitalize on this packaging demand. Recently, there has been a surge in merger and acquisition activity within the industry as companies are positioning themselves to seize growth opportunities and enhance their packaging and sustainability offerings, among other strategic objectives.

Apart from the WRK-SMFKY combination, another noteworthy merger is International Paper’s IP pending acquisition of DS Smith DITHF, which was announced on Apr 17, 2024. Previously, Mondi plc had expressed an interest in acquiring DS Smith.

The combination of International Paper and DS Smith will establish a global leader in sustainable packaging solutions that is well-positioned in attractive and growing markets.

Per reports, Suzano, the world’s largest pulp producer, had expressed verbal interest in an all-cash acquisition of International Paper for around $15 billion, contingent upon the company abandoning its deal with DS Smith. This offer was rejected by International Paper. Suzano, meanwhile, is in talks with potential lenders to enhance the terms of the transaction.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Paper Company (IP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Smurfit Kappa (SMFKY) : Free Stock Analysis Report

D S SMITH (DITHF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance