Westlake Chemical (WLK) Declares Pricing of Senior Notes

Westlake Chemical Corporation WLK announced the pricing of its underwritten public offering of EUR 700,000,000 total principal amount of senior unsecured notes due 2029.

Per the company, the notes will carry interest rate of 1.625% per year and will mature on Jul 17, 2029. The sale of notes is slated to close on Jul 17, 2019, which is subject to customary closing conditions.

The company plans to use the net proceeds from the transaction for general corporate purposes.

Shares of Westlake Chemical have gained 3.2% year to date against the industry’s 0.7% decline.

Earlier this month, the company provided earnings guidance for the second quarter and full-year 2019.

It expects earnings between 73 cents and 87 cents per share for the second quarter. For 2019, the company projects earnings in the band of $3.10-$4.28 per share, factoring current margin and pricing expectations for its products in the second quarter and the full year.

For the second quarter, Westlake Chemical envisions net income in the range of $106-$123 million. The company expects EBITDA to improve roughly 8-15% on a sequential comparison basis to $340-$363 million. Net sales for the quarter have been projected in the band of $2.1-$2.2 billion.

For 2019, the company sees net income in the range of $443-$596 million and net sales of between $8 billion and $8.8 billion. EBITDA for the year has been forecast in the range of $1.4-$1.6 billion.

Westlake Chemical noted that while its average margin rose on a sequential comparison basis in the second quarter, it did not increase as per industry pricing expectations at the start of second quarter.

However, the company stated that the guidance is preliminary and subject to change. It expects to release final second-quarter results on Aug 6.

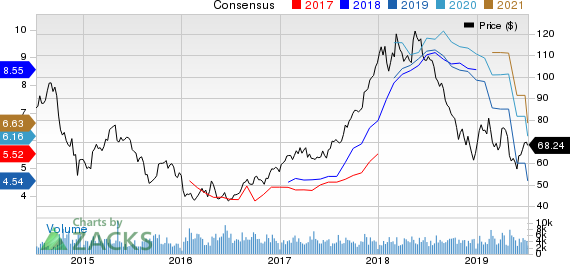

Westlake Chemical Corporation Price and Consensus

Westlake Chemical Corporation price-consensus-chart | Westlake Chemical Corporation Quote

Zacks Rank & Key Picks

Westlake Chemical currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Materion Corporation MTRN, Flexible Solutions International Inc FSI and Fortescue Metals Group Ltd FSUGY, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Materion has an expected earnings growth rate of 30.3% for 2019. The company’s shares have gained 15.7% in the past year.

Flexible Solutions has projected earnings growth rate of 342.9% for the current year. The company’s shares have surged 171.1% in a year’s time.

Fortescue Metals has an estimated earnings growth rate of 294.2% for the current year. Its shares have rallied 87.9% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

Flexible Solutions International Inc. (FSI) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

Materion Corporation (MTRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance