Western Asset Mortgage Capital (NYSE:WMC) Shareholders Received A Total Return Of 49% In The Last Five Years

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Western Asset Mortgage Capital Corporation (NYSE:WMC), since the last five years saw the share price fall 25%.

See our latest analysis for Western Asset Mortgage Capital

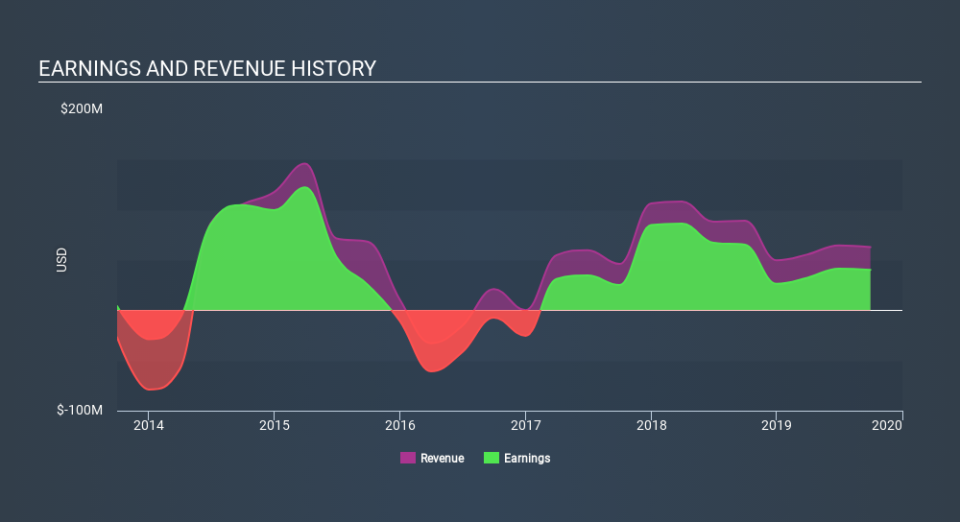

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Western Asset Mortgage Capital moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower. The revenue decline of 1.8% per year wouldn't have helped. So it seems weak revenue and dividend trends may have influenced the share price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Western Asset Mortgage Capital will earn in the future (free profit forecasts).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Western Asset Mortgage Capital the TSR over the last 5 years was 49%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Western Asset Mortgage Capital's TSR for the year was broadly in line with the market average, at 26%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 8.3%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Western Asset Mortgage Capital better, we need to consider many other factors. Take risks, for example - Western Asset Mortgage Capital has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Western Asset Mortgage Capital is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance