WesBanco Inc (WSBC) Q1 2024 Earnings: Modestly Surpasses Analyst Projections

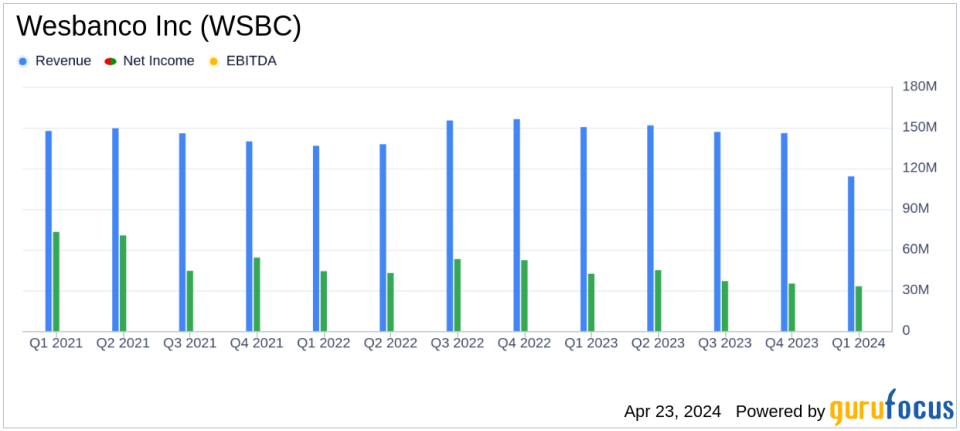

Net Income: Reported at $33.2 million for Q1 2024, falling short of estimates of $32.66 million.

Earnings Per Share (EPS): Achieved $0.56, slightly exceeding the estimated $0.55.

Revenue: Total interest and dividend income stood at $195.33 million for Q1 2024, showing robust growth compared to the previous year.

Loan Growth: Year-over-year increase of 9.0%, with total portfolio loans reaching $11.9 billion.

Deposit Growth: Grew by 4.8% year-over-year to $13.5 billion, supporting strong loan growth and strategic pay-downs.

Non-Interest Income: Rose by 10.8% year-over-year to $30.6 million, driven by increases in commercial loan swap and wealth management fees.

Net Interest Margin: Decreased to 2.92% in Q1 2024, down 44 basis points year-over-year, primarily due to higher funding costs.

On April 23, 2024, WesBanco Inc (NASDAQ:WSBC), a prominent bank holding company, disclosed its financial results for the first quarter of 2024. The company reported a net income of $33.2 million, translating to a diluted earnings per share (EPS) of $0.56, which slightly exceeds the analyst estimates of $0.55 per share. This performance marks a decrease from the previous year's $39.8 million net income and $0.67 EPS, reflecting ongoing economic challenges yet demonstrating resilience in a competitive sector. For detailed insights, refer to WesBanco's recent 8-K filing.

About WesBanco Inc

Founded in 1870, WesBanco Inc operates as a diversified and multi-state bank holding company. It offers a comprehensive range of financial services including retail and corporate banking, trust services, brokerage services, mortgage banking, and insurance. WesBanco Bank, its primary subsidiary, serves customers through numerous branches across several states, focusing on the Rust Belt region. The company is known for its community banking approach combined with significant market presence in commercial real estate lending.

Quarterly Financial Highlights

The first quarter saw WesBanco achieving a total loan growth of 9.0% year-over-year, with deposits also increasing by 4.8% within the same period. This robust growth in deposits and loans underscores the company's effective strategy in market penetration and customer retention. Notably, non-interest income witnessed a 10.8% increase, buoyed by new commercial loan swap and wealth management fees, which aligns with WesBanco's objectives to diversify its revenue streams.

Operational and Strategic Developments

During the quarter, WesBanco demonstrated strategic prowess by managing its loan and deposit portfolios effectively, leading to a strengthened financial position. The bank's focus on controlling costs and optimizing its staffing levels contributed to a sequential decrease in non-interest expenses. Moreover, the company's credit quality metrics remained robust, with low levels of non-performing assets and net charge-offs, showcasing strong risk management capabilities.

Challenges and Market Conditions

Despite the positive outcomes, WesBanco faced challenges such as a competitive banking environment and rising interest rates, which pressured the net interest margin, leading to a 44 basis points year-over-year decline. The bank's net interest income for the quarter stood at $114.0 million, down by 8.3% from the previous year, primarily due to increased funding costs.

Looking Ahead

WesBanco's management remains optimistic about the future, citing solid foundational strategies and operational efficiency as key drivers for sustained growth. The bank continues to receive national recognition, including being named among Forbes Americas Best Banks 2024, which could enhance its reputation and customer trust going forward.

Investor and Analyst Perspectives

Investors and analysts might view WesBanco's latest earnings with cautious optimism. While the bank has navigated economic headwinds effectively, the ongoing challenges of a competitive market and interest rate volatility require continuous strategic adjustment. The slight surpassing of EPS estimates suggests operational efficiency, but the year-over-year declines highlight areas for potential improvement.

For further information and detailed financial data, stakeholders are encouraged to review the full earnings report and participate in the upcoming investor conference call, as detailed in WesBanco's communications.

For ongoing updates and financial analyses, keep following GuruFocus.com.

Explore the complete 8-K earnings release (here) from Wesbanco Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance