Wendy's (WEN) Banks on Solid Comps Growth Amid High Costs

The Wendy's Company WEN is benefiting from solid comps growth, expansion strategies, and franchised business model. Furthermore, menu innovations and variety in offerings also bode well.

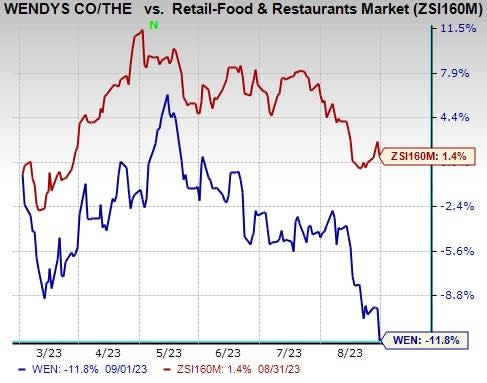

Shares of WEN declined 11.8% in the past six months against the Zacks Retail - Restaurants industry’s 1.4% growth. This quick-service restaurant company is facing headwinds in the form of inflationary pressures and an uncertain macro environment.

Let us delve deeper.

Image Source: Zacks Investment Research

Factors Aiding WEN’s Growth

Wendy’s continues to witness impressive comps growth globally. In the first six months of fiscal 2023, the company reported global comps growth of 6.5% year over year compared with 3.1% in the prior-year period. The upside was primarily backed by higher average check and strategic pricing actions. The company expects 6-8% growth in global system-wide sales in fiscal 2023 backed by mid-single-digit global same-restaurant sales and global net unit growth of approximately 2%.

Wendy’s is focusing on delivering global growth through various initiatives including driving solid same-restaurant sales momentum across all dayparts, accelerating the implementation of consumer-centric digital platforms and technologies and expanding its footprint through global restaurant expansion.

Wendy’s is steadfast in expanding its presence globally. Backed by a strong pipeline of locations and a talent team, the company is optimistic about growth opportunities in the US as well as international markets. In the first half of fiscal 2023, the company opened 80 new restaurants, including the very first Global Next Gen restaurant opened on Aug 15. Also, it reported growth in international markets including Canada, the UK, India, and the Philippines. The company has a robust pipeline and is on track to achieve its target of approximately 2% net unit growth in 2023. For 2024 and 2025, the company anticipates global net unit growth in the range of 2-3% and 3-4%, respectively, year over year.

The company’s transition to a franchised business model is aiding its growth notably. During the fiscal second quarter of 2023, the company entered into a franchise contract with Flynn Restaurant Group for the objective of developing 200 Wendy's restaurants in the Australian market. Furthermore, during the quarter, the company progressed in turning franchisee interests into new development agreements, in consideration of the suit development programs comprising the Pacesetter, Groundbreaker, and Build-to-Suit programs.

Furthermore, Wendy's’ brand transformation initiative, which includes menu innovation and various other related offers, adds to the uptrend. It has planned a variety of product promotions for different price points and occasions. In the second quarter of fiscal 2023, the company launched a new item to the menu, Frosty Cream Cold Brew, and is expecting additional menu innovations to launch soon. Also, the return of customers’ favorite Strawberry Frosty and the introduction of the Ghost Pepper Ranch Chicken Sandwich are additional positives. During the quarter, the company also witnessed an all-time-high quarterly breakfast sales volume, mainly backed by the $3 croissant promotion. The company emphasized on menu innovation, creating awareness for new products and promoting targeted trial-driving offers to drive growth.

Factors Hindering Growth

Wendy’s is facing high costs owing to the ongoing inflationary environment and uncertain macroeconomic conditions. During the second quarter of fiscal 2023, the company’s total cost of sales came in at $201 million compared with $197.3 million reported in the prior-year quarter. The downside was primarily due to higher labor costs, a decline in customer counts and increased occupancy, advertising and other operating costs. Moving ahead, the company anticipates the headwinds to persist for some time. For 2023, our model predicts the cost of sales to increase 3.4% to $799.3 million year over year.

Zacks Rank

Wendy’s currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Retail-Wholesale sector are Amazon.com, Inc. AMZN, BJ's Restaurants, Inc. BJRI and Builders FirstSource, Inc. BLDR.

Amazon currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMZN delivered a trailing four-quarter earnings surprise of 41%, on average. Shares of the company have gained 8.3% in the past year. The Zacks Consensus Estimate for AMZN’s 2023 sales and earnings per share (EPS) indicates growth of 11.1% and 214.1%, respectively, from the previous year’s reported levels.

BJ's Restaurants currently sports a Zacks Rank of 1. BJRI delivered a trailing four-quarter earnings surprise of 121.2%, on average. Shares of the company have gained 15.7% in the past year.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates growth of 5.6% and 435.3%, respectively, from the previous year’s reported levels.

Builders FirstSource currently sports a Zacks Rank of 1. BLDR has a trailing four-quarter earnings surprise of 52.2%, on average. Shares of the company have rallied 147.7% in the past year.

The Zacks Consensus Estimate for BLDR’s 2023 sales and EPS indicates a decline of 23.3% and 29.6%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

The Wendy's Company (WEN) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance