Webster Financial Corp's Dividend Analysis

Exploring the Sustainability and Growth of Webster Financial Corp's Dividends

Webster Financial Corp (NYSE:WBS) has recently declared a dividend of $0.4 per share, scheduled for payout on May 16, 2024, with shareholders needing to own the stock by May 3, 2024, to be eligible. This announcement has turned investor attention towards the company's dividend reliability and growth potential. Through an in-depth analysis using GuruFocus data, this article will explore the sustainability and future prospects of Webster Financial Corp's dividends.

Company Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Webster Financial Corp operates as a comprehensive financial services provider, focusing on commercial and consumer banking, along with mortgage, investment advisory, trust, and wealth management services. The company operates primarily across Connecticut, New York, Rhode Island, Massachusetts, and Pennsylvania. Its business is segmented into Commercial Banking, HSA Bank, and Consumer Banking, with the majority of its revenue stemming from its Commercial Banking operations.

Dividend History and Performance

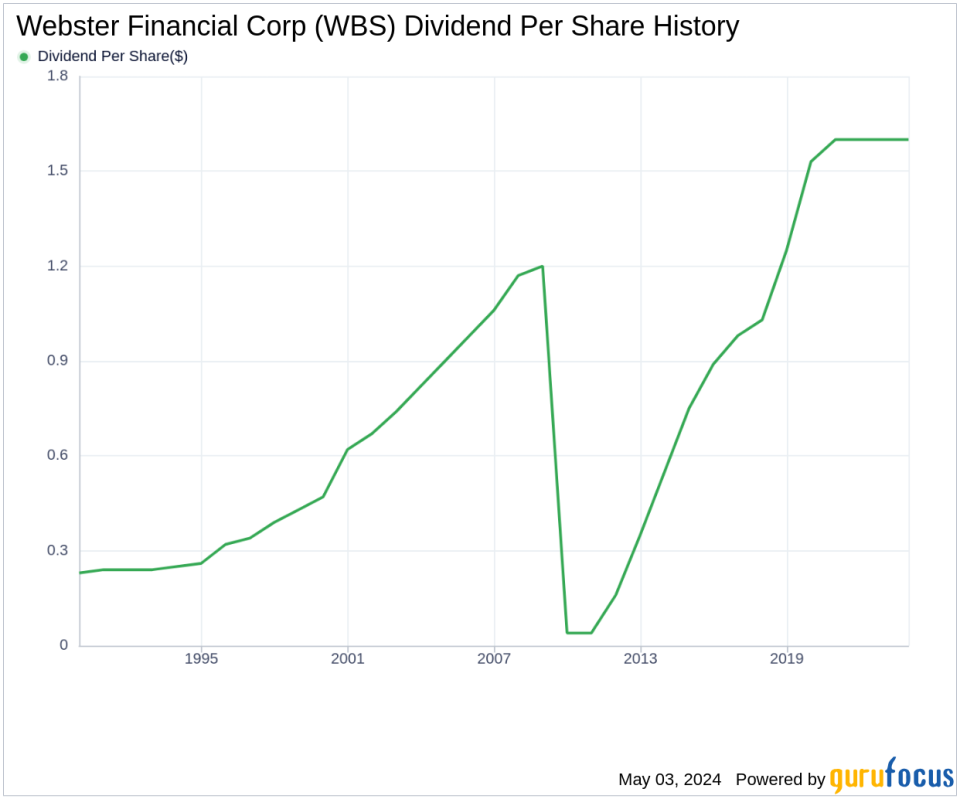

Webster Financial Corp has a long-standing history of distributing dividends, consistently doing so since 1987. The dividends are paid quarterly, and notably, the company has increased its dividend annually since 2009, earning it the status of a dividend achiever. This title is reserved for companies that have consistently raised their dividends for at least 15 consecutive years.

Below is a chart illustrating the annual Dividends Per Share trends for Webster Financial Corp:

Analysis of Dividend Yield and Growth

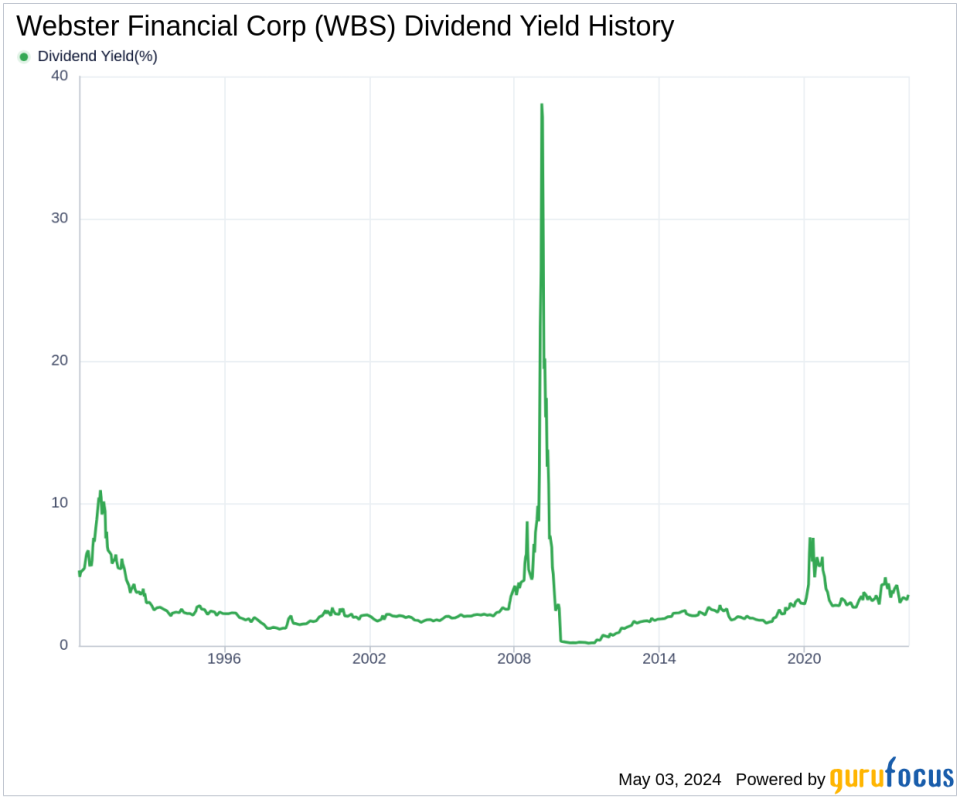

Currently, Webster Financial Corp boasts a trailing twelve-month dividend yield of 3.56% and a forward dividend yield of 3.56%, indicating stability in expected dividend payments. Over the past five years, the dividend growth rate has averaged 4.00% annually, and over the past decade, the annual dividends per share growth rate impressively stands at 11.00%.

The 5-year yield on cost for Webster Financial Corp stock is approximately 4.33%, reflecting the yield investors purchasing today can expect based on future dividends if the growth trend continues.

Dividend Sustainability Insights

The sustainability of dividends is often gauged by examining the dividend payout ratio, which for Webster Financial Corp stands at 0.27 as of March 31, 2024. This relatively low payout ratio indicates that the company retains a substantial portion of its earnings, which supports future growth and provides a buffer against economic downturns. Additionally, Webster Financial Corp's profitability rank is 6 out of 10, supported by consistent positive net income over the past decade.

Future Growth Prospects

For dividends to remain sustainable, underlying company growth is crucial. Webster Financial Corp's growth rank of 6 suggests moderate growth prospects. The company's revenue per share and 3-year revenue growth rate of approximately 5.70% per year, though slightly underperforming against global competitors, still indicates a robust revenue model. Its 3-year EPS growth rate and 5-year EBITDA growth rate further underscore its potential to sustain and grow dividends.

Conclusion

Considering Webster Financial Corp's consistent dividend increases, a manageable payout ratio, and solid profitability, the company presents a potentially attractive opportunity for dividend investors. The firm's growth metrics, although mixed, suggest a cautious optimism for its ability to maintain its dividend growth trajectory. Investors interested in high-dividend-yield stocks might consider using tools like the High Dividend Yield Screener available for GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance