Wealthy European investors drop nearly $1B on commercial properties in Canada

While it has been investors in the East that have been the subject of many a headline about their penchant for Canadian real estate, it turns out that their counterparts in the West are also snapping up properties.

According to data reported by The Globe and Mail, foreign buyers doled out a record $5.6 billion on commercial properties last year, according to U.S. commercial real estate firm CBRE Group, $950 million of which came from the Europe.

The majority of foreign investors were based in Asia, but a large part of the deals were hotel and office building acquisitions by financial groups such as China’s Anbang.

The insurer has gone on a high-profile property-buying spree, swallowing up the likes of New York’s Waldorf Astoria, a US$6.5-billion acquisition of Strategic Hotels and Resorts, as well as a 30-storey tower occupied by the Government of Ontario in downtown Toronto.

However, according to CBRE’s research, it appears as though wealthy European investors are also dipping their toes in the Canadian market.

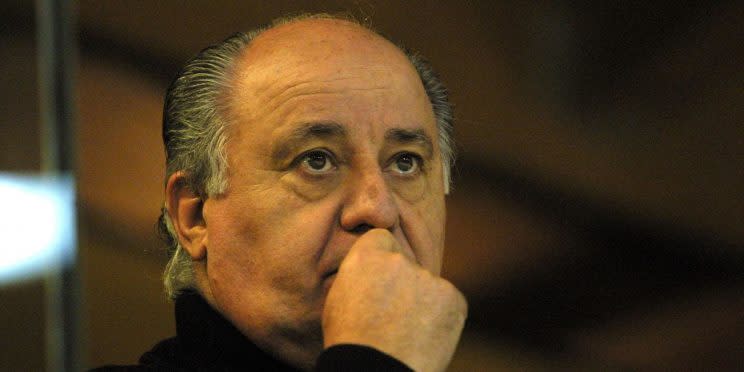

The elite list includes Spain’s Amancio Ortega, the founder of clothing giant Zara and Germany’s Klaus-Michael Kuehne, whose nearly US$10-billion fortune comes from his family’s shopping company Kuehne + Nagel.

Ortega has picked up prime real estate in Montreal’s downtown, while Kuehne acquired Vancouver’s highly coveted, 37-storey Royal Centre office tower for about $400 million last year.

Isabelle Hayen, a Belgian real estate investor, also recently bought a two-storey property on Toronto’s ritzy “Mink Mile,” which home to the country’s priciest retail rents, and is ripe for redevelopment.

The Globe reports that these wealthy European investors were drawn to Canada because of a number of factors, including the emergence of Toronto and Vancouver as global destinations, with commercial real estate prices that remain significantly below other, larger financial hubs, such as London and New York.

There’s also the Brexit element. CBRE said that many Europeans could be putting money into the Canadian market to hedge their bets, as the future of the European Union remains in question.

“Geopolitical uncertainty seems to increase on an on an almost daily basis. Against that backdrop, Canada is about as safe a bet as there is on the global scale,” Peter Senst, president of CBRE Canada Capital Markets,” told The Globe.

“What’s clear is Toronto and Vancouver have developed as gateway cities for global investors and we expect this demand to continue into 2017.”

In total, CBRE said foreign buyers made up 27 per cent of the $34.7 billion in Canadian commercial real estate transactions last year.

However, it only tracks sales of properties of $10 million or more.

CBRE said the previous record of foreign investment was set in 2008, when buyers from abroad account for 9 per cent of transactions.

Yahoo Finance

Yahoo Finance