WD-40 Co (WDFC) President and CEO Steven Brass Acquires Company Shares

Steven Brass, President and CEO of WD-40 Co (NASDAQ:WDFC), has recently increased his stake in the company. According to a SEC Filing dated 2024-04-16, the insider purchased 432 shares of WD-40 Co at a price of $232.22 per share.WD-40 Co is known for its namesake product, WD-40, a widely used lubricant, rust preventative, penetrant, and moisture displacer. The company also offers a range of homecare and cleaning products. WD-40's products are used in various industries and households worldwide, making it a staple in maintenance and repair operations.Over the past year, Steven Brass has been an active buyer of the company's stock, with a total of 432 shares purchased and no shares sold. This recent transaction aligns with the overall insider buying trend at WD-40 Co, which has seen 3 insider buys and no insider sells over the past year.

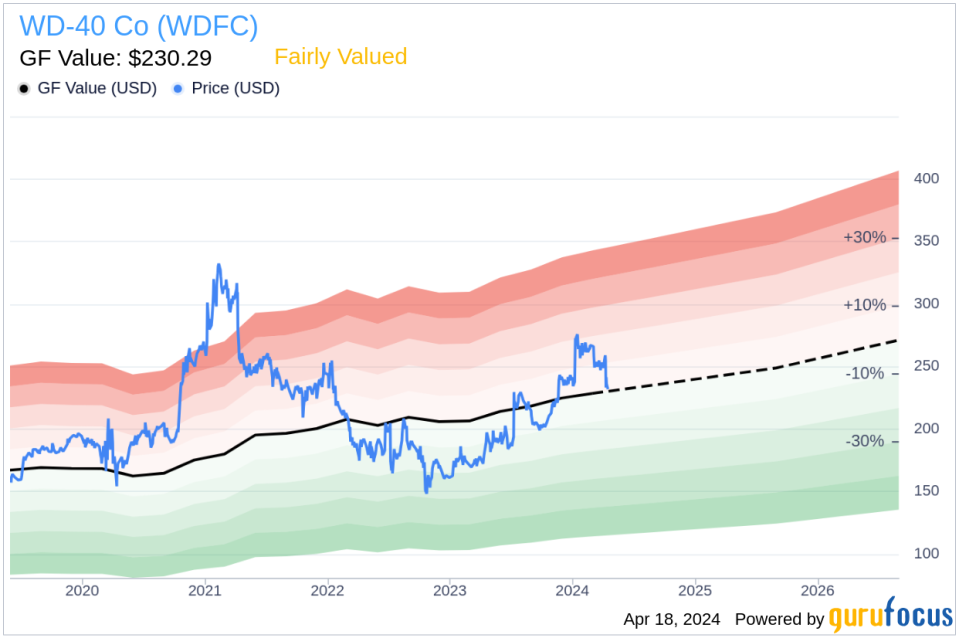

The market capitalization of WD-40 Co stands at $3.137 billion, reflecting the stock's position in the market. The company's price-earnings ratio is currently 46.21, which is above both the industry median of 22.37 and the company's historical median. This indicates a premium valuation compared to its peers and its own trading history.Regarding the stock's valuation, the price-to-GF-Value ratio is 1.01, with the stock trading at $232.22 and a GF Value of $230.29. This suggests that WD-40 Co is Fairly Valued based on GuruFocus's intrinsic value estimate.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates provided by Morningstar analysts.The insider's recent purchase adds to the positive sentiment around WD-40 Co's stock, as it reflects confidence from top management in the company's future prospects. Investors often look to insider transactions as an indicator of a stock's potential direction, and consistent insider buying can be a sign of underlying value in the company's shares.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance