WD-40 Co (WDFC) Posts Mixed Q2 Results: Revenue Up, EPS Misses Estimates

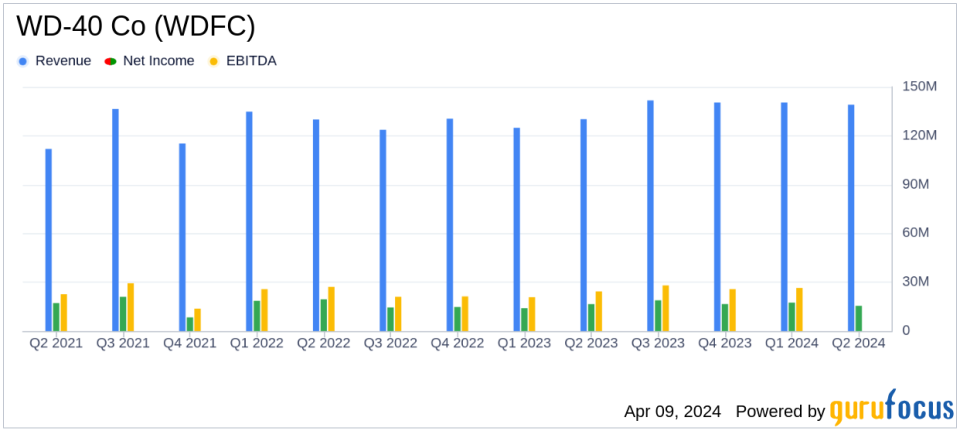

Revenue: $139.1 million, up 7% from the prior year quarter, below analyst expectations of $149.548 million.

Net Income: $15.5 million, a 6% decrease from the prior year quarter, missing the estimated $19.7 million.

Earnings Per Share (EPS): $1.14, down from $1.21 in the prior year quarter, not meeting the estimated $1.455.

Gross Margin: Improved to 52.4% from 50.8% in the prior year quarter.

Dividend: Declared a regular quarterly dividend of $0.88 per share.

Share Repurchase: Repurchased 23,000 shares at a total cost of $5.3 million under the $50.0 million plan.

On April 9, 2024, WD-40 Co (NASDAQ:WDFC) released its 8-K filing, detailing its financial results for the second quarter ended February 29, 2024. The company, known for its lubricants and cleaning products, saw a 7% increase in net sales compared to the same quarter of the previous year, reaching $139.1 million. However, this figure fell short of analyst revenue estimates of $149.548 million. Net income for the quarter was reported at $15.5 million, a 6% decrease from the prior year, and below the estimated $19.7 million. Earnings per share (EPS) also missed expectations, coming in at $1.14, compared to the estimated $1.455.

WD-40 Co (NASDAQ:WDFC) is a global company that manufactures and sells lubricants and cleaning products, with a product range that includes the iconic WD-40 aerosol spray, degreasers, rust removers, and a variety of maintenance and cleaning products. The company operates through three geographical segments: Americas, Europe/Middle East/Africa (EIMEA), and Asia-Pacific, with the Americas segment accounting for nearly half of the company's revenue.

The company's gross margin improved to 52.4% in the second quarter, up from 50.8% in the prior year fiscal quarter. This financial achievement is particularly important for a company in the chemicals industry, where margins are critical to profitability. WD-40 Co (NASDAQ:WDFC) also declared a regular quarterly dividend of $0.88 per share, illustrating its commitment to returning value to shareholders.

WD-40 Co (NASDAQ:WDFC) faced increased expenses, with selling, general, and administrative expenses up 19% to $45.0 million, and advertising and sales promotion expenses rising 12% to $6.7 million. Despite these challenges, the company is confident in its long-term targets and has increased its fiscal year 2024 net income and diluted earnings per share guidance.

According to Steve Brass, WD-40 Companys president and CEO, the company has made significant progress and is focusing on its core maintenance products, which represent 94% of total net sales. The decision to pursue a sale of the U.S. and U.K. Homecare and Cleaning Products portfolio is aimed at concentrating on higher-margin products and creating space for future innovation.

WD-40 Co (NASDAQ:WDFC) has also updated its fiscal year 2024 guidance, expecting net sales growth between 6 and 12 percent, with net sales anticipated to be between $570 million and $600 million on a non-GAAP constant currency basis. The company is narrowing its gross margin range and increasing its net income and diluted earnings per share guidance based on its year-to-date performance.

For a more detailed analysis and further information on WD-40 Co (NASDAQ:WDFC)'s financials, including balance sheets and cash flow statements, investors and interested parties are encouraged to review the full 8-K filing. The company is poised to continue its strategic focus on maintenance products, aiming for sustainable, profitable growth.

Explore the complete 8-K earnings release (here) from WD-40 Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance