Warren Buffett's Top 5 Holdings as of the 1st Quarter

According to top 10 holdings statistics, a Premium feature of GuruFocus, the top five holdings of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) as of the March quarter-end were Apple Inc. (NASDAQ:AAPL), Bank of America Corp. (NYSE:BAC), Coca-Cola Co. (NYSE:KO), American Express Co. (NYSE:AXP) and Wells Fargo & Co. (NYSE:WFC).

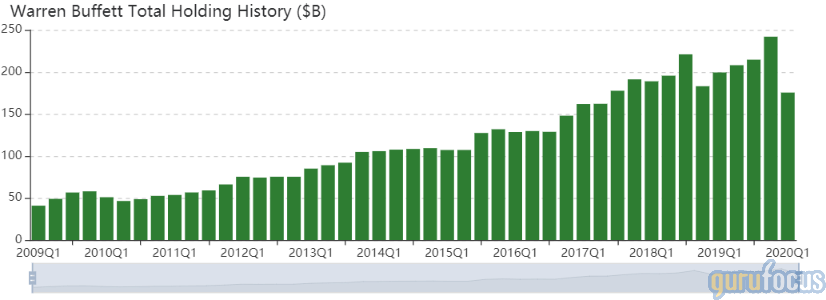

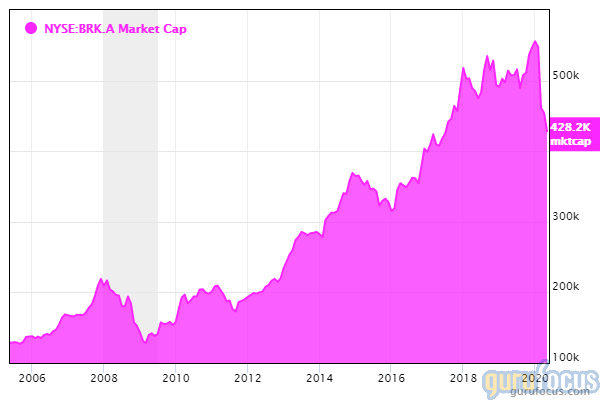

Commonly known as the "Oracle of Omaha," Buffett studied under the legendary Benjamin Graham at Columbia University. The CEO of Berkshire took the textile company and transformed it into conglomerate with a market cap over $425 billion.

Buffett reassured investors at his shareholder meeting earlier this month that "nothing can stop America": The "American miracle" has prevailed during tough times like World War II, the Cuban missile crisis, the Sept. 11, 2001 attacks and the 2008 financial crisis. His conglomerate seeks companies that have understandable businesses, with favorable long-term prospects, operated by competent management and available at attractive prices.

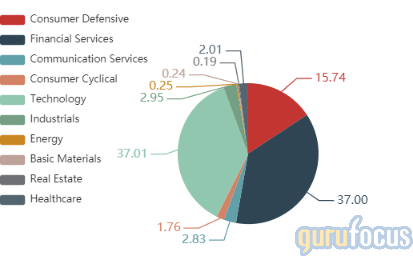

As of the quarter-end, Berkshire's $175.53 billion equity portfolio contains 50 stocks, with the top five holdings occupying 69.46% of the portfolio and the top10 holdings occupying 84.23% of the portfolio. The top three sectors in terms of weight are financial services, technology and consumer defensive, with weights of 37%, 37.01% and 15.74%.

The following video explores how to access and read information on Buffett's guru pages, including the current portfolio and sector weightings pages.

Apple

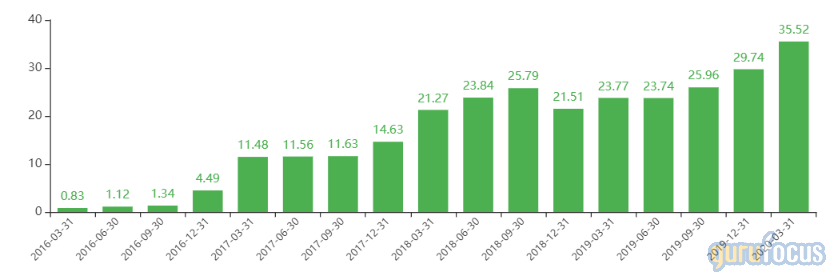

Berkshire owns 245,155,566 shares of Apple as of March 31. While the conglomerate made no change to its holding, the Cupertino, California-based tech giant occupies 35.52% of the equity portfolio, up from the December 2019 weight of 29.74%.

Figure 1 illustrates the top sections of Apple's summary page, which includes some basic fundamentals, a valuation chart, a price chart and information on Apple's financial strength, profitability and relative valuation.

Figure 1

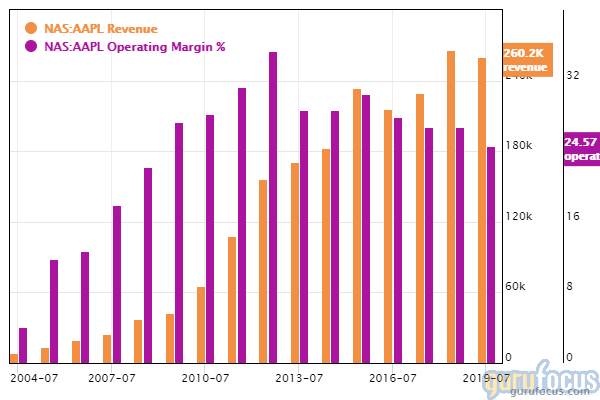

As we can see, Apple has a profitability rank of 10 out of 10, driven by several strong investing signs, which include a 4.5-star business predictability rank, a high Piotroski F-score of 8 and profit margins and returns outperforming over 96% of global competitors. Notice how the color bars in the "Profitability" section are green, indicating positive investing signs.

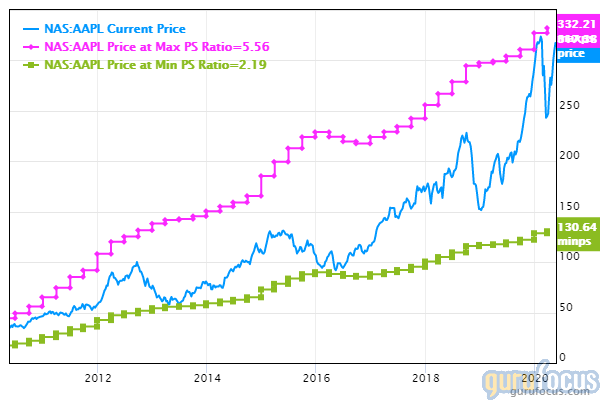

Despite high profitability, Apple's valuation ranks 1 out of 10 on several signs of overvaluation, which include price-book and price-sales ratios close to 10-year highs and underperforming over 87% of global competitors. In other words, at least 87% of global consumer electronics companies have price valuations that are lower, and thus more attractive than that of Apple's. The red bars indicate warning signs, i.e., red flags.

Bank of America

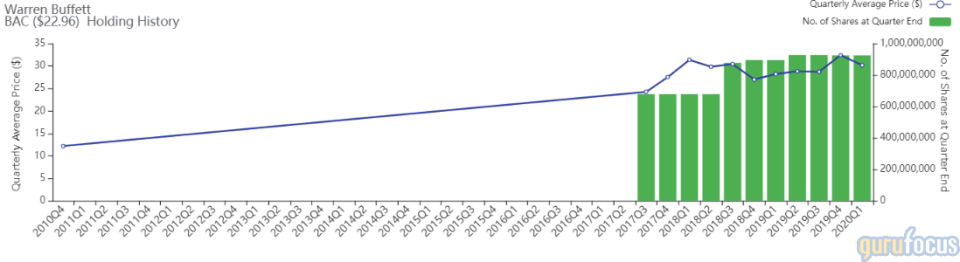

Berkshire owns 925,008,600 shares of Bank of America, dedicating 11.19% of the equity portfolio to the holding.

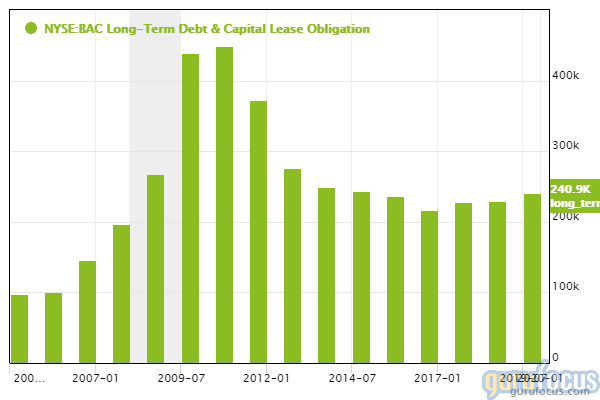

The Charlotte-based bank operates four businesses: consumer banking, global wealth and investment management, global banking and global markets. GuruFocus ranks Bank of America's financial strength 3 out of 10 on the back of debt ratios underperforming 67.46% of global competitors, suggesting high financial leverage. The website warns that Bank of America has increased its long-term debt by $9.8 billion over the past three years.

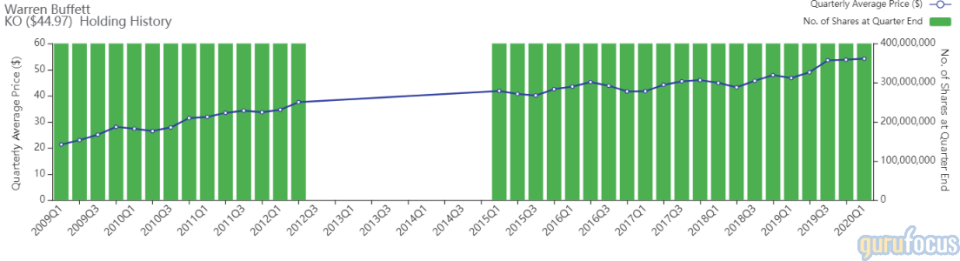

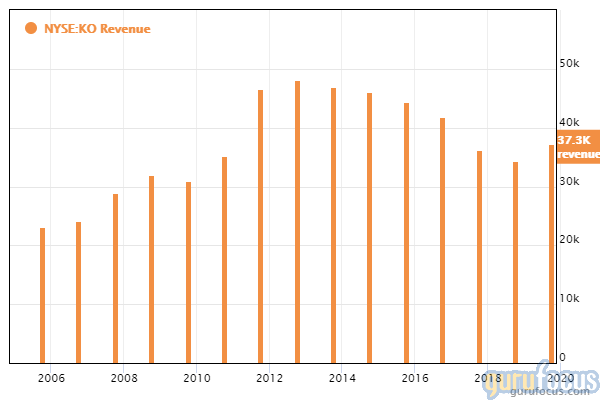

Coca-Cola

Berkshire owns 400 million shares of Coca-Cola, giving the position 10.08% weight in the equity portfolio.

GuruFocus ranks the Atlanta-based beverage giant's profitability 8 out of 10 on several positive investing signs, which include expanding operating margins and returns that are outperforming over 83% of global competitors. Despite this, revenues have declined approximately 3.4% per year on average over the past three years, a rate that underperforms 74.44% of global non-alcoholic beverage companies.

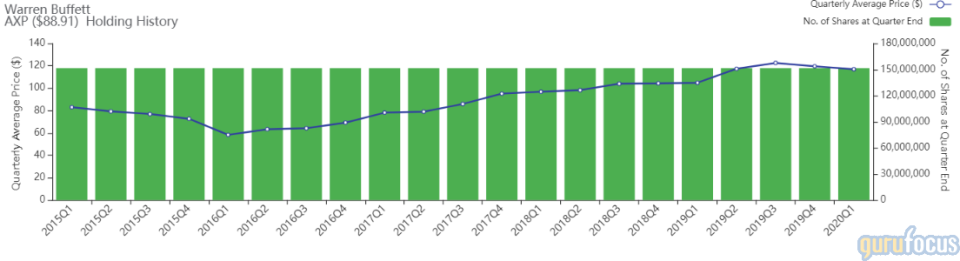

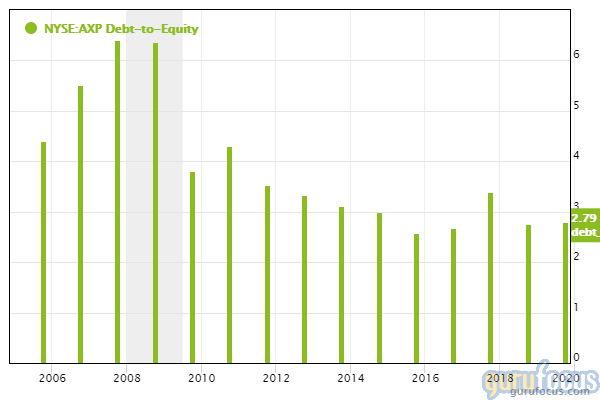

American Express

Berkshire owns 151,610,700 shares of American Express, giving the position 7.39% weight in the equity portfolio.

The New York-based company operates three credit service businesses: global consumer services, global commercial services and global merchant and network services. According to GuruFocus, American Express' equity-to-asset ratio of 0.11 underperforms over 86% of global competitors, suggesting high leverage. Despite this, American Express' cash-to-debt ratio of 0.64 outperforms 64.8% of global credit service companies.

Wells Fargo

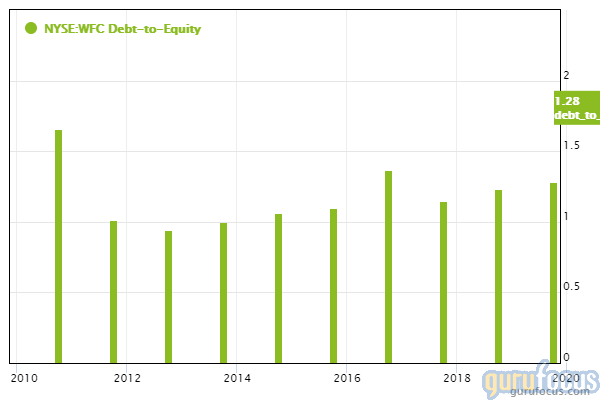

Berkshire owns 323,212,918 shares of Wells Fargo, giving the position 5.28% weight in the equity portfolio.

GuruFocus ranks the San Francisco-based bank's financial strength 3 out of 10 on the heels of cash-to-debt and debt-to-equity ratios underperforming over 65% of global competitors.

Disclosure: The author is long Apple as of this writing. The discussion of stocks in this article reflects Berkshire's holdings as of the March filing and does not consider any trades Buffett's conglomerate might have made during April or May.

Read more here:

Bruce Berkowitz Buys Buffett's Berkshire and Kraft Heinz in the 1st Quarter

Video: Warren Buffett's Market Indicator Rises Above 130%

Warren Buffett's Apple Falls as Company Skips June-Quarter Guidance

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance