Warren Buffett's Strategic Acquisition of Occidental Petroleum Shares

Overview of the Recent Transaction

On June 12, 2024, Berkshire Hathaway, under the stewardship of Warren Buffett (Trades, Portfolio), expanded its holdings in Occidental Petroleum Corp (NYSE:OXY) by acquiring an additional 1,750,308 shares. This transaction, executed at a price of $60.3 per share, has increased Berkshire Hathaway's total holdings in Occidental Petroleum to 252,333,913 shares. This move not only reflects a significant confidence in the oil and gas sector but also increases Berkshire's stake in Occidental Petroleum to a commanding 28.46%, with the position now representing 4.59% of Berkshire's total portfolio.

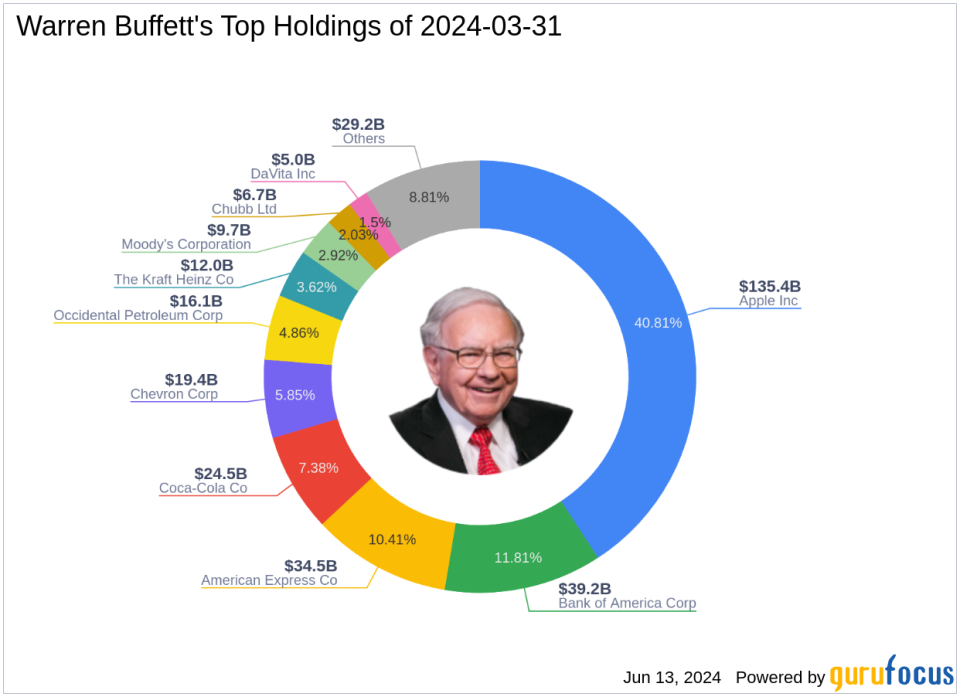

Profile of Warren Buffett (Trades, Portfolio)

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a legendary figure in the investment world. As the Chairman of Berkshire Hathaway, Buffett has transformed a struggling textile company into a major conglomerate, with a keen focus on insurance and other diverse investments. Buffett's investment philosophy, deeply rooted in the principles of value investing taught by Benjamin Graham, emphasizes understanding a business deeply, investing with a margin of safety, and holding for the long term. Berkshire Hathaway's top holdings include significant positions in major companies across various sectors, demonstrating a diversified strategy aimed at robust and sustained growth.

Insight into Occidental Petroleum Corp (NYSE:OXY)

Occidental Petroleum is a leading entity in the oil and gas industry, focusing on exploration and production, with additional operations in chemical and midstream marketing. As of the end of 2023, the company boasted nearly 4 billion barrels in net proved reserves and a daily production average of 1,234 thousand barrels of oil equivalent. Despite being currently valued at $53.46 billion and having a PE ratio of 16.48, the stock is considered modestly overvalued with a GF Value of $53.68. Occidental's market performance and strategic operations position it as a significant player in the energy sector.

Impact of the Trade on Berkshire Hathaway's Portfolio

The recent acquisition of Occidental Petroleum shares further solidifies Berkshire Hathaway's investment in the energy sector, particularly in a time of global economic fluctuations and energy transitions. The addition of these shares not only enhances the diversity of Berkshire's portfolio but also aligns with Buffett's strategy of investing in companies with strong fundamentals and long-term growth potential.

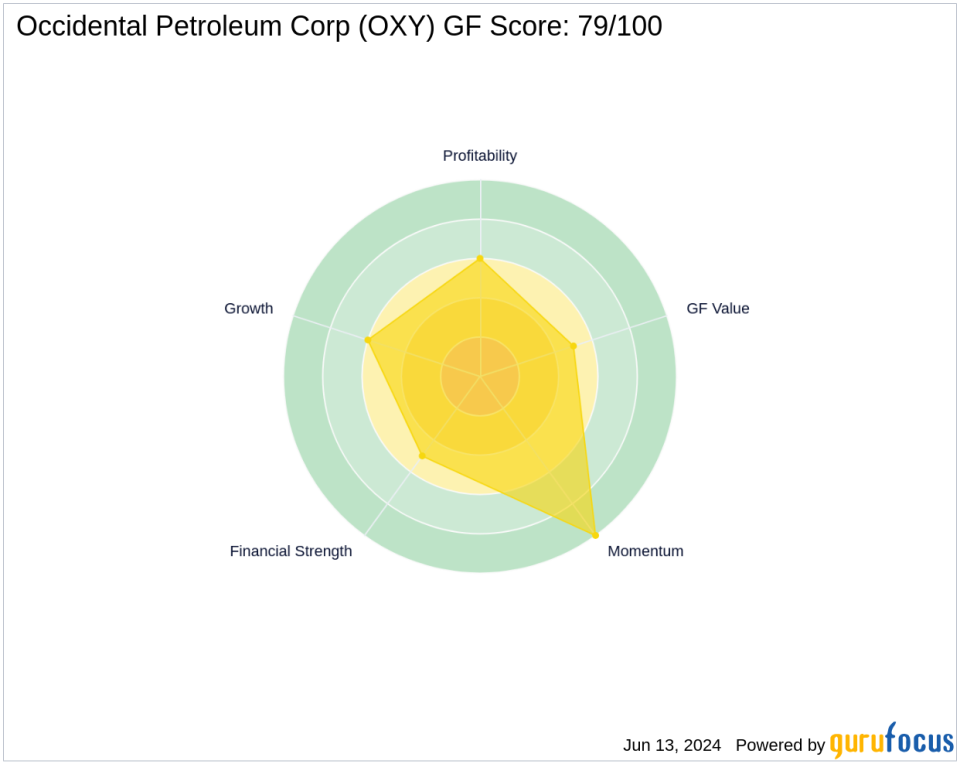

Financial Health and Market Performance of Occidental Petroleum

Occidental Petroleum exhibits a solid financial structure with a Financial Strength rank of 5/10 and a Profitability Rank of 6/10. The company's commitment to maintaining a balanced sheet and its strategic market positioning underscore its resilience in a competitive industry. Furthermore, Occidental's Piotroski F-Score of 5 indicates a stable financial situation, which could be appealing to conservative investors.

Comparative Analysis with Other Gurus

Other notable investors in Occidental Petroleum include Dodge & Cox and Prem Watsa (Trades, Portfolio), indicating a strong guru interest in this stock. However, Berkshire Hathaway remains the largest shareholder, underscoring its strategic commitment to Occidental as a key component of its investment portfolio.

Conclusion

Warren Buffett (Trades, Portfolio)'s recent purchase of additional shares in Occidental Petroleum is a testament to Berkshire Hathaway's confidence in the oil and gas industry's robust fundamentals and long-term growth potential. This strategic investment not only enhances Berkshire's portfolio but also positions it to capitalize on industry trends and potential economic recoveries. As the market continues to evolve, this move by Buffett could be seen as a significant indicator of the energy sector's future trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance