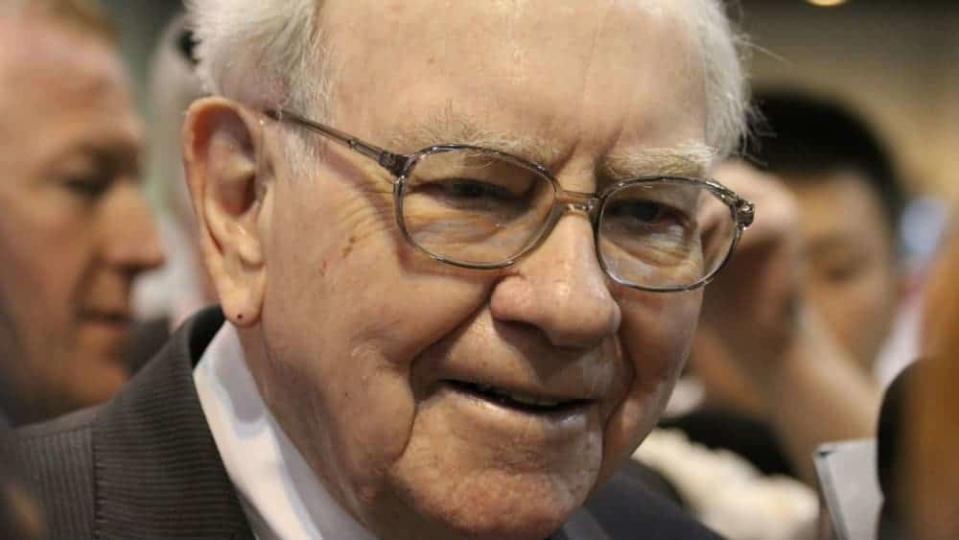

Warren Buffett: Why You Need to Heed His Words of Wisdom

Warren Buffett seems to be playing it cautious in these unprecedented times. The coronavirus pandemic has decimated the world economy while claiming hundreds of thousands of lives. Various pundits have attempted to predict the extent of the total economic damage that will be done and the trajectory of the recovery.

Some see a quick ‘V-shaped’ recovery with a rapid rebound in employment. Others see the worst depression since the 1930s. And others, like Warren Buffett, are humble enough to acknowledge they have no idea what’s next, but note the range of possibilities is vast.

Warren Buffett: I don’t know the consequences of shutting down the American economy

It is likely that COVID-19 may be around longer than initially expected. This makes the extent of the economic damage nearly impossible to forecast. Buffett knows this, and he’s not trying to grab attention with a bold, alarmist prediction.

The Canadian and U.S. economies may be on the cusp of reopening for business. But investors need to be aware that the gradual return to normal could still be derailed in a big way. It may not be as smooth as some may be expecting, given this bear market bounce. That could leave many market chasers holding the bag as cautious optimism turns back into fear.

Dr. Anthony Fauci recently warned that a premature reopening of the U.S. economy could spark a potentially uncontrollable resurgence in coronavirus infections. Fauci is the director of the National Institute of Allergy and Infectious Diseases (NIAID) in the United States.

“There is a real risk that you will trigger an outbreak that you might not be able to control,” said Fauci. “Not only leading to some suffering and death, but it could even set you back on the road to get economic recovery.”

The wide range of possibilities needs an “all-weather” investment strategy

Buffett’s actions, I believe, speak louder than his words. He was a net seller of equities in April, but still made around US$4 billion worth of bets in the first quarter. His bets were likely defensive in nature and speak to his cautious optimism, even in times of crisis.

Buffett warned investors that they have to be careful how they bet on stocks in the face of such considerable uncertainty. If you’re one to heed the man’s words of wisdom, you should be looking to adopt an “all-weather” approach to investing. This means picking your spots carefully and avoiding “all-or-nothing” type bets.

Few things in this world are more unpredictable than biology.

By selling all your stocks and hoarding cash, you’re betting against the production of an effective vaccine or a promising treatment. That bet could cost you significant upside. The other side of the bet would be to go all-in on stocks, especially in the more cyclical areas of the market. That could leave you in big trouble if a worst-case scenario ends up unfolding. That could happen if a vaccine isn’t developed for many years, and this pandemic drags on through 2021 and beyond.

What’s a Buffett-esque stock to buy today?

The range of possibilities is wide. You need to be like Buffett and proceed cautiously, rather than making rash decisions based on emotions. If you’re looking for something to buy, consider bolstering your defences with a stock like Shaw Communications (TSX:SJR.B)(NYSE:SJR). Shaw sports a well-covered 5.4%-yielding dividend that I see as safe, even with dividend cuts coming from all sides.

I’ve noted in the past that as a lower-cost provider of telecom services, Shaw is the most defensive play in an already defensive industry. I believe those two layers of defence make Shaw a good addition to any portfolio that needs some all-weathering.

Shaw will still move along with the broader markets. But the stock is easier to value than many, given its steady and predictable cash flow stream. Plus, it doesn’t depend on a full return to normalcy.

Stay hungry. Stay Foolish.

The post Warren Buffett: Why You Need to Heed His Words of Wisdom appeared first on The Motley Fool Canada.

More reading

Why the Canada Revenue Agency Might Ask You for Those CERB Payments Back

Canada Revenue Agency: How to Generate $418 in Extra Monthly Pension Income and Avoid OAS Clawbacks

Fool contributor Joey Frenette owns shares of SHAW COMMUNICATIONS INC., CL.B, NV.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance