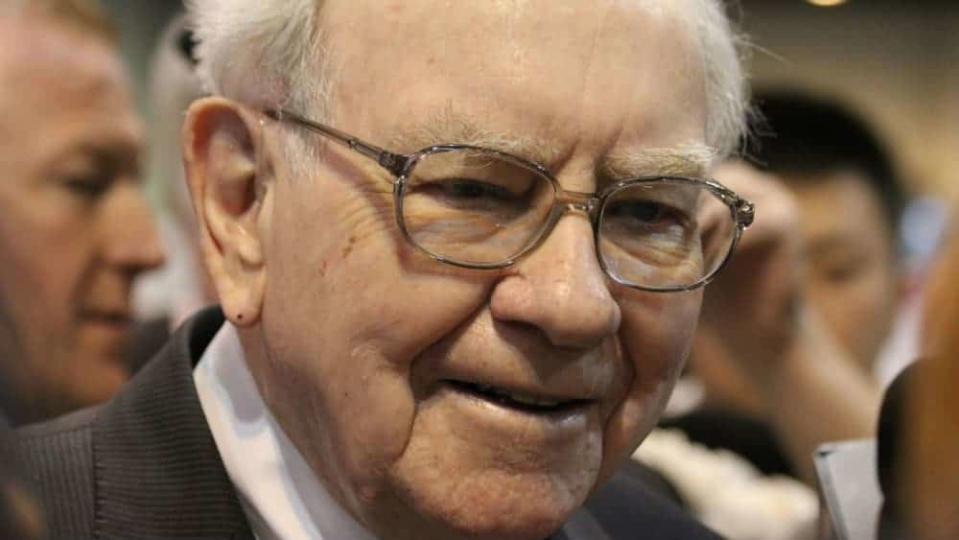

Warren Buffett Fans: 1 Buffett Stock to Buy (and 1 Vital Piece of His Advice to Heed)

Does market volatility have you rattled? What about the fact that politics are dictating the trajectory of the market, the inverting yield curve, or that other economic indicators that point to an imminent recession? What about lower bond yields, low oil prices, and their negative implications on the Canadian economy?

There are a plethora of things to worry about at this juncture, but as a Foolish long-term investor, we try not to focus our efforts on where we think the markets are headed over the near term. That is impossible. Instead, we look to individual businesses themselves and look to purchase them at discounts to their intrinsic values.

As Warren Buffett once pointed out, intrinsic value isn’t necessarily a precise point; it’s more of a range. And anytime you can buy at the low end of the range (or below the range), you have an opportunity to make an outsized gain over the long term, as dust inevitably settles on whatever is causing investors to worry at any given instance.

While it is important to analyze the macro picture and a company’s industry environment using a top-down analysis, one must not draw too much emphasis on broader market predictions made by so-called pundits in the mainstream media, nor the “odds” of material contingent events.

So, forget about “the odds that Trump will make a deal with China” or “the odds that a pipeline will be built to relieve the pressure faced by heavy Canadian crude.” The stock market isn’t a casino (well, it may be for many short-term-focused traders), and for long-term investors, the erratic moves made in response to whatever “odds” of events happening are usually an opportunity to scoop-up quality merchandise that’s been unfairly placed in the bargain bin.

The best thing about the stock market and the elevated levels of volatility we’ve seen over the past two years is the fact that those “massive stock sales” and the degree of market inefficiency are both higher than they would be in a calmer market. And that’s good news for do-it-yourself value investors who are hungry for deals.

Warren Buffett couldn’t care less about timing the markets over the short term. He’s all about spotting value and owning pieces of businesses for very long periods of time, sometimes in spite of the dire circumstances that are well-known to many investors.

Think Suncor Energy (TSX:SU)(NYSE:SU), the Canadian integrated oil sands company that’s been doing its best to protect its investors from the hideous industry-wide conditions that have existed since the 2014 implosion in oil prices.

While Suncor is a best-in-breed energy operator in Alberta’s oil patch, it is still basketed with the other bad apples in Canada’s energy sector, and that makes Suncor a fairly underwhelming bet through the eyes of foreign institutional investors who have been throwing in the towel on Canadian energy stocks left, right, and centre over the past few years.

The regulatory environment was unattractive in the past, but it’s constantly changing. The UCP government is more accommodative to energy firms. Should a Conservative government be elected, foreign investors may see Canada’s energy patch as a more attractive place to invest again. In any case, true long-term investors shouldn’t try to pin “odds” on the election of a Conservative Prime Minister, which could be a boon for Canadian energy investment.

Instead, investors should weigh the risks and rewards, and the price they’ll pay for what they’re getting. With Suncor, you’re getting a strong, growing dividend (4.2% yield at the time of writing) that’s able to grow, even if WCS prices were never to see their pre-2014 highs again. And if, unexpectedly, WCS does rally higher? Suncor will prosper greatly, as it becomes more economical to turn on the taps to its “hibernating” potential projects.

Suncor is sitting on a black-gold mine, and while a bet on rising oil prices over the near term is a foolish wager, a long-term bet on dividend growth for a historically low multiple (13.2 times next year’s expected earnings), with a good chance of big upside in the event of higher oil prices over the years, makes for a fabulous investment.

Stay hungry. Stay Foolish.

More reading

Get $290 a Month in Passive TFSA Income From This Reliable REIT

How a Canadian Couple Can Turn $12,000 in TFSA Contributions Into $135,000

Fool contributor Joey Frenette has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2019

Yahoo Finance

Yahoo Finance