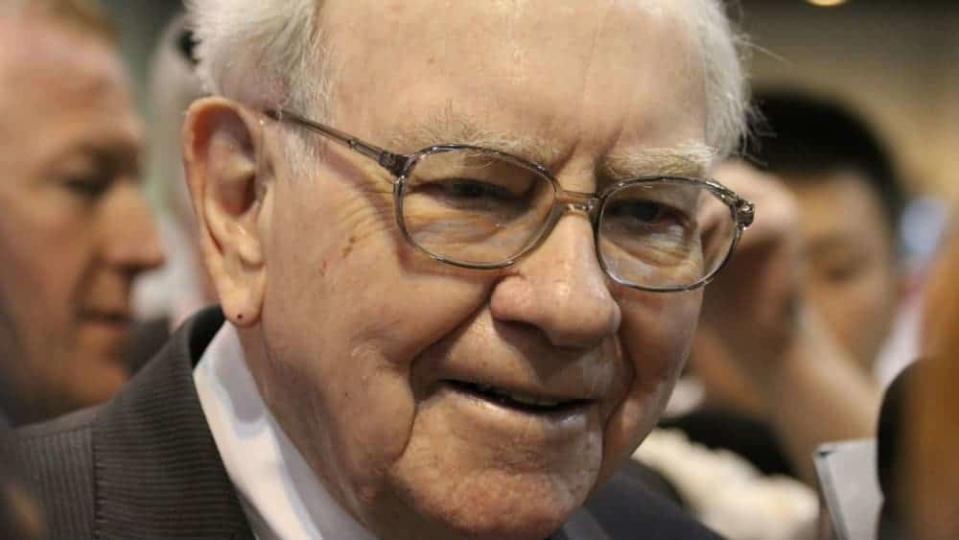

Will Warren Buffett Buy Air Canada (TSX:AC) Stock?

Air Canada (TSX:AC) stock looks like a great value opportunity.

From 2012 to 2019, shares rose 50 times in value. However, in 2020, the COVID-19 pandemic sent shares lower by nearly 70%. Many investors are betting that a rebound is just around the corner. If they’re right, they could triple their investment.

Last year, Warren Buffett was a leading investor of four different airlines. He’s also known for buying distressed businesses during a market panic. During the financial crisis of 2008, for example, he took big positions in many well-known companies.

With a high-quality business model and a proven record of success, it’s reasonable to believe that the Oracle of Omaha will make a bet on Air Canada stock. In many ways, it’s a perfect fit.

Will Warren Buffett buy Air Canada stock?

Learn the background

Before you decide whether Buffett will jump in, it’s important to understand how he thinks about airlines. In a nutshell, he wasn’t always a fan. But over time, he learned to love these businesses.

“If a far-sighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favour by shooting Orville down,” Buffett said more than a decade ago. “I think there have been almost 100 airline bankruptcies,” he later added. “I mean, that is a lot. It’s been a disaster for capital.”

By 2017, however, Buffett bought shares in several airlines. While he didn’t take a position in Air Canada, his investing actions clearly indicated what type of airline he preferred.

“It’s true that the airlines had a bad twentieth century,” Buffett noted a few years before the pandemic began. “They’re like the Chicago Cubs. And they got that bad century out of the way. The hope is they will keep orders in reasonable relationship to potential demand.”

The biggest thing that changed was competition. Industry supply used to be so rampant that no airline could turn a profit, including Air Canada.

Then competition rationalized. Supply and demand were balanced, meaning pricing recovered. All of this was due to consolidation.

Buffett’s airline positions were completely focused on businesses with high market shares, which give them disproportionate pricing power. If you want to know which airlines Buffett will buy, look at the market share leaders.

Will Buffett buy Air Canada?

It’s critical to note that Buffett no longer owns any airline stocks. He sold his positions when the pandemic first began. There was simply too much uncertainty for him to remain invested.

With a willingness to invest in the industry, however, it’s only a matter of time before he returns. With valuations near multi-year lows, that return could happen quicker than expected.

Air Canada could top his buy list. The four airlines Buffett used to own combined for a 60% market share in the United States. Air Canada alone has a 50% market share in Canada.

Buffett prefers airlines with dominant market shares. In that regard, AC stock leads the way. Few airlines command this much market power.

When Buffett returns to airlines, he’ll likely target Air Canada.

The post Will Warren Buffett Buy Air Canada (TSX:AC) Stock? appeared first on The Motley Fool Canada.

More reading

Hotter Than Shopify (TSX:SHOP), This Underrated TSX Tech Stock Has Room to Soar!

Market Crash 2020: A Chance to Turn Your $69,500 TFSA Into $1 Million

Fool contributor Ryan Vanzo has no position in any stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance