Warren Buffett Bolsters Stake in Liberty SiriusXM Group

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway has recently made a notable addition to its investment portfolio by acquiring additional shares in Liberty SiriusXM Group (NASDAQ:LSXMA). On April 12, 2024, the firm increased its stake in the company, signaling a strategic move by the seasoned investor. This transaction has caught the attention of the investment community, as it may indicate Buffett's confidence in the future prospects of Liberty SiriusXM Group.

Warren Buffett (Trades, Portfolio)'s Investment Acumen

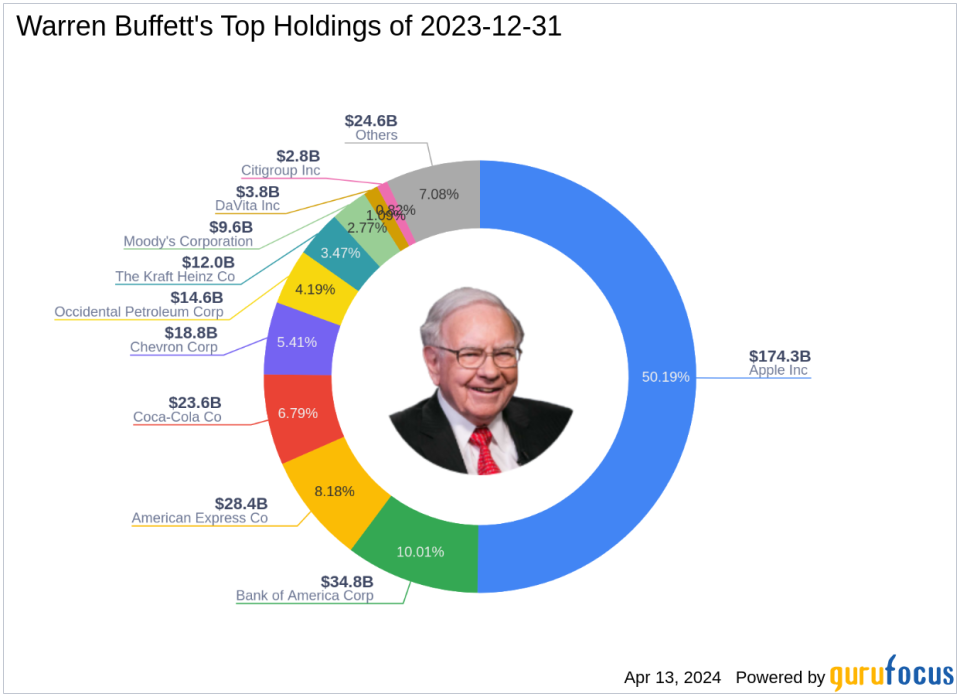

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a paragon of investment success. With a storied career that has set the benchmark for value investing, Buffett's Berkshire Hathaway has transformed from a textile manufacturer into a behemoth with a diverse portfolio of businesses and investments. Buffett's investment philosophy, deeply influenced by Benjamin Graham, emphasizes understanding a business, long-term prospects, management quality, and intrinsic value. Berkshire Hathaway's top holdings, including giants like Apple Inc (NASDAQ:AAPL) and Bank of America Corp (NYSE:BAC), reflect this strategy.

Understanding Liberty SiriusXM Group

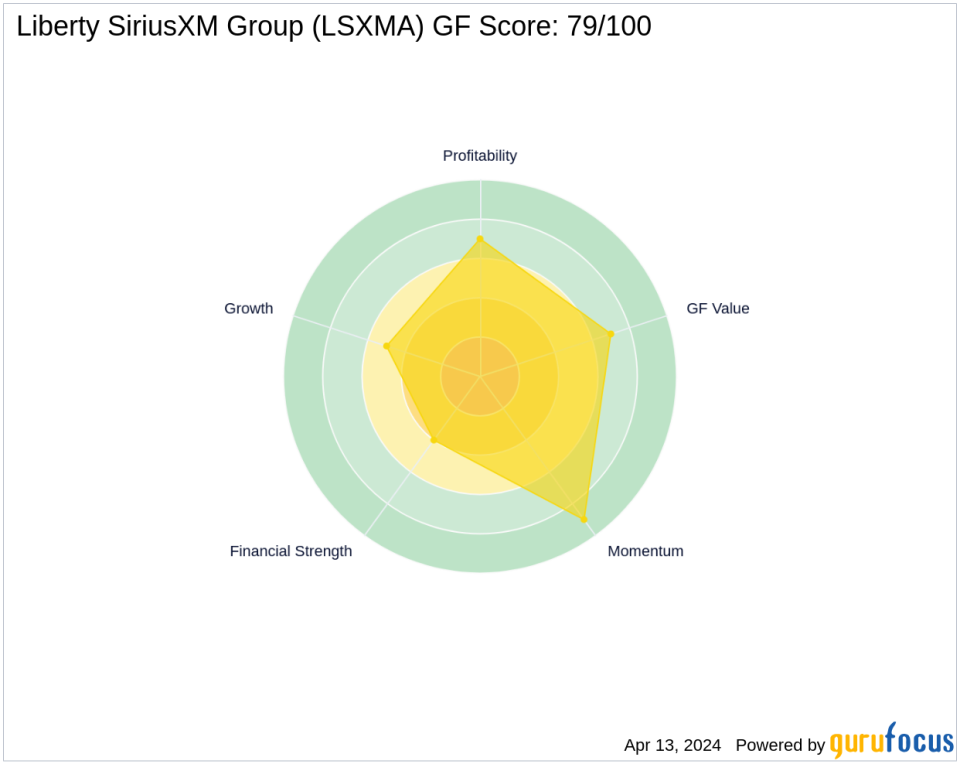

Liberty SiriusXM Group operates a subscription-based satellite radio service, offering a wide array of channels and infotainment services. Since its IPO on April 18, 2016, the company has expanded its reach in the US and UK, distributing its services through various channels, including automakers and retail locations. With a market capitalization of $8.31 billion and a stock price of $25.5, Liberty SiriusXM Group is a significant player in the media-diversified industry. The company's financial metrics, such as a PE ratio of 11.45 and a GF Score of 79/100, suggest a strong potential for future performance.

Details of Buffett's Latest Trade

The recent transaction saw Buffett's firm add 803,890 shares of Liberty SiriusXM Group at a trade price of $25.92. This move increased Berkshire Hathaway's total holdings in the company to 34,682,219 shares, representing a 10.62% stake in the traded stock and a 0.26% position in the firm's portfolio. The trade had a modest impact of 0.01% on the portfolio, yet it reflects a strategic decision by one of the world's most respected investors.

Liberty SiriusXM's Role in Buffett's Portfolio

With the latest acquisition, Liberty SiriusXM Group now constitutes a significant portion of Buffett's portfolio, showcasing the firm's confidence in the stock's value and growth potential. While the position is not as large as some of Buffett's top holdings in the technology and financial services sectors, it is a noteworthy investment that aligns with Berkshire Hathaway's value investing principles.

Market Valuation and Performance

Liberty SiriusXM Group is currently considered modestly undervalued, with a GF Value of $30.95 and a price to GF Value ratio of 0.82. Despite a slight decline of 1.62% in stock price since the transaction, the company's long-term performance remains positive, with a 23.96% increase since its IPO and a GF Score indicating high outperformance potential.

Other Notable Investors in LSXMA

Berkshire Hathaway is not the only prominent investment firm with a stake in Liberty SiriusXM Group. Other notable investors include Seth Klarman (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), and Mario Gabelli (Trades, Portfolio), each with their own unique investment strategies and share percentages in the company. Their interest further validates the stock's appeal to savvy investors.

Implications of Buffett's Investment Move

Warren Buffett (Trades, Portfolio)'s recent investment in Liberty SiriusXM Group underscores the stock's potential and aligns with Berkshire Hathaway's value-driven approach. For value investors and market watchers, this transaction is a significant indicator of the stock's intrinsic value and future prospects. As Buffett's firm continues to adjust its portfolio, the investment community will be watching closely to see how this position evolves and impacts the broader market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance