Warning! 1 TSX Dividend Stock I’d Avoid Right Now

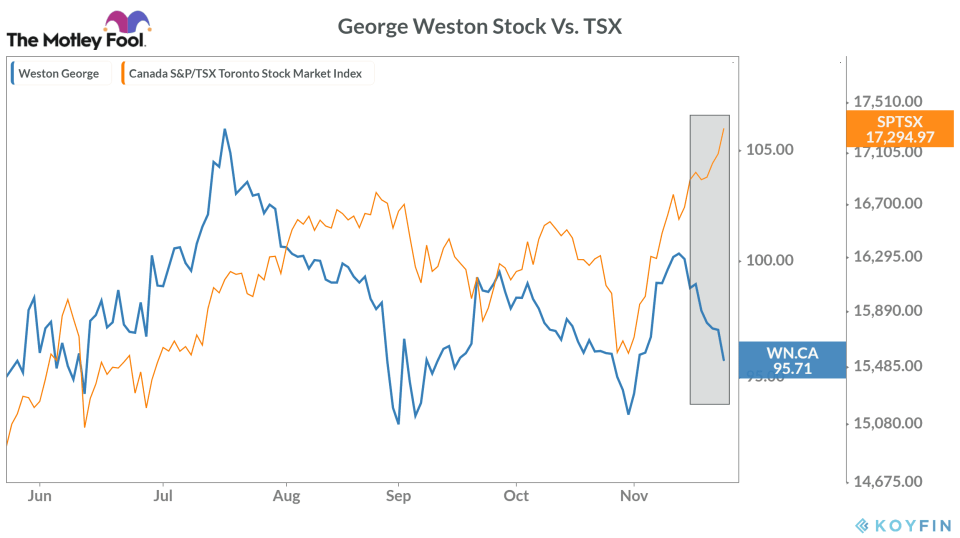

George Weston (TSX:WN) stock is continuing to trade on a negative note after reporting its slightly positive Q3 results last week. Since November 17 — the day of its earnings release — its stock has lost over 3%. In contrast, the broader market has traded with positive sentiments during this period. In the last 10 days, the S&P/TSX Composite Index has gone up by 3.8%.

As we know, if a stock with good fundamentals temporarily goes down, it could be a buying opportunity. Let’s find out whether this rule applies to George Weston stock after its recent decline.

George Weston’s key businesses

George Weston is a Toronto-based food processing and distribution group. Its primary subsidiaries include Weston Foods, Loblaw (TSX:L), and Choice Properties. In 2019, the food processing giant’s over 95% of total revenue came from Loblaw — the Canadian supermarket chain.

Despite having a presence in the United States, George Weston makes most of its profit from its home market. Last year, Canada accounted for about 98% of its total revenue, while the U.S. market accounted for the remaining 2%.

Recent earnings trend

The overall trend in George Weston’s recent earnings has been slightly negative in the last couple of quarters. While the group’s adjusted earnings saw a massive 45.3% YoY (year-over-year) drop in the second quarter, the trend slightly improved in the third quarter. In Q3 2020, its earnings fell by 7.5% YoY to $2.35 per share, but it still managed to beat analysts’ consensus estimates of $2.19 per share.

George Weston’s total revenue growth has been around 6.5% YoY in the last couple of quarters. It was much lower than 10.4% growth rate in the first quarter of 2020 but much better than its 2019 sales growth of 3.2%.

The COVID-19 impact

Notably, George Weston’s double-digit Q1 sales growth was mainly driven by a sudden but temporary surge in essential items’ demand around mid-March due to COVID-19. That’s why comparing its latest quarterly sales with the first quarter won’t be appropriate.

While the demand for essential items has gradually normalized, businesses — including George Weston — still have to bear higher costs related to COVID-19 measures. It’s one of the reasons why Bay Street expects the company’s 2020 net profit margin to be around 1.9% — lower from 2.2% in 2019.

Bottom line

Despite being the top Canadian food-processing company, George Weston hasn’t been a great investment in the last five years. Its stock has lost 10.7% against nearly 28% rise in the TSX Composite benchmark during this period. The company also doesn’t offer very attractive dividends, as its dividend yield currently stands at just 2.3%.

Higher costs related to its subsidiary Loblaw’s ongoing restructuring efforts could further affect the group’s overall financial performance in 2020 and 2021. While George Weston’s food-service business has seen improvements in the third quarter, higher overall restructuring costs and costs related to COVID-19 measures would make maintaining this positive trend a challenging task.

That’s why you may want to avoid buying George Weston stock right now, as it may go further down in the coming quarters.

The post Warning! 1 TSX Dividend Stock I’d Avoid Right Now appeared first on The Motley Fool Canada.

More reading

Fool contributor Jitendra Parashar has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance