Wall Street Banks Set For Bond Sales Spree After Earnings

(Bloomberg) -- Wall Street’s biggest banks are set to borrow more than they usually do after reporting second-quarter earnings, taking advantage of falling yields and tapping debt markets before the US presidential election potentially brings market turmoil later this year.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

The six biggest US banks could borrow $21 billion to $24 billion after they post results, JPMorgan Chase & Co. credit analyst Kabir Caprihan wrote in a research note on Monday. Their average for July was roughly $17 billion over the past decade, but he expects it to be higher this time.

“Issuance should again be the near-term driver of spreads and remains (the) top question we get from investors going into earnings season,” wrote Caprihan.

JPMorgan, Citigroup Inc. and Wells Fargo & Co. are scheduled to kick off earnings Friday morning, followed by Goldman Sachs Group Inc. on Monday and Bank of America Corp. and Morgan Stanley on Tuesday. Analysts predict net interest income — the difference between what banks earn on their assets and what they pay on debts — will drop for a second straight quarter after a record surge last year.

Yields have been falling for weeks amid signs that inflation is cooling. Thursday’s report showing lower-than-expected inflation in June sent them down further.

That provides a favorable backdrop for big banks, which are some of the largest issuers of investment grade corporate debt and whose funding decisions help set the tone for the rest of that market. Bonds from financial companies account for about a third of the US investment-grade market, according to Bloomberg index data.

The “Big Six” banks face about $50 billion of redemption calls and maturities in second-half of 2024, according to Barclays analysts including Peter Troisi. Barclays expects those bonds to be fully replaced with new senior debt, with the banks borrowing about $30 billion in the third quarter. Most of that would be issued this month.

Bank of America and Goldman have been the least active this year. As a result, analysts expect them to be big issuers in the second half.

Barclays predicts those two banks will borrow about $15 billion each. Troisi and his team forecast another $10 billion from regional lenders and $15 billion from trust and credit-card banks for the rest of the year.

Big lenders are also bracing for new capital rules that might require them to hold more debt at the holding-company level. The Federal Reserve is close to detailing a revamped plan for those rules, known as Basel III Endgame, Fed Chair Jerome Powell said Tuesday.

Bloomberg Intelligence analyst Arnold Kakuda expects big-bank bond issuance to rise, partly because of the anticipated rules. He forecasts issuance of $20 billion to $25 billion this month.

“Post-pandemic, the lenders have much bigger assets and larger debt footprints,” said Kakuda. “To keep their debt footprint, they will naturally be bigger issuers.”

Strong Demand

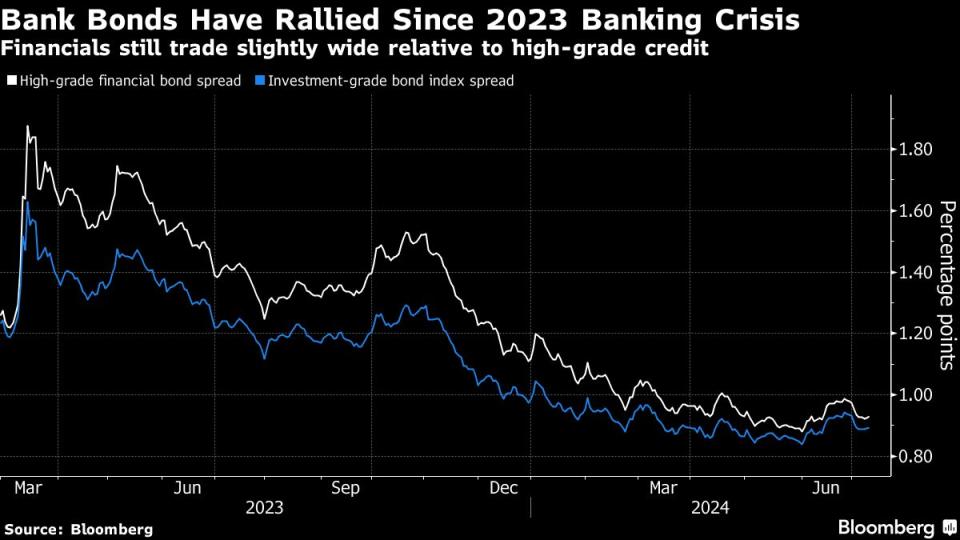

Banks’ borrowing spree is likely to be met with strong demand from investors flush with cash, including foreign firms and US pension plans. Bank bond spreads have rallied this year despite record corporate issuance in the first half, thanks in part to subdued issuance from some of the big lenders.

Banks have also been issuing more bank-level debt in recent months as deposits receded from their pandemic-era highs, helping keep a tight lid on the sector’s spreads. The average spread on a financial institution bond ended Wednesday at 93 basis points, just 3 basis points wider than the broader high-grade index, according to Bloomberg index data. That spread was 13 basis points wider at the start of the year.

Voya Investment Management is one of the investors interested in purchasing bank debt, according to Samuel Wilson, portfolio manager at the firm.

“We are looking to add into bank supply, especially the Big Six,” he said. “We have recently reduced the larger banks in anticipation of supply and because spreads are generally full in the broader IG market. So that gives us room to add, especially if we see some underperformance or broader spread widening.”

(Updates with additional details throughout.)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance