Vishay (VSH) Boosts Opto Offerings With New Proximity Sensor

Vishay Intertechnology VSH is continuously making concerted efforts to strengthen its position in the booming optoelectronics market, which, per a Mordor Intelligence report, is expected to hit $47.6 billion in 2024 and reach $62.9 billion by 2029, witnessing a CAGR of 5.7% between 2024 and 2029.

In this regard, the company launched VCNL36828P, a compact, fully integrated proximity sensor featuring a vertical-cavity surface-emitting laser.

The proximity sensor offers a 20% smaller package, 20% lower idle current and 40% higher sunlight cancellation, enhancing efficiency in space-constrained, battery-powered applications.

It is designed for use in smartphones and smartwatches, enabling automatic screen wake-up and turn-off functions, detecting wearer status, and reducing costs by enabling two sensors without a multiplexer.

The device also boasts features like intelligent cancellation and a smart persistence scheme for efficient communication, reducing cross-talk and ensuring accurate sensing and faster response times.

Vishay is expected to gain solid traction across consumer applications like smartphones and smartwatches on the back of its latest move.

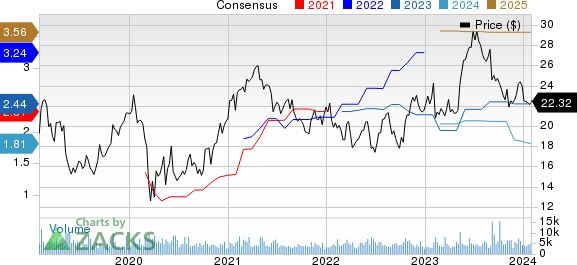

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Strengthening Optoelectronics Offerings

Apart from the launch of VCNL36828P, Vishay upgraded its family of infrared receiver (IR) modules, namely TSOP18xx, TSOP58xx and TSSP5xx, with its latest in-house integrated circuit technology.

These devices, which include a photodetector, preamplifier circuit and IR filter, enhance battery life in mobile devices and offer robustness for outdoor applications, ensuring long-term availability and cost savings.

Vishay also unveiled five 10 MBd high-speed optocouplers with a wide voltage supply range and open collector output, enabling low power consumption in industrial applications.

The company introduced three new IR sensor modules, namely TSMP95000, TSMP96000 and TSMP98000, to boost its optoelectronics offerings.

These new devices used for remote control systems offer features like pin-to-pin compatibility, wider supply voltage range, smaller bandwidth, higher ESD withstand capability and robust performance under strong DC light.

Overall Portfolio Strength Aids Growth

The company’s growing endeavors to bolster its opto offerings align with Vishay’s increasing efforts to strengthen its overall product portfolio.

Notably, Vishay introduced synchronous buck regulator modules, namely, SiC931, SiC951 and SiC967, to ensure ultrafast transient response, tight ripple regulation and loop stability, regardless of output capacitor type.

Further, the company debuted R3T2FPHM3, a two-in-one standard rectifier and transient voltage suppressor device for automotive applications.

Strength in the overall product portfolio will, in turn, continue to aid the company’s overall financial performance in the near term.

However, geopolitical tensions, inflationary pressures and a softening demand environment remain major concerns for the company. Vishay’s shares have lost 0.3% in the past year, underperforming the Zacks Computer & Technology sector’s growth of 50%.

The Zacks Consensus Estimate for 2024 total revenues stands at $3.21 billion, indicating a year-over-year decline of 5.7%.

The consensus mark for 2024 earnings is pegged at $1.84 per share, indicating a 24.3% decline from the year-ago figure.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Arista Networks ANET, Logitech International LOGI and Itron ITRI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks shares have returned 108.4% over the past year. The long-term earnings growth rate for ANET is pegged at 19.77%.

Shares of Logitech International have returned 42.4% over the past year. The long-term earnings growth rate for LOGI is currently projected at 15.75%.

Shares of Itron have gained 24.7% over the past year. The long-term earnings growth rate for ITRI is currently projected at 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance