Vincerx (VINC) Tumbles on Results From Cancer Therapy Study

Shares of Vincerx Pharma VINC plunged around 65% in pre-market trading on Tuesday after management announced preliminary results from early-stage clinical studies evaluating its pipeline candidates. These results were presented at the American Society of Cataract and Refractive Surgery (ASCRS).

At the ASCRS, Vincerx reported initial data from a phase I study evaluating VIP236, its investigational small molecule drug conjugate (SMDC), in 15 patients with metastatic tumors who have exhausted all standard therapy options. Early data from this study showed that seven patients achieved objective stable disease, including tumor reduction. Management also claimed that treatment with the drug was well-tolerated with no dose-limiting toxicities (DLTs).

Wall Street was not impressed with these results. Analysts at Leerink Partners pointed out that though the patients did achieve stable disease, the results were ‘lacking RECIST responses.’ The Leerink analysts claimed that the results posted by the company were ‘early’ and ‘potentially below investor expectations.’

The company intends to report additional data from the above study later this summer.

RECIST — short for ‘Response Evaluation Criteria in Solid Tumors’ — is a standard way to measure how well a cancer patient responds to treatment. It is based on whether tumors shrink, stay the same or get bigger.

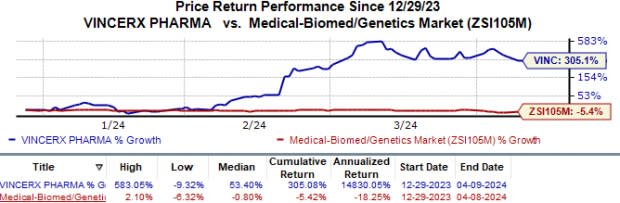

Year to date, Vincerx’s shares have skyrocketed 305.1% against the industry’s 5.4% fall.

Image Source: Zacks Investment Research

Apart from VIP236, management also provided an update on VIP943, its investigational antibody drug conjugate (ADC) targeting CD123 antibody. The ADC drug is currently being evaluated in an early-stage study for treating certain patients with leukemia or myelodysplastic syndromes (MDS).

Pharmacokinetic (PK) data from the above study which showed that treatment with VIP943 demonstrated minimal free payload in circulation, consistent with the favorable safety profile observed preclinically and clinically. Additional data from this study is expected at the European Hematology Association (EHA) meeting this June.

The successful implementation of these two clinical initiatives will be crucial for investors, especially given Vincerx’s limited cash runway until early third-quarter 2024.

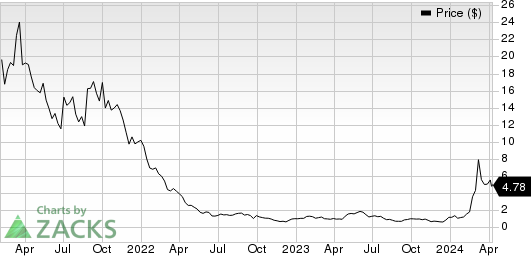

Vincerx Pharma, Inc. Price

Vincerx Pharma, Inc. price | Vincerx Pharma, Inc. Quote

Zacks Rank & Key Picks

Vincerx currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and Ligand Pharmaceuticals LGND,each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have surged 37.6%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 22.6%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, Ligand Pharmaceuticals’ earnings estimates per share for 2024 have increased from $4.42 to $4.56. During the same period, earnings estimates for 2025 have risen from $5.11 to $5.27. Year to date, shares of Ligand have gained 11.5 %.

Ligand Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters. On average, LGND’s four-quarter earnings surprise was 84.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Vincerx Pharma, Inc. (VINC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance