Video Gaming Stocks Q1 Highlights: Skillz (NYSE:SKLZ)

Let's dig into the relative performance of Skillz (NYSE:SKLZ) and its peers as we unravel the now-completed Q1 video gaming earnings season.

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

The 4 video gaming stocks we track reported a weak Q1; on average, revenues missed analyst consensus estimates by 2.3%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and video gaming stocks have held roughly steady amidst all this, with share prices up 3.2% on average since the previous earnings results.

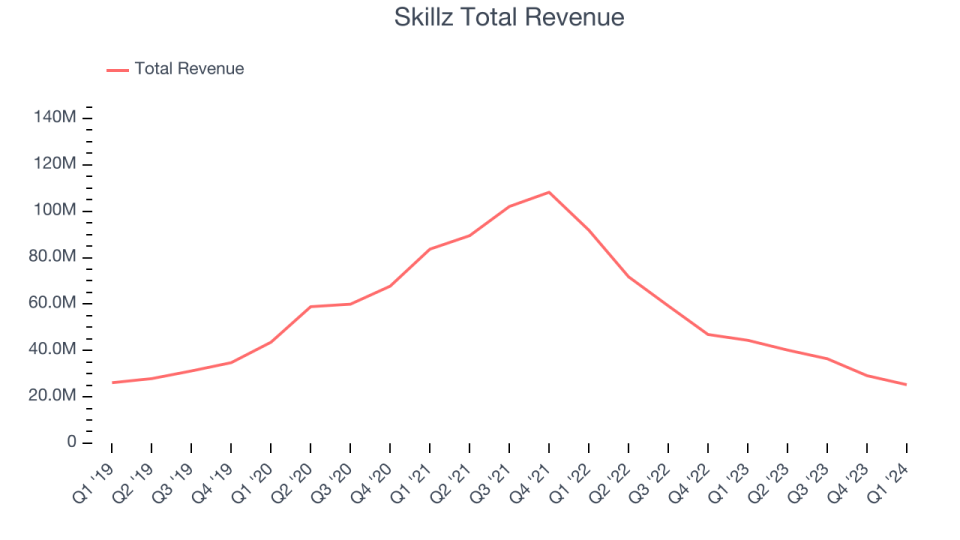

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

“Execution in the first quarter on our strategic initiatives met with some short-term setbacks, particularly with our new customer onboarding in the period. We have acted quickly to resolve these issues to position Skillz to deliver top-line growth and positive Adjusted EBITDA,” said Andrew Paradise, Skillz’ CEO.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is up 5.5% since the results and currently trades at $6.76.

Read our full report on Skillz here, it's free.

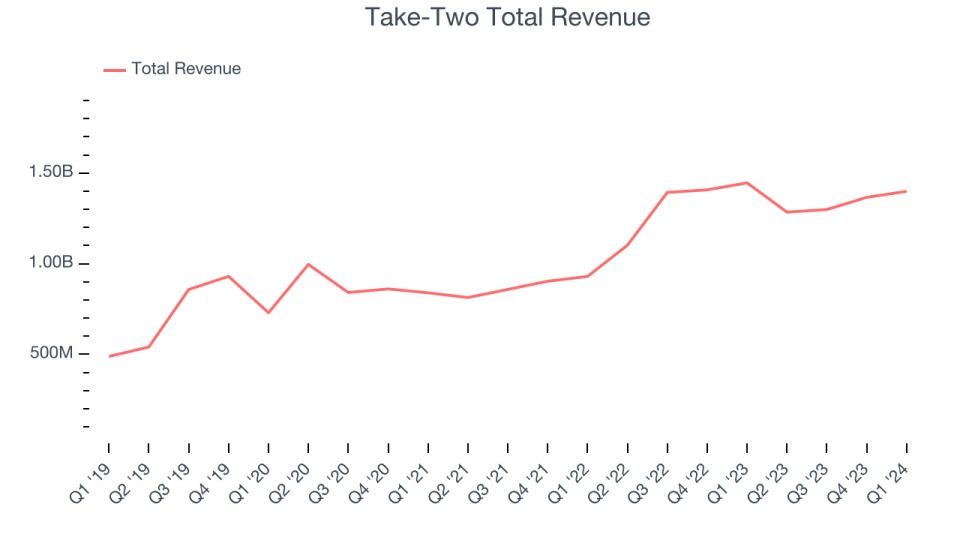

Best Q1: Take-Two (NASDAQ:TTWO)

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

Take-Two reported revenues of $1.40 billion, down 3.2% year on year, outperforming analysts' expectations by 3.4%. It was a weaker quarter for the company, with slow revenue growth.

Take-Two pulled off the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 5.9% since the results and currently trades at $154.65.

Is now the time to buy Take-Two? Access our full analysis of the earnings results here, it's free.

Electronic Arts (NASDAQ:EA)

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

Electronic Arts reported revenues of $1.78 billion, down 5.1% year on year, in line with analysts' expectations. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and slow revenue growth.

Electronic Arts scored the highest full-year guidance raise in the group. The stock is up 6.4% since the results and currently trades at $138.5.

Read our full analysis of Electronic Arts's results here.

Roblox (NYSE:RBLX)

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

Roblox reported revenues of $801.3 million, up 22.3% year on year, falling short of analysts' expectations by 0.6%. It was a weak quarter for the company, with some shareholders hoping for a better result.

Roblox achieved the fastest revenue growth among its peers. The stock is down 5.1% since the results and currently trades at $37.05.

Read our full, actionable report on Roblox here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance