Viad Corp (VVI) Q1 Earnings: Misses on EPS, Revenue Exceeds Expectations

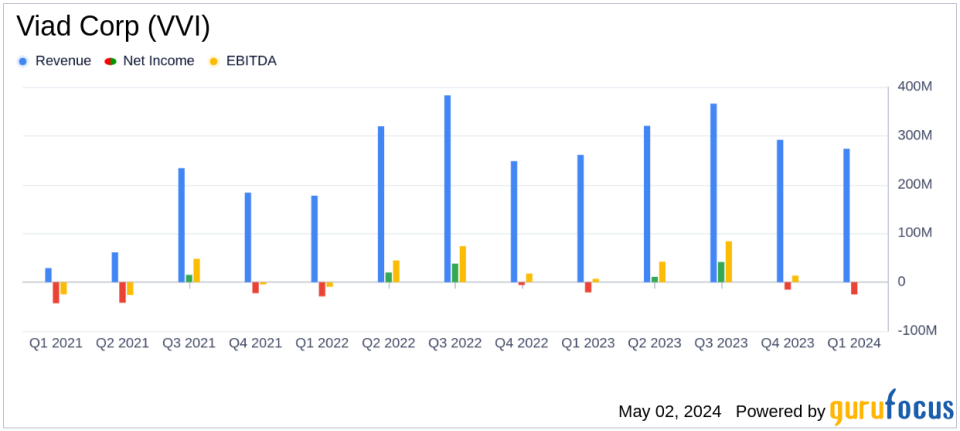

Revenue: Reported $273.5 million, up by 4.9% year-over-year, surpassing estimates of $269.52 million.

Net Loss: Increased to $25.1 million, a deterioration from the previous year's $20.9 million, exceeding the estimated net loss of $20.60 million.

Earnings Per Share (EPS): Recorded a loss of $1.29 per share, deeper than the estimated loss of $1.07 per share.

Pursuit Segment Revenue: Grew by 14% to $37.2 million, driven by strong demand at year-round attractions and the opening of FlyOver Chicago.

GES Segment Revenue: Increased by 3.6% to $236.3 million, primarily due to underlying growth offsetting the decline from the timing of major non-annual shows.

Adjusted EBITDA: Rose to $4.3 million, marking a 27.1% improvement from the previous year, indicating better operational efficiency.

Outlook: Maintains a positive full-year outlook with expected year-over-year consolidated adjusted EBITDA growth of 16% to 30% and strong free cash flow generation.

On May 2, 2024, Viad Corp (NYSE:VVI) released its 8-K filing, detailing the financial outcomes for the first quarter of the year. The company, a global provider of extraordinary experiences through its segments Pursuit and GES, reported mixed results with revenue surpassing expectations but a deeper net loss than anticipated.

Company Overview

Viad Corp operates through two main segments: Pursuit, which offers travel experiences including attractions and lodgings, and GES, which provides exhibition and event services. These segments cater to a diverse range of customer needs from leisure to corporate event management.

Financial Performance Highlights

The reported revenue for Q1 2024 stood at $273.5 million, a 4.9% increase from $260.8 million in the same quarter the previous year, and above the analyst estimate of $269.52 million. This growth was primarily driven by a 14% increase in Pursuit's revenue, attributed to strong performances at year-round attractions and the successful launch of FlyOver Chicago.

However, Viad faced challenges with an increased net loss of $25.1 million compared to $20.9 million in Q1 2023, a 20.4% deterioration. This was notably worse than the estimated net loss of $20.60 million. The diluted earnings per share (EPS) also declined to -$1.29 from -$1.10, missing the estimated EPS of -$1.07.

Segment Performance and Challenges

Pursuit's adjusted EBITDA was down by 8.1%, reflecting higher operating costs to support increased business volume. On the other hand, GES showed a healthier performance with a 13% rise in adjusted EBITDA, benefiting from higher revenue and improved margins.

Operational and Strategic Developments

Viad Corp's capital expenditures for the quarter totaled $20.7 million, focusing significantly on growth projects within the Pursuit segment. The company also reported a net leverage ratio of 2.7, with total liquidity standing at $137.2 million as of March 31, 2024.

Looking Ahead

For the upcoming quarters of 2024, Viad anticipates revenue between $352 million to $377 million in Q2 and projects a full-year revenue growth in the high-single to low-double digits. Adjusted EBITDA is expected to be between $51 million to $59 million for Q2 and between $171 million to $191 million for the full year.

Management's Perspective

"We delivered solid first quarter results that were in line with our expectations. With accelerating business activity ahead and signs of robust demand for our extraordinary experiences at both Pursuit and GES, our favorable full year outlook remains unchanged," stated Steve Moster, President and CEO of Viad.

Conclusion

Despite the challenges posed by increased losses, Viad Corp's revenue growth and strategic expansions, particularly with the successful launch of new attractions, position it for potential recovery and growth in the upcoming periods. Investors and stakeholders will likely keep a close watch on how the company manages its operational costs and capital expenditures to support its growth trajectory while mitigating losses.

For more detailed information, including financial tables and segment-specific performance, please refer to the full 8-K filing by Viad Corp.

Explore the complete 8-K earnings release (here) from Viad Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance