Vestis: A 'Fixer-Upper' in a Good Neighborhood

Vestis Corp. (NYSE:VSTS) in an interesting recent spinoff I came across when I was looking for significant insider buying near 52-week low prices. I think the company has potential as it is an established player operating in a fragmented but attractive industry where one big player dominates (Cintas Corp. (NASDAQ:CTAS)). The investment thesis is that if it can improve its operating performance closer to that of the leader, it can do very well. The stock has fallen steeply lately, but I think the problems are fixable and it is fundamentally a good stock.

The company is a provider of uniforms and workplace supplies across the U.S. and Canada, uniforms being the primary business. Organizations use companies like Vestis to outsource these tasks so they do not have to bother with these non-core activities. The company offers a range of services, including uniform programs with design, sourcing, manufacturing, customization, delivery, laundering and repair/replacement of shirts, pants, outerwear, gowns, scrubs and more. It also provides managed restroom supply services, first aid supplies, safety products, floor mats, towels and linens on a recurring rental basis.

Vestis serves a diverse customer base spanning numerous industries such as manufacturing, hospitality, retail, government, automotive, health care, food processing and pharmaceuticals. Its clients range from small, family-owned businesses with a single location to large corporations and national franchises with multiple sites. By catering to the varied needs of organizations across different sectors, Vestis helps maintain clean, safe, professional uniforms and workplaces while reducing operating costs and enhancing brand image. Its business is about 90% in the U.S. and about 10% in Canada.

While Vestis has over 75 years of history, it only recently became an independent, publicly traded company after being spun off from Aramark Corp. (NYSE:ARMK) in 2023. Prior to the spinoff, Vestis was a division within the large food service and hospitality company, which built it into the second-largest player in the uniform and workwear industry.

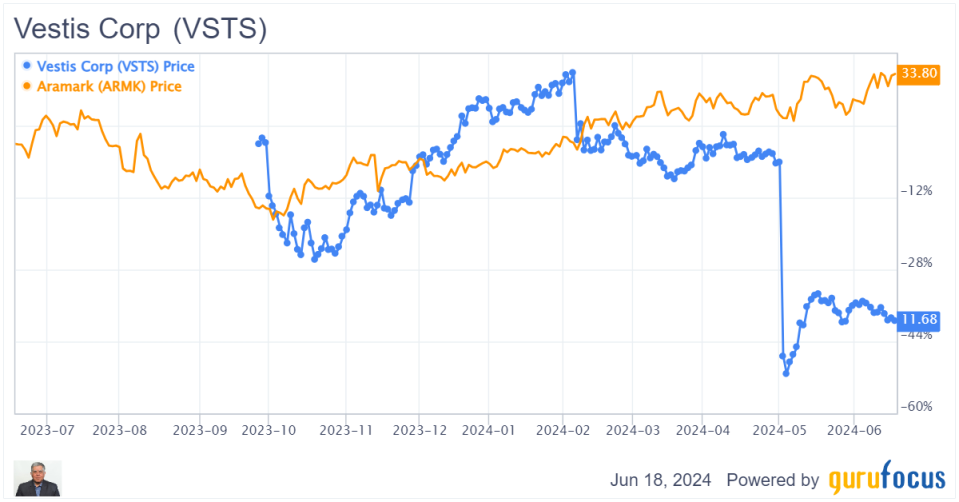

Its shares started trading on Oct. 2, 2023 on the New York Stock Exchange. However, the stock has fallen sharply lately following weaker-than-expected results and near-term guidance, as shown in the chart below. As such, it may be a good opportunity for new investors to come into the stock. Investors who owned shares of the parent company received shares of the newly spun off company automatically. However, some of these investors may not be interested in holding them, either because they are unfamiliar with the business or because it does not fit their investment strategy. This leads to indiscriminate selling pressure on the spinoff stock in the initial period of trading. The selling pressure tends to exacerbate if the company disappoints in any way, as happened in this case.

In addition to unlocking value, the spinoff was a strategic move to allow Vestis to focus solely on its core uniform rental and workplace supplies business, while Aramark could concentrate on its core food service operations. This separation enabled Vestis to pursue more ambitious growth plans and margin expansion opportunities as an independent entity.

The company operates a route-based business where profitability depends on the number of touch points on a delivery or collection route. Supplying and servicing uniforms is a simple, predictable and cash-generative business, but execution and operational excellence is key. Another key plank is to cross-sell more services to existing customers so the same route can generate more revenue. The company has brought in experienced executives, including CEO Kim Scott, who has a background in route-based and recurring revenue businesses. Thus, Vestis can be considered a leveraged bet on execution by management and achieving operational excellence. Much larger competitor Cintas has already shown how it can be done.

Balance sheet

Vestis had to take on a large amount of debt prior to the spinoff to pay a dividend to Aramark. As a result, its net debt-to-equity ratio (154.10%) is high. The company incurred a large amount of debt when spinning off from Aramark, which is, nowadays, a typical price to pay for separation. Basically, the parent organization looks to recover its equity in the spun off business by receiving an exit dividend, which is funded by debt taken on by the spinoff.

Regardless, the company's debt is well covered by operating cash flow (22.30%). Vestis' interest payments on its debt are well covered by Ebitda (about 3.50 times coverage).

Recent performance

So far, Vestis is having a disappointing first year. The stock fell sharply after it reported second-quarter results that disappointed analysts and investors. The shares sold off rather violently. The table below gives some key metrics of growth per share over recent quarters.

Vestis Corp | Growth per share | Quarterly growth vs. year ago | |||

VSTS | TTM vs. 1 yr | Latest Q vs. Q year ago | 2nd Latest Q vs. y/y | 3rd Latest Q vs y/y | 4th latest Q vs. y/y |

Revenue | 2.89% | 0.19% | 1.87% | 4.98% | 4.62% |

EBITDA | 28.63% | -6.35% | 5.00% | 130.61% | 8.70% |

EBIT | 47.8 | -13.53 | 6.49 | 268.67 | 12.21 |

OCF | 365.38% | 26.09% | 550.00% | ||

EPS | -10.10% | -53.74% | -14.06% | 306.21% | -141.10% |

FCF | 559.35% | 49.22% | 709.30% | ||

Book Value | 10.83% | -1.01% | -62.37% |

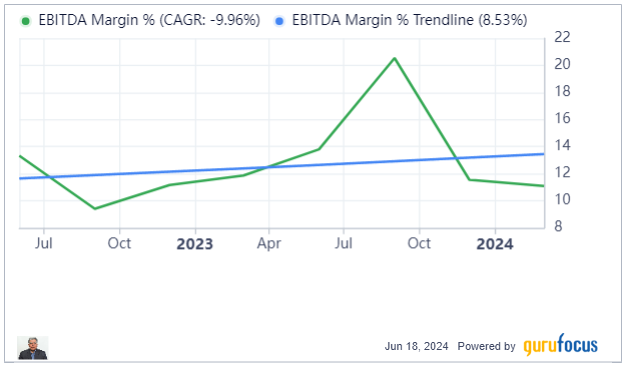

While Ebitda has gone up, the Ebitda margins have eroded in the last quarter. Investors have been counting on improving margins to see if the investment thesis is going to work.

However, I think investors may have overreacted. It is not too surprising that the company will require more time to find its footing. New investors now have a better entry point for this story.

Competitor analysis

The following table shows the company in comparison to some of its competitors. The 800-pound gorilla in the uniform space is Cintas. A distant second is UniFirst (NYSE:UNF). K-Bro (TSX:KBL) is a small Canadian competitor. Vestis trades at a lower valuation, particularly with respect to Cintas and UniFirst.

Ticker | Company | Current Price | Market Cap($M) | EV-to-EBITDA | EV-to-EBIT | Price-to-Operating Cash Flow |

VSTS | Vestis Corp | 11.73 | 1542.57 | 7.75 | 11.81 | 4.87 |

TSX:KBL | K-Bro Linen Inc | 31.62 | 240.41 | 7.74 | 15.17 | 7.61 |

UNF | UniFirst Corp | 155.45 | 2900.44 | 10.14 | 19.11 | 11.3 |

CTAS | Cintas Corp | 708.67 | 71904.47 | 30.67 | 37.32 | 37.73 |

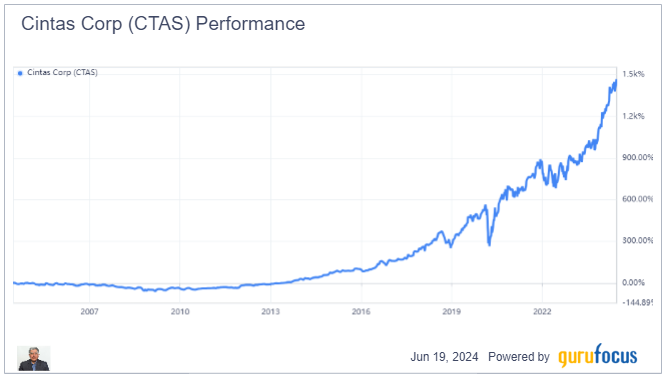

Cintas' annualized stock returns over the last 10 years have been a spectacular 27.25%. Therefore, if Vestis can come close to its operational excellence, or even partially close the gap, it could do very well.

Stock Annualized Return % | ||||

Symbol | 1 Year | 3 Years | 5 Years | 10 Years |

VSTS | - | - | - | - |

CTAS | 43.8 | 25.9 | 25.05 | 27.25 |

UNF | -10.42 | -11.52 | -1.92 | 4.26 |

TSX:KBL | -0.81 | -10.42 | -4.46 | -2.04 |

The following table shows the various profit margins for the companies. The challenge and opportunity for Vestis is to get its profit margins up closer to the industry leader. If it can do that, this could be a very lucrative opportunity for the company.

Ticker | Company | Gross Margin % | Operating Margin % | Net Margin % | EBITDA Margin % | FCF Margin % |

VSTS | Vestis Corp | 30.44 | 7.54 | 5.65 | 14.26 | 8.44 |

TSX:KBL | K-Bro Linen Inc | 86.22 | 8.71 | 5.27 | 17.48 | 9.86 |

UNF | UniFirst Corp | 34.1 | 6.45 | 4.92 | 12.16 | 3.78 |

CTAS | Cintas Corp | 48.46 | 21.17 | 15.98 | 25.8 | 16.21 |

Insider buys

Vestis has experienced heavy insider buying over the past three months with over 4 million shares bought. The insider buyers have included the CEO as well as the chief financial officer. Most of the buying has been by an activist hedge fund, Corvex Management Inc. Corvex owns about 13% of the outstanding shares and is the company's largest shareholder. Corvex is known for its aggressive activist stance, and I think this is a good sign they are interested in Vestis. Their presence will ensure management remains focused on creating shareholder value. Conclusion

Shares of Vestis trade with a price-earnings ratio of 16, versus 49 for Cintas and 25 for UniFirst. That lower valuation should compensate investors for taking a chance on the company as it aims to transition into a more Cintas-like company. Progress on its debt paydown will shift more value to equity holders. An activist investor, Corvex, is already on board and is also the biggest shareholder.

The risk, of course, is the North American economy weakening. Vestis and business services stocks are sensitive to the economy and demand for uniform services are tied to employment. Thus, investors should be prepared for volatility as we navigate the next 12 to 24 months. Also, holders of Aramark who were allocated Vestis shares may still be selling, which places additional pressure on the stock. This is not unexpected. Spin-off companies like Vestis are essentially new entities without a long financial track record or history as a standalone business. This lack of information and uncertainty about their prospects can make investors cautious, leading to selling pressure in the initial trading period that can last up to a year.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance