Vertex (VRTX), TreeFrog Sign Deal for Diabetes Cell Therapies

Vertex Pharmaceuticals Incorporated VRTX announced that it has entered into a licensing and collaboration agreement with France-based biotech company, TreeFrog Therapeutics, to optimize the production of VRTX's type 1 diabetes (T1D) cell therapies.

The agreement will grant the pharmaceutical company an exclusive license to TreeFrog's proprietary cell manufacturing technology, C-Stem, which will be leveraged by VRTX to enhance its ability to generate large amounts of fully differentiated insulin-producing pancreatic islet cells for its portfolio of T1D cell therapies.

TreeFrog’s C-Stem technology imitates the natural microenvironment of cells that facilitates those cells to grow exponentially in a three-dimensional setting.

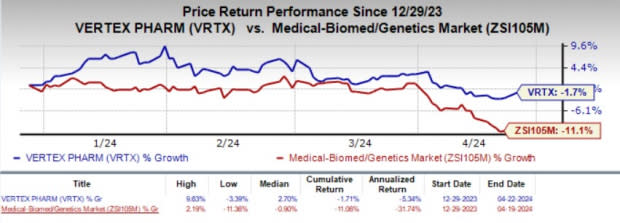

Year to date, shares of Vertex have lost 1.7% compared with the industry’s 11.1% decline.

Image Source: Zacks Investment Research

Per the terms of the agreement, VRTX is liable to make an upfront payment of $25 million to TreeFrog in consideration of the C-Stem license grant while making an equity investment in the partner company. Additionally, Vertex is also liable to make milestone payments to TreeFrog of up to $215 million related to the development of a scaled-up process for fully differentiated islet cells.

Furthermore, TreeFrog is eligible to receive an additional $540 million from Vertex upon the achievement of certain clinical, regulatory and commercial milestones on up to two future products. Subject to approval and commercialization of such products, the company will also have to pay tiered single-digit royalties on the sales of the same to TreeFrog.

The collaboration agreement bestows the responsibility of funding all research and development costs for the T1D cell therapies program on Vertex. The company will also be responsible for all development and commercialization of its cell therapies.

Please note that Vertex’s T1D therapies pipeline comprises two novel investigational candidates, VX-880 and VX-264, which are currently being developed in early to mid-stage studies.

VX-880 is an investigational allogeneic stem cell-derived, fully differentiated and insulin-producing islet cell therapy. The method of delivery of the drug is an intravenous infusion that requires immunosuppressive therapy to protect the islet cells from immune rejection.

Vertex is planning to use TreeFrog’s C-Stem technology to boost stem cell production in this phase I/II study of VX-880 in T1D patients, which will likely shorten the clinical study duration.

On the other hand, VX-264 is being developed following a unique approach that requires encapsulating cells in a protective device, which will then be surgically implanted in the body.

The device acts as a protective shield for the cells against the body’s immune system, which allows the evaluation of the candidate without the use of immunosuppressive therapy.

Vertex Pharmaceuticals Incorporated Price and Consensus

Vertex Pharmaceuticals Incorporated price-consensus-chart | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank & Stocks to Consider

Vertex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ADMA Biologics ADMA, FibroGen FGEN and Annovis Bio ANVS. While ADMA sports a Zacks Rank #1 (Strong Buy), FGEN and ANVS carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2024 earnings per share (EPS) has remained constant at 30 cents. During the same period, the estimate for ADMA’s 2025 EPS has remained constant at 50 cents. Year to date, shares of ADMA have soared 37.2%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 85%.

In the past 30 days, the Zacks Consensus Estimate for FibroGen’s 2024 loss per share has remained constant at $1.09. During the same period, the estimate for FibroGen’s 2025 loss per share has remained constant at 6 cents. Year to date, shares of FGEN have climbed 28.6%.

FGEN beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 2.26%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.49 to $3.35. The estimate for Annovis’ 2025 loss per share is currently pegged at $2.82. Year to date, shares of ANVS have plunged 38.6%.

ANVS’ beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

FibroGen, Inc (FGEN) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance