Vertex (VRTX) Moves Kidney Disease Drug to Phase 3 Development

Vertex Pharmaceuticals VRTX initiated the late-stage portion of the phase II/III AMPLITUDE study evaluating inaxaplin (VX-147) in APOL1-mediated kidney disease (AMKD), a genetic disorder affecting kidney function.

This phase III portion will evaluate a 45 mg oral dose of Vertex’s drug, on top of standard of care, in AMKD patients, compared with placebo. Management also expanded the study to include adolescents aged 10 and older with AMKD. Previously, the AMPLITUDE study only enrolled adults with the disease.

The primary endpoint of the study for final analysis is the estimated glomerular filtration rate (eGFR) slope in patients receiving inaxaplin compared to placebo, with at least two years of data. The eGFR slope serves as an indicator of kidney disease progression.

Vertex plans to have a pre-planned interim analysis evaluating eGFR slope at week 48. If this interim analysis is positive, management intends to pursue the FDA’s approval for the drug under the accelerated pathway.

The AMPLITUDE study is designed to assess the impact of inaxaplin on kidney function and proteinuria for people living with proteinuric kidney disease mediated by two variants in the APOL1 gene, known as AMKD.

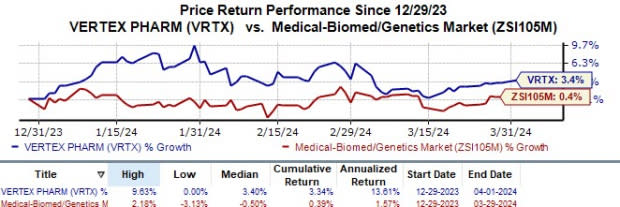

Year to date, Vertex’s shares have risen 3.3% compared with the industry’s 0.4% growth.

Image Source: Zacks Investment Research

Inaxaplin is a first-in-class, investigational small molecule inhibitor of APOL1, which targets the underlying cause of AMKD. Per management, there are no disease-specific therapies for this disorder and a successful development of this drug will cater to an unmet patient population.

Vertex reiterated data from a phase IIa proof-of-concept (POC) study on inaxaplin in AMKD patients, which was released in 2021. Data from this POC study showed that patients treated with inaxaplin achieved a mean reduction of 47.6% in the urine protein to creatinine ratio (UPCR) at 13 weeks of treatment when compared with baseline.

Though Vertex enjoys a dominant position in the cystic fibrosis (CF) market, it has seen success in the development of its non-CF pipeline candidates lately. Many of these non-CF candidates represent multibillion-dollar opportunities.

Last year in December, the FDA approved Vertex and partner CRISPR Therapeutics’ CRSP Casgevy (exagamglogene autotemcel) for the treatment of sickle cell disease (SCD) for patients aged 12 years and older with recurrent vaso-occlusive crises. Following this approval, Casgevy became the first gene therapy utilizing the Nobel prize-winning CRISPR technology.

In January, Vertex/CRISPR announced that the FDA expanded the label of their one-shot gene therapy Casgevy to treat transfusion-dependent beta thalassemia (TDT) in patients aged 12 years and older. The CRSP-partnered therapy also won approval in both indications this year across multiple other regions, including Europe, the Kingdom of Saudi Arabia and Bahrain.

Investors are also paying a lot of attention to pain asset VX-548. Vertex has completed three pivotal phase III acute pain studies on this novel first-in-class, non-opioid NaV1.8 inhibitor. Data from the studies, announced in January 2024, showed that treatment with VX-548 led to a significant reduction in pain intensity across a range of conditions, both surgical and non-surgical, and across a range of settings. Based on the above data, Vertex plans to submit a new drug application with the FDA for VX-548 across a broad label in moderate-to-severe acute pain by mid-2024.

Last month, the FDA cleared Vertex’s investigational new drug application to begin clinical development of its pipeline candidate, VX-407, for the treatment of autosomal dominant polycystic kidney disease (ADPKD). An early-stage study evaluating this drug in healthy volunteers was initiated last month. Per management, ADPKD is the 10th disease area in Vertex’s clinical pipeline.

Vertex Pharmaceuticals Incorporated Price

Vertex Pharmaceuticals Incorporated price | Vertex Pharmaceuticals Incorporated Quote

Zacks Rank & Key Picks

Vertex currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA and ANI Pharmaceuticals ANIP, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 44.7%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 23.1%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance