Venezuela Crypto Remittances Skyrocket as Migration Crisis Worsens

(Bloomberg) -- As Venezuela recovers from one of the most dire economic crises in its history, more families are turning to an unconventional lifeline: cryptocurrency.

Most Read from Bloomberg

Biden Narrows Gap With Trump in Swing States Despite Debate Loss

Iran Elects President Who Wants to Revive Nuclear Talks With West

Remittances, or cash payments from relatives living abroad, are traditionally sent through international banks or financial retail businesses such as Western Union or MoneyGram often saddled with high transaction fees of up to 7%. With the bolivar’s volatility and a host of governmental restrictions, and transfers taking up to three business days to complete, speed often gives crypto the upper hand.

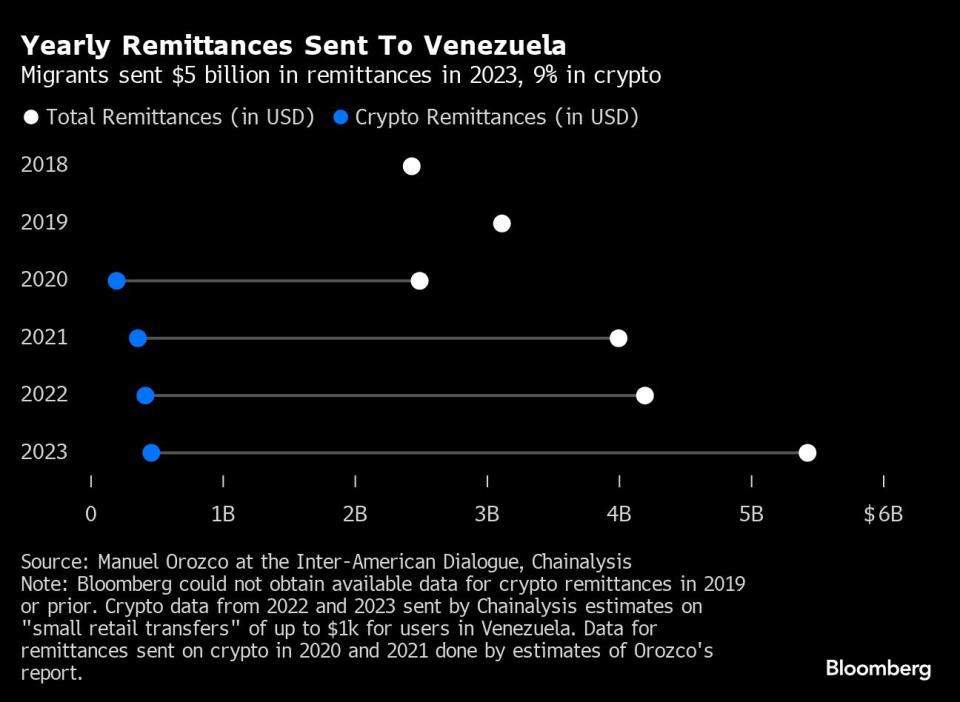

Within the last decade, Venezuela has become one of the primary remittance-dependent nations in South America. After the skyrocketing migration crisis that has faced the country, about 30% of Venezuelan households began receiving remittances, according to a study by the Inter-American Dialogue. The amount transmitted via crypto likely reached a record 9% of all the money sent home last year, according to data from the blockchain analysis firm Chainalysis.

Over 7.7 million migrants and refugees have fled Venezuela in the last decade, according to the Inter-Agency Coordination Platform for Refugees and Migrants from Venezuela. To put that in perspective, 6 million people have left Ukraine since 2022 and 5 million more have fled Syria since 2011.

In the last two years, the US’s Venezuelan immigrant population has grown exponentially, with almost 300,000 migrants arriving in the US last year.

The exodus has weighed on US cities like New York and Chicago, adding to expectations that immigration could be one of the main deciding factors for the US presidential election.

The next step for many migrants after they settle in is to help the ones they left behind. Last year, Venezuelans received more than $5.4 billion in remittances, constituting at least 6% of gross domestic product, according to Inter-American Dialogue. That’s almost 75% higher than the amount sent in 2021. Over $461 million of the remittances in 2023 were through cryptocurrencies.

“The number of Venezuelan migrants that are sending remittances has jumped 50-60%,” said Manuel Orozco, director of the Migration, Remittances, and Development program at the Inter-American Dialogue. “It’s not a higher percentage because the rest of the migrants cannot yet afford to send money.”

In the case of Paola Moncrieff, one of her goals when she moved to the US in 2018 was to find a job where she could afford to help her relatives back home. After settling in Austin, Texas, she began sending money through Zelle to a money changer known as a cambista, but her favorite way to transfer funds – especially to her younger, more tech-savvy cousins – is through crypto. To do this, she buys the memecoin Dogecoin on Coinbase, which have the lowest transfer fees she could find, as compared to other cryptocurrencies or stablecoins which have a higher fees in US platforms.

In Venezuela, her cousins use Binance to transfer the Dogecoin into Tether, a cryptocurrency that seeks to maintain a one-to-one ratio with the dollar. Once the money is in stablecoins, they can use it however they prefer: convert it into bolivars or dollars, or spend it at one of the few businesses in the country that accept crypto.

“Before I could only rely on my cambista and it was really hard when she didn’t have bolivars, but now this way through crypto solved many of my problems,” Moncrieff said, who learned to do this thanks to her cousin’s husband who began playing NFT games during the pandemic. “If I need to give my aunt or my grandma money quickly for any emergency and I know my cambista doesn’t have the money, I ask my cousin to help me by giving them crypto and they deposit the money in her account.”

While cryptocurrency is appealing in Venezuela’s remittance scene, this method of sending or receiving funds is beset with risks.

Crypto prices notoriously fluctuate wildly, meaning the amount that’s received can vary significantly from the amount sent. Regulatory uncertainties add another layer of risks.

Peer-to-peer platforms have become popular for Venezuelans looking to convert received crypto funds into bolivars. They have the option to exchange crypto at market rates, often bypassing the official exchange controls. And despite Binance’s US regulatory issues, it remains the most popular exchange site for Venezuelans and migrants in many places of the world.

“You don’t know who you’re talking with when you do peer-to-peer exchanges,” said Enrique De Los Ríos, a cryptocurrency consultant in Venezuela. “They could give you fake dollar bills, they could give you money that they used to sell a stolen car or do any other crimes, there is no entity you can back that out from.”

The massive migration comes in the wake of a major economic collapse, marked by uncontrolled inflation and widespread shortages of food and medicine.

That’s what prompted Carlos Espinoza’s move to Argentina in 2018. Espinoza – whose name has been modified for his family’s safety – had used crypto for many years before migrating. Now he’s sending remittances by buying Tether on Binance and depositing it in bolivars into his bank account in Venezuela, which his parents have access to.

“This is the easiest way I have found to send money to my family and also save money in another currency hit by hyperinflation,” Espinoza said. “My current job thankfully pays me in dollars, but back when I made a living in Argentine pesos, I transferred them into crypto so they wouldn’t lose value.”

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance