VBI Vaccines (VBIV) Down 53% on Initiating Restructuring Plans

Shares of VBI Vaccines VBIV plummeted 53.1% on Apr 4 after management announced multiple restructuring initiatives to curb cash burn and save operating expenses.

Management will focus the company’s resources on preventing and treating hepatitis B (HBV). The company will focus on broadening its access to VBI Vaccines’ sole-marketed product PreHevbrio [Hepatitis B Vaccine (Recombinant)], approved by the FDA in 2021 for the prevention of infection caused by all known subtypes of HBV virus in adults aged 18 years and older.

VBI Vaccines also reprioritized the focus on its pipeline. Management will now focus on advancing its HBV immunotherapeutic candidate, VBI-2601, which is being evaluated in an ongoing phase II study. Management expects VBI-2601 to be part of a functional cure regimen for chronic HBV patients.

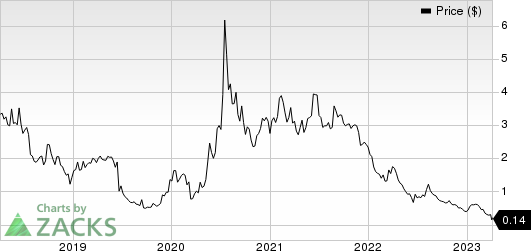

In the year so far, shares of VBI Vaccines have plunged 64.0% compared to the industry’s 5.8% fall.

Image Source: Zacks Investment Research

Management also announced that it intends to reduce its existing workforce by 30-35%, which is expected to be completed by the end of this ongoing quarter. As a result of this workforce reduction, VBI Vaccines expects a 30-35% decline in its operating expenses in second-half 2023 from the year-ago period’s levels.

In addition, Christopher McNulty, who is VBI Vaccines’ current chief financial officer (CFO), Head of Business Development, and director, will resign from the company and its board of directors with effect from Apr 10, 2023. Following Christopher’s departure, Nell Beattie will be appointed in his place as CFO and Head of Business Development. Beattie has already been elected as a director in the company.

Apart from the above changes, VBI Vaccines’ board of directors also approved a 1-for-30 reverse stock split of its issued and outstanding common shares. With effect from Apr 12, every 30 shares of VBI’s issued and outstanding common shares will be converted automatically into one issued and outstanding common share. This will reduce the number of outstanding shares, currently at 258 million to around 8.6 million. This reverse stock split is intended to allow VBI Vaccines to regain compliance with NASDAQ’s continued listing requirements.

VBI Vaccines, Inc. Price

VBI Vaccines, Inc. price | VBI Vaccines, Inc. Quote

Zacks Rank & Other Stock to Consider

VBI Vaccines currently carries a Zacks Rank #4 (Sell). Some other top-ranked stocks in the overall healthcare sector include Certara CERT, CRISPR Therapeutics CRSP and EQRx EQRX. While Certara sports a Zacks Rank #1 (Strong Buy), CRISPR Therapeutics and EQRx carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Certara’s 2023 earnings per share have increased from 46 cents to $1.24. During the same period, the earnings estimates per share for 2024 have risen from 54 cents to $1.85. Shares of Certara are up 43.8% in the year-to-date period.

Earnings of Certara missed estimates in two of the last four quarters, beating the mark on one occasion while meeting the mark on another. On average, the company’s earnings witnessed a negative surprise of 3.25%. In the last reported quarter, Certara’searnings beat estimates by 14.29%.

In the past 60 days, estimates for CRISPR Therapeutics’ 2023 loss per share have narrowed from $8.21 to $7.35. Shares of CRISPR Therapeutics have risen 7.5% in the year-to-date period.

Earnings of CRISPR Therapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 3.19%, on average. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 39.22%.

In the past 60 days, estimates for EQRx’s 2023 loss per share have narrowed from 66 cents to 58 cents. In the year so far, shares of EQRx have declined 25.6%.

Earnings of EQRx beat estimates in each of the last four quarters, witnessing an earnings surprise of 34.99%, on average. In the last reported quarter, EQRx’s earnings beat estimates by 73.68%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

VBI Vaccines, Inc. (VBIV) : Free Stock Analysis Report

Certara, Inc. (CERT) : Free Stock Analysis Report

EQRx, Inc. (EQRX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance