Vanke Warns of $1.2 Billion Loss on China’s Housing Slump

(Bloomberg) -- China Vanke Co. warned of hefty losses in the first half, as the country’s property downturn took a toll on the closely watched developer that’s trying to secure cash to pay off debts.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

NYC Penthouse Sells for $135 Million in Priciest Deal Since 2022

State-backed Vanke expects to post a first-half loss of 7 billion yuan to 9 billion yuan ($962 million to $1.2 billion), it said in a filing late Tuesday. The projected loss signals a sharp downturn from the first quarter, when it lost 362 million yuan.

The homebuilder resorted to price discounts to reduce inventory and boost cash flow, squeezing profit margins. Investment in some projects has been “over-optimistic” and resulted in high land acquisition costs, it said.

At the same time, Vanke said it has made “repayment arrangements” on onshore bonds due in the second half of this year, and has no offshore notes maturing in the period.

Vanke’s update is the latest sign that China’s years-long property crisis continues unabated, as the government’s supportive policies have yet to materially reinvigorate homebuyer demand. The company, once considered one of the more sound players in the industry, has been raising funds and looking to sell assets to calm investor concern over liquidity stress.

The developer hasn’t reported a first-half loss since at least 2003, according to data compiled by Bloomberg. In the first half of 2023, it had a profit of 9.87 billion yuan.

“The company deeply apologizes for the performance loss,” it said.

Vanke’s Hong Kong-listed shares fell 1.8% on Wednesday, bringing this year’s decline to 39%. Its dollar bond due 2027 slid 0.9 cent to 61.9 cents, and its note due 2029 dropped 0.6 cent to 54.7 cents.

WATCH: Inside China’s Property Crisis

The earnings warning was significantly worse than expected, Jefferies Hong Kong Ltd. analysts led by Calvin Leung wrote in a note. “We believe the cash flow mismatch could widen, in turn lifting reliance on asset disposal and new financing.”

Vanke said many of its projects were developed on land acquired before 2022 that had relatively high purchase costs. Because they were sold during the subsequent market downturn, sales and gross profit margins were lower than expectations, shrinking profits.

Other developers that bought land before the property slump intensified — such as Longfor Group Holdings Ltd. and Greentown China Holdings Ltd. — may also issue profit warnings, according to Bloomberg Intelligence analysts Andrew Chan and Daniel Fan. “Major Chinese developers could write down their inventory as falling new-home prices are unlikely to turn around in the near term,” they wrote in a note.

For more BI reaction: Vanke Losses Set to Deepen on Ongoing Home-Sales Decline

Vanke said a package of plans was formed during the first half of this year for business reformation and risk mitigation. It also sought to slim down and achieved “positive progress.” Also, 74,000 homes were delivered and Vanke “ensured repayment of open market debts on schedule.”

On the bright side, executives told some analysts Tuesday that Vanke has reduced some of its short-term debt, according to minutes of the meeting published online by the builder. Debt refinancing and new financing has totaled 60 billion yuan this year as over 50 billion yuan of debt has been paid.

In a separate statement on Tuesday, Vanke said it has a combined 4.3 billion yuan of onshore bonds due in the second half of this year and has made “repayment arrangements.” It added 10.5 billion yuan of offshore bonds were repaid in the first half and that no such notes are due the rest of this year.

Vanke, whose major shareholder is a state-owned firm in Shenzhen, is one of the few distressed Chinese developers that have yet to default. Others such as Country Garden Holdings Co. and Shimao Group Holdings Ltd. face winding-up hearings in Hong Kong courts, while former giant China Evergrande Group has been ordered to liquidate.

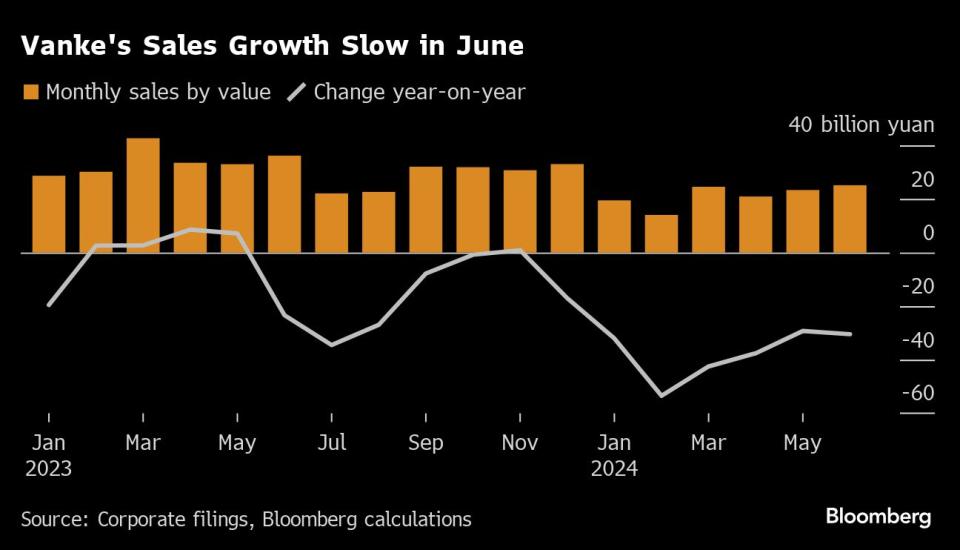

Vanke continues to face headwinds as its home sales growth stalled in June. Its month-on-month contracted sales rose 7.9%, much slower than the average 36% increase at the 100 biggest real estate companies in China.

The builder’s June sales reached a breakeven level of 25 billion yuan, Jefferies estimated, but part of it was driven by front-loaded purchases following the easing of home-buying rules in May. With diminishing room for cities to further relax property measures, analysts including Leung remain skeptical on the sustainability of sales into the second half.

The preliminary interim loss is likely to extend into a full-year one, according to JPMorgan Chase & Co. property analyst Karl Chan.

“As Vanke’s priority is to prevent a bond default, we think the margin squeeze will continue as Vanke would likely have to prioritize cash flows over profitability,” Chan said.

--With assistance from Jeanny Yu and Lea Mok.

(Updates with comments from analysts in 11th paragraph)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance