Is Vanguard Total Stock Market ETF (VTI) a Millionaire Maker?

Written by Tony Dong, MSc, CETF® at The Motley Fool Canada

When it comes to investing in the stock market, U.S. investors often seek a straightforward and effective strategy. Among the plethora of options, the Vanguard Total Stock Market ETF (NYSEMKT:VTI) stands out as a popular choice for those who favour the “VTI and chill” approach.

This method simplifies investing into a single, comprehensive move – buying shares of VTI, which holds over 3,500 U.S. market stocks. But why does this ETF attract so much attention and loyalty? The answer lies in its potential to be a millionaire maker.

While some may approach this claim with skepticism, a dive into the historical data reveals compelling evidence of its potential to substantially grow an investor’s wealth over time.

What the data says

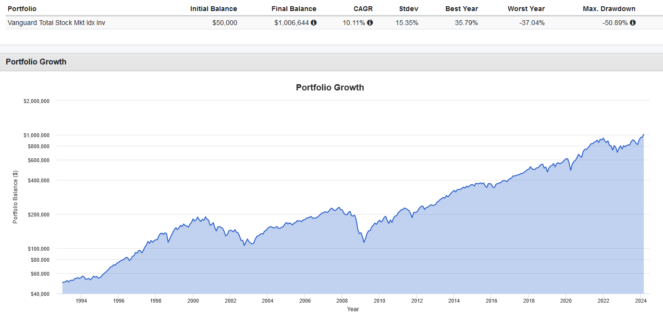

For a clearer picture, let’s look at VTI’s mutual fund counterpart, which has been around since 1993. This longer history provides us with tangible evidence of what consistent investment in this fund could yield.

To illustrate, if an investor had placed $50,000 in the fund in 1993 and faithfully reinvested dividends every quarter, by March 2024, they’d have reached the milestone of $1 million. This achievement underscores not just the fund’s performance but the added growth from reinvesting dividends, which compounds the investment’s value over time.

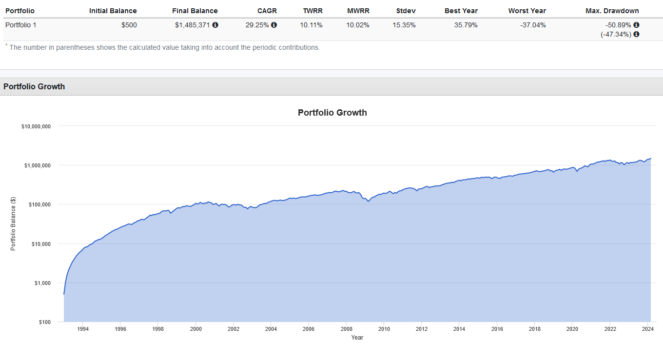

However, the story gets even more compelling when considering a strategy known as dollar-cost averaging. By starting with a $500 investment and continuing to invest $500 every month, an investor could have seen their investment grow to $1.4 million by 2024. This approach mitigates the risk of market volatility, as it spreads the investment over various market conditions, buying more shares when prices are low and fewer when prices are high.

The significant growth, especially after crossing the $100,000 mark, showcases the power of compounding and importance of timing in the market. Compounding accelerates the growth of an investment, as returns are earned on top of returns. And the more time your investment has to grow, the more significant the impact of compounding can become.

How to invest in VTI

VTI is particularly well-suited for investors who either have the means to convert currency at low cost or already have access to U.S. dollars, such as those who receive income in USD.

One key strategy for Canadian investors is to hold VTI within a Registered Retirement Savings Plan (RRSP). This approach is beneficial because it sidesteps the 15% foreign withholding tax on dividends that typically applies to Canadian investors holding U.S. securities.

But for those who prefer to invest in Canadian dollars or wish to avoid the complexities of currency conversion, an alternative is the Vanguard U.S. Total Market Index ETF (TSX: VUN).

This ETF provides similar exposure to the U.S. stock market as VTI but trades in Canadian dollars on the Toronto Stock Exchange. With an expense ratio of 0.16%, it offers a cost-effective way to gain comprehensive access to U.S. equities without managing U.S. currency.

The post Is Vanguard Total Stock Market ETF (VTI) a Millionaire Maker? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Total Stock Market Etf right now?

Before you buy stock in Vanguard Index Funds - Vanguard Total Stock Market Etf, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Total Stock Market Etf wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $17,988!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 35 percentage points since 2013*.

See the 10 stocks * Returns as of 1/24/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Tony Dong has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance