Vanguard Market & Economy Perspective: ECB May Cut Rates but Not as Much, Given Fed's Stance

The European Central Bank (ECB), poised to start cutting interest rates in June, faces a dilemma. With the U.S. Federal Reserve now likely to keep policy rates on hold for the foreseeable future, markets are questioning how much the ECB could diverge. In our view, a policy divergence is probable: We think the ECB will cut rates in 2024 without the Fed. However, the Fed's prominence in global markets means the risks are skewed toward a slower pace of easing than what domestic circumstances might otherwise warrant, particularly if downward pressure on the euro intensifies.

Well before a third straight hotter-than-expected U.S. inflation report in April led markets to abandon hopes for a Fed rate cut in June, Vanguard cautioned that a prudent Fed may choose to forgo rate cuts altogether this yearOpens in a new tab, given unexpected U.S. economic strength.

The euro area economy is in a different situation. Growth has tracked close to or below zero in recent quarters and inflation has moderated significantly toward the ECB's 2% target. Currently, core inflation is 2.9% on an annual basis and we expect it to fall toward 2% by the end of the year.

What's more, there's little evidence of further inflation downstream. Although wage growth is elevated, it represents a healthy catch-up of real incomes and is moderating gradually. Meanwhile, inflation expectations remain well anchored, and corporate price-setting behavior has normalized.

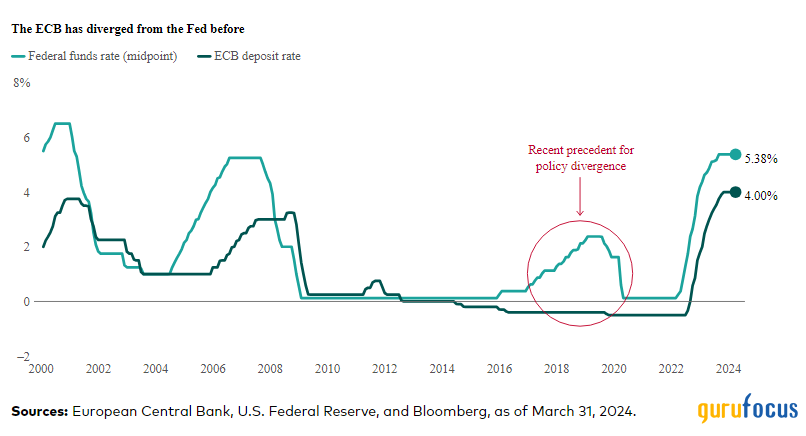

In our view, the ECB will start to cut interest rates at its next monetary policy meeting in June. This would result in a divergence from the policy setting of the Fed, which we expect to keep rates on hold for the rest of the year. This has raised eyebrows in the investment community. After all, it's common for ECB policy to follow that of the Fed, often with a lag. As shown in the chart below, the ECB's hiking and cutting cycles came slightly after the Fed's both in the early 2000s and from 2006 through 2009.

However, in our view, this time is different. Domestic conditions in the euro area are sufficiently distinct to warrant a divergence in monetary policy. This line of thinking has been backed by key ECB policymakers, including President Christine Lagarde.

There's a recent precedent of divergence between the two central banks: Toward the end of the last decade, the ECB cut rates slightly and expanded quantitative easing while the Fed embarked on a rate-hiking cycle. The ECB was justified then because domestic conditions were different. It won't be afraid to front-run the Fed this time either.

Vanguard's outlook for financial markets

That said, what comes after June is highly uncertain. This is because the greater the policy divergence priced in by financial markets, the less divergent policy is likely to be.

This negative feedback loop is driven by foreign-exchange markets. A growing policy rate differential between the U.S. and Europe would exert downward pressure on the euro relative to the U.S. dollar. This in turn would generate additional inflationary pressure in the euro area further down the road, making the ECB more cautious about cutting interest rates quickly.

Another risk to the ECB outlook is the recent rise in energy prices amid conflict in the Middle East. Brent crude oil is up nearly 15% since the start of the year and stands above $88 per barrel. According to our calculations, if Brent crude rises to more than $100 per barrel and stays there for at least two quarters, it would be enough to justify the ECB materially slowing the pace of monetary easing.

The impact of a weaker euro on investment portfolios

A weakening euro has implications for globally diversified investment portfolios. For U.S.-based investors, it suggests lower returns from euro area equities, as revenues buy fewer dollars. (Vanguard recommends currency-hedging international bond investments, mitigating concerns about currency fluctuations.) For investors in the euro area, a weaker euro suggests the opposite: stronger returns from dollar-denominated equities.

But markets can turn quickly, and our caveats against trying to time the markets apply equally to currency exchange rates. Long-term investors are well served by choosing an asset allocation that suits their financial goals and risk tolerances.

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Diversification does not ensure a profit or protect against a loss.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance