Vanguard Health Care Fund's Top 5 1st-Quarter Trades

The Vanguard Health Care Fund (Trades, Portfolio) recently released its portfolio updates for the first quarter of 2020, which ended on March 31.

Founded in 1984, the fund has been investing globally in health care-related stocks with the aim of long-term capital appreciation for over 30 years. Portfolio manager Jean Hynes, who has been advising the fund since 2008, chooses stocks based primarily on balance sheet strength, good management teams and product pipelines that show high potential for consistent profitability and growth.

At the end of the quarter, the fund consisted of holdings in 89 stocks valued at $39.63 billion. The top holdings were UnitedHealth Group Inc. (UNH) with 5.72%, AstraZeneca PLC (LSE:AZN) with 5.49% and Pfizer Inc. (PFE) with 5.28%.

Based on its investing criteria, the fund sold out of its holdings in CVS Health Corp. (NYSE:CVS), Teva Pharmaceutical Industries Ltd (NYSE:TEVA) and Teladoc Health Inc. (NYSE:TDOC) during the quarter. It also established new holdings in six stocks, the most significant of which were Penumbra Inc. (NYSE:PEN) and PPD Inc. (NASDAQ:PPD).

CVS Health

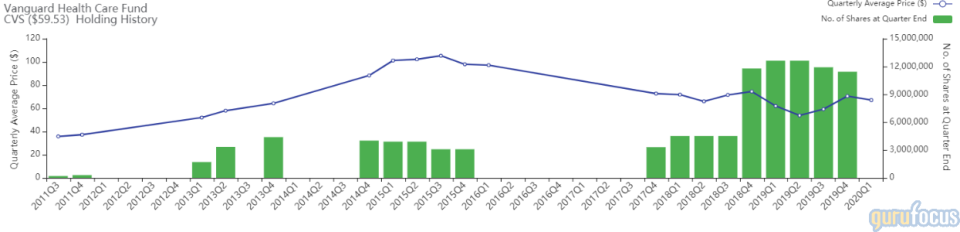

The Vanguard Health Care Fund (Trades, Portfolio) sold out of its 11,436,465-share position in CVS Health, which had a -1.82% impact on the equity portfolio. Shares traded at an average price of $67.09 during the quarter.

CVS Health is a health care company that owns the CVS Pharmacy retail pharmacy chain, as well as Aetna (a health insurance provider), CVS Caremark (a pharmacy benefits manager) and several smaller operations. It is headquartered in Woonsocket, Rhode Island.

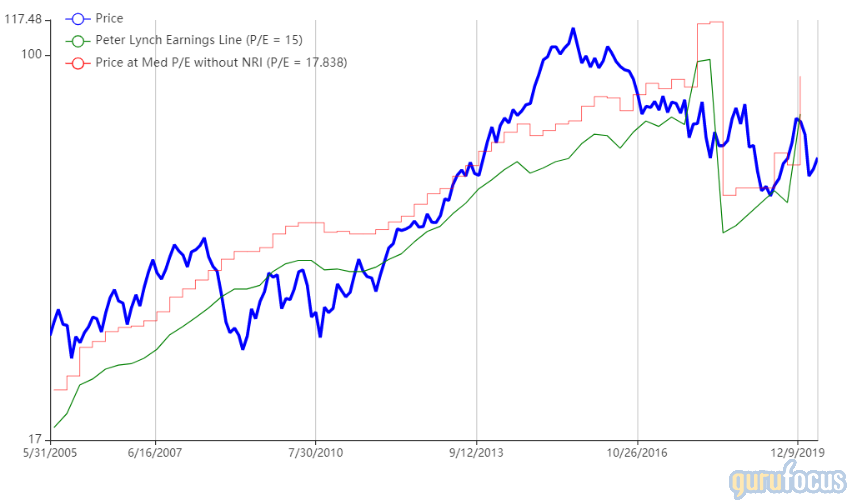

On May 1, shares of CVS Health traded around $59.35 for a market cap of $77.62 billion and a price-earnings ratio of 11.73. The Peter Lynch chart suggests that the stock is likely trading around its fair value.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rating of 8 out of 10 and a business predictability rating of five out of five stars.

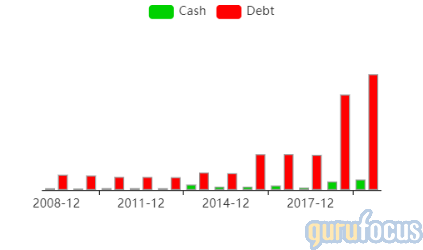

The cash-debt ratio of 0.09 is bottom-tier for the industry, and the Altman Z-Score of 1.9 suggests that the company could encounter financial difficulties.

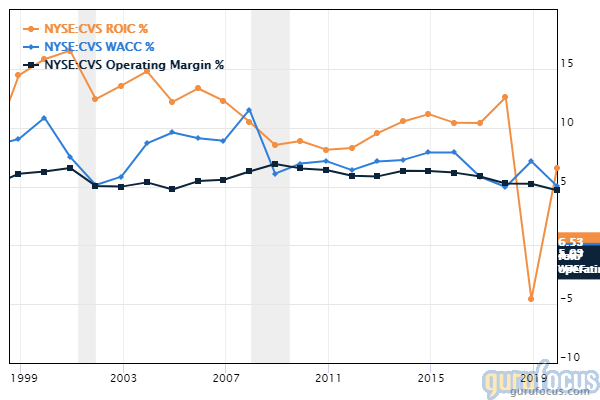

The operating margin of 4.87% is lower than the industry median of 5.5%. Return on invested capital surpassed weighted average cost of capital again in full-year 2019 after tax law changes negatively impacted 2018 results.

Teva Pharmaceutical Industries

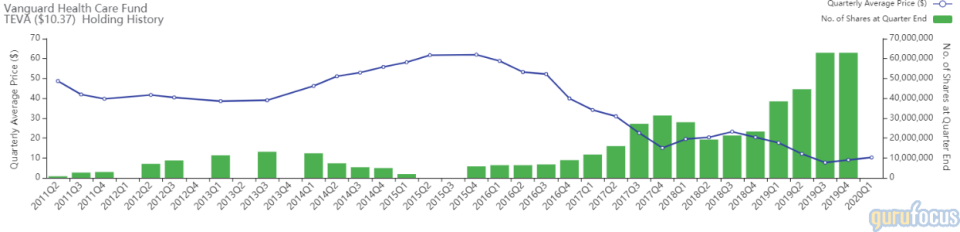

The fund exited its 62,898,811-share stake in Teva Pharmaceutical, impacting the equity portfolio by -1.32%. During the quarter, shares traded around an average price of $10.27.

Teva Pharmaceutical is a multinational pharmaceutical company with dual headquarters in Israel and New Jersey. The company has a wide variety of drug research and development pipelines in the categories of generics, specialty therapeutics and biopharmaceuticals.

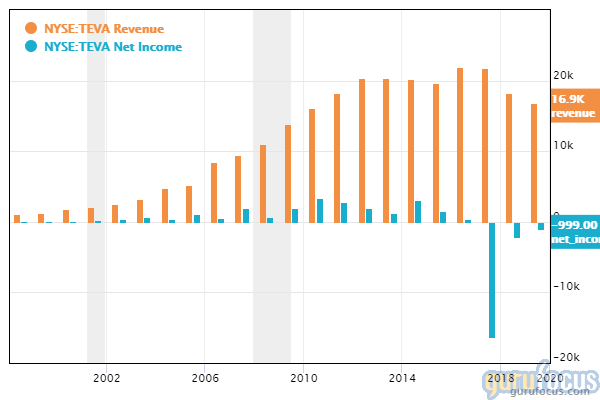

On May 1, shares of Teva Pharmaceuticals traded around $10.10 per share for a market cap of $11.33 billion. The company has reported net losses every year since 2017.

The company has a GuruFocus financial strength rating of 3 out of 10, a profitability rating of 6 out of 10 and a business predictability rating of one out of five stars.

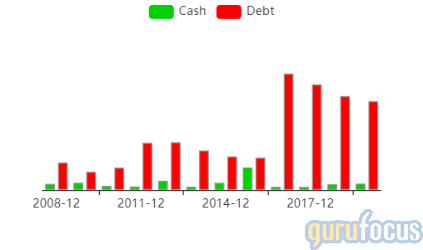

The cash-debt ratio of 0.07 is lower than 91% of competitors, and the current ratio of 0.98 also indicates a weak cash position. The Altman Z-Score of 0.27 suggests that the company could be in danger of bankruptcy within the next two years.

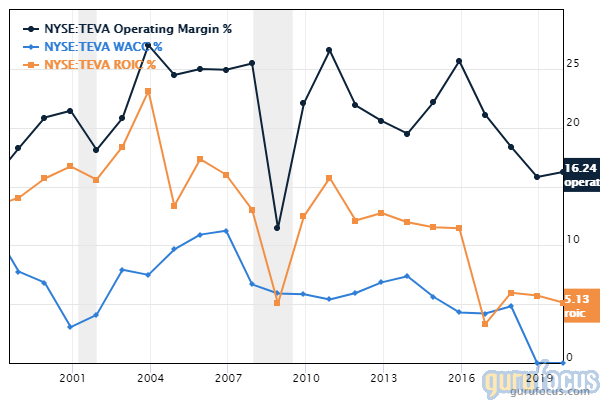

Although the operating margin of 16.24% is higher than 76% of competitors, the number marks a decline from previous years. The ROIC and WACC have also declined, reflecting a downsizing in operations.

Teladoc Health

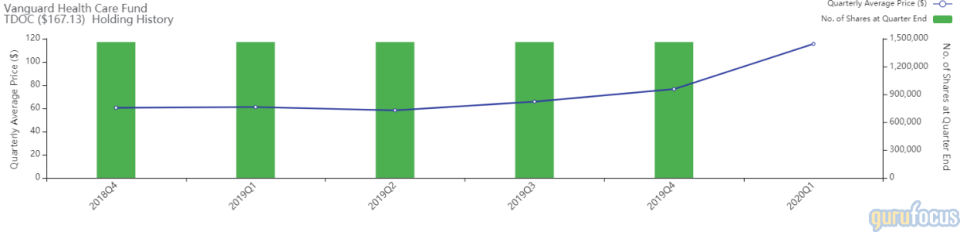

The fund also sold all 1,462,938 of its shares of Teladoc Health, which had a -0.26% impact on the equity portfolio. Shares traded at an average price of $115.45 during the quarter.

Teladoc Health is a multinational telemedicine and virtual health care company based in Harrison, New York. It allows users to connect with health care providers for online appointments, which can often be timelier and more convenient that going to see a doctor in person, especially for at-risk patients.

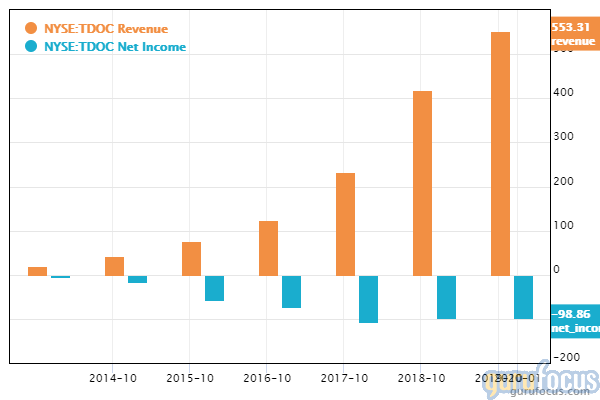

On May 1, shares of Teladoc traded around $167.13 for a market cap of $12.36 billion. Revenue has increased every year since the company went public, though it has yet to turn a net profit.

GuruFocus gives Teladoc a financial strength rating of 5 out of 10 and a profitability rating of 3 out of 10.

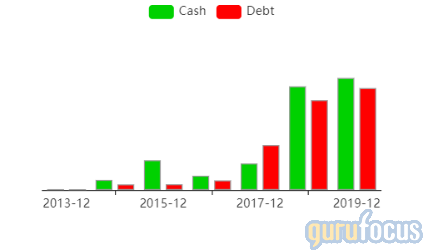

The cash-debt ratio of 1.1 and equity-to-asset ratio of 0.63 are higher than the industry medians, while the Altman Z-Score of 12.88 suggests that the company is not likely to go bankrupt.

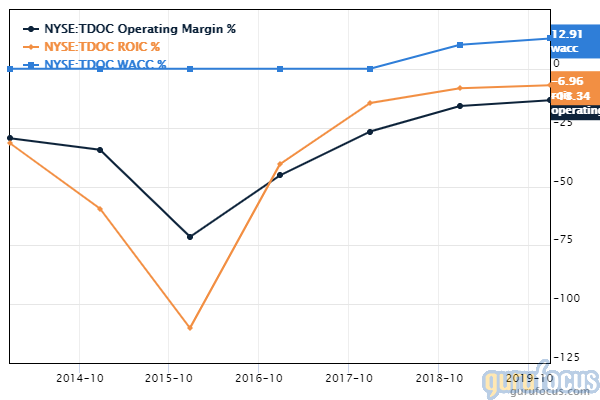

The operating margin of -13.34% is lower than 81% of other companies in the industry. The ROIC is also in the negatives, with a gap of more than 10% between it and the WACC.

Penumbra

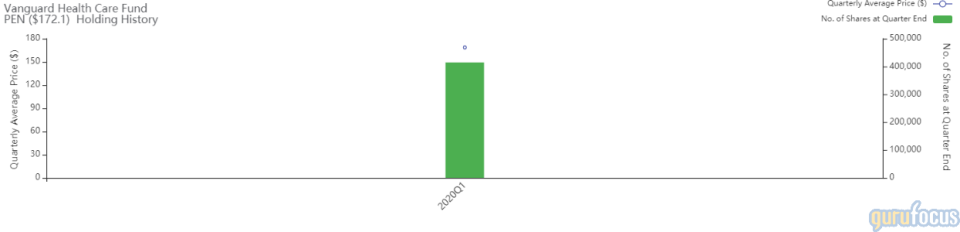

The fund's biggest new buy was for 414,598 shares of Penumbra. The trade had a 0.17% impact on the equity portfolio. During the quarter, shares traded for an average price of $168.63.

Penumbra is a California-based medical devices company that focuses on innovative neuro and vascular therapies to address challenging medical conditions such as deep vein thrombosis and brain and body aneurysms.

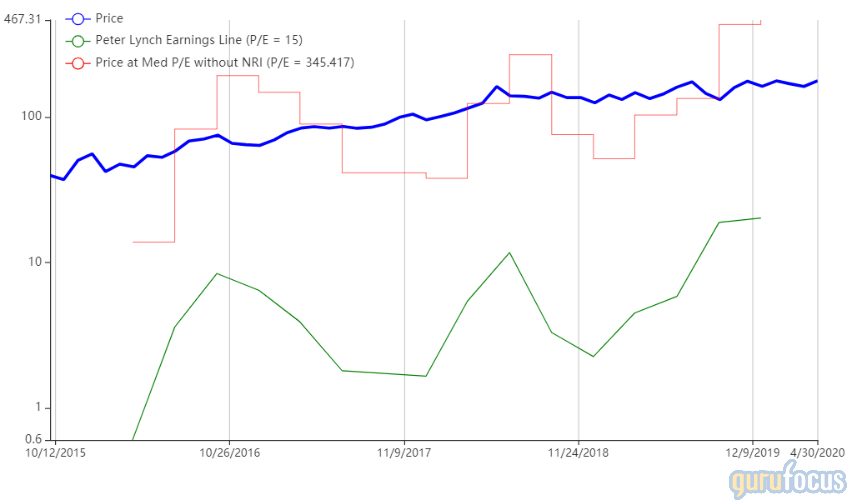

On May 1, shares of Penumbra traded around $171.45 for a market cap of $6 billion and a price-earnings ratio of 129.5. According to the Peter Lynch chart, the company is trading higher than its intrinsic value but lower than the historical median valuation.

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 7 out of 10.

The Altman Z-Score of 22.05 indicates that the company is in almost no danger of bankruptcy, and the equity-to-asset ratio of 0.73 is higher than 70% of competitors. The cash-debt ratio of 2.3 is above the industry median of 1.55.

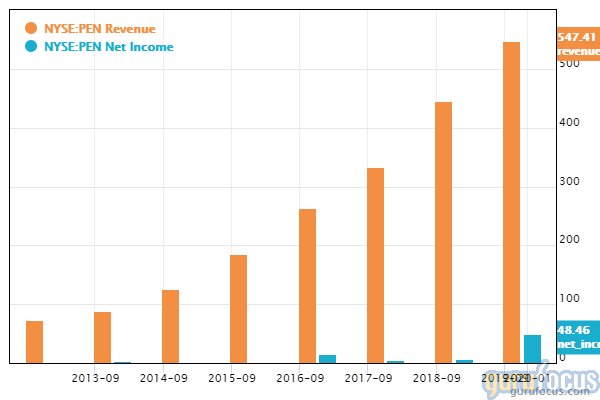

The ROIC of 14.55% exceeds the WACC of 5.52%. The company has shown strong growth in terms of revenue and net income in recent years.

PPD

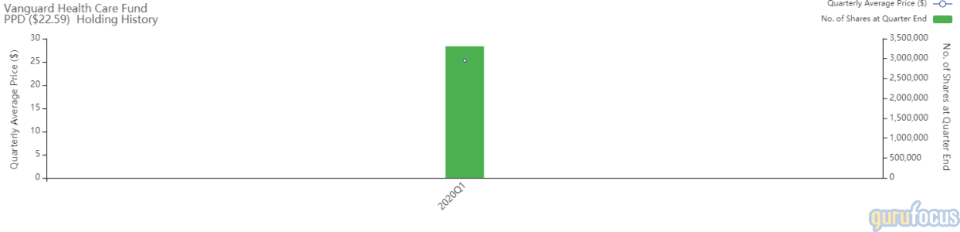

The fund also established a new holding of 3,307,722 shares in PPD, impacting the equity portfolio by 0.15%. During the quarter, shares traded for an average price of $25.27.

Based in Wilmington, North Carolina, PPD is a global contract-based research organization that provides drug development, laboratory and lifecycle management services to help clients streamline every stage of getting medical products to market.

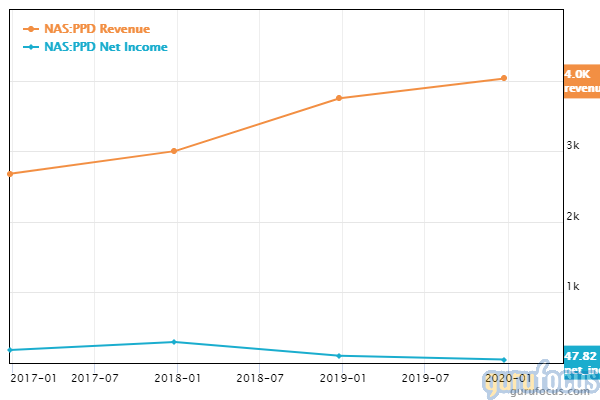

On May 5, PPD shares traded around $22.05 for a market cap of $7.62 billion and a price-earnings ratio of 138.74. The stock price is down approximately 6% from its initial public offering price of $27 in February of 2020.

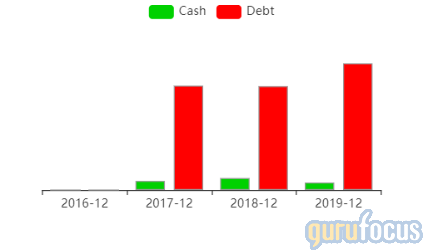

The cash-debt ratio of 0.06 is lower than 91% of competitors, while the equity-to-asset ratio of -0.49 and the current ratio of 0.86 also indicate potential financial weakness.

The operating margin of 12.14% and return on capital of 36.23% place the company ahead of 66% of competitors. The company's brief history has produced a three-year revenue growth rate of 12.9% and a three-year earnings per share (without non-recurring items) decline rate of -34.2%.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Hillman Capital Buys 3 Stocks in 1st Quarter

American Tower Posts Strong Growth on Minimal Covid-19 Impact

Caterpillar Loses Momentum as 1st-Quarter Volumes Decrease

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance