Vancouver home sales tumble, Calgary's slide as rising rates and uncertainty take toll

The aggressive path of interest rate hikes continues to take a toll on Canada’s housing markets with home sales and prices slumping in July.

Vancouver and Calgary both saw declines in home sales as more buyers move to the sidelines and await a better opportunity to jump back into the market. This comes as the Bank of Canada hikes interest rates to combat inflation, including a supersized full percentage rate hike in July.

The number of homes exchanging hands in the Greater Vancouver Area tumbled nearly 23 per cent in July from the month before, with 1,887 units sold. Sales were down 43 per cent from last summer when the Vancouver market was in the midst of a buying frenzy, according to data from the Real Estate Board of Greater Vancouver.

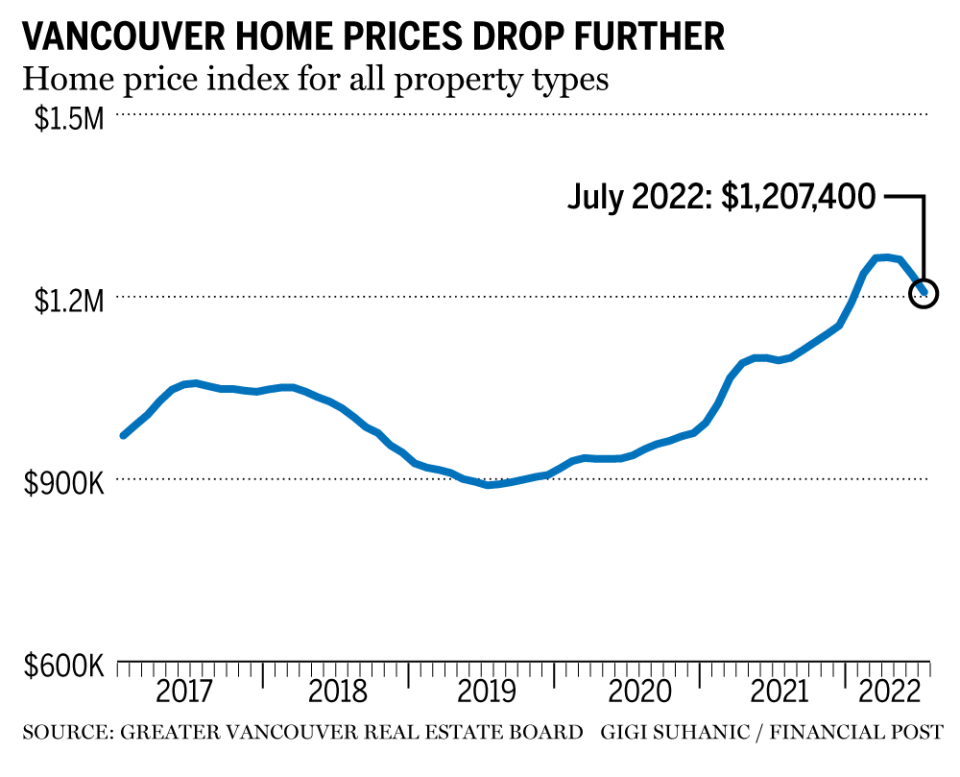

The board’s benchmark price index, which compiles typical property prices in each market, sits at about $1.2 million, a two per cent decrease from June.

“Home buyers are exercising more caution in today’s market in response to rising interest rates and inflationary concerns,” REBGV chair Daniel John said in a press release accompanying the data. “This allowed the selection of homes for sale to increase and prices to edge down in the region over the last three months.”

Calgary home sales slipped for the second straight month with a three per cent decline in July compared to a year earlier, according to data released by the Calgary Real Estate Board on Tuesday. This is a turnaround for the market which saw better performance earlier this year as homebuyers moved from Toronto and Vancouver to seek out more affordable options.

The average price of a home in Calgary reached $491,392 in July, a 0.6 per cent gain from last year.

While many in the real estate industry have blamed rising interest rates for the drop in demand, Leah Zlatkin, LowestRates.ca expert and licensed mortgage broker, said the pause in home buying has more to do with the risk of a recession and overall uncertainty.

“You have to be cautious in assuming that a Bank of Canada overnight rate increase is really impacting the entire market and I don’t think that that’s really what’s causing people’s hesitation,” Zlatkin said. “I think the thing that’s causing people’s hesitation is housing prices dropping and the uncertainty around whether a recession is coming. A job loss is much more impactful to a mortgage payment than the actual rate increase.”

Prices are falling but rents are rising in Canada's paradoxical housing market

FP Answers: Where is the best value in Canada for real estate?

Cancelled Toronto property listings surge as prices come off the boil

Lauren Haw, chief executive officer at Canadian real estate agency Zoocasa, told the Financial Post’s Larysa Harapyn in July that more home buyers are sitting on the sidelines as they wait for more certainty in the market.

“Everyone’s waiting for you to tell them it’s the bottom and then they rush and it becomes a spike back up,” Haw said in a July 12 interview. “So, the real question is going to be: … will we hit a bottom… and it’s good time to buy, which just creates kind of the next run-up? Or are we going to get to the state where it becomes a bit balanced or it’s a prolonged buyers’ market and it takes a few years to recover?”

“Admittedly I do not have a crystal ball,” Haw continued. “But I think for 2022, we’re going to see that it’s going to stay pretty quiet.”

• Email: shughes@postmedia.com | Twitter: StephHughes95

Yahoo Finance

Yahoo Finance