Valmet Corp Leads as Oakmark Intl Small Cap Adjusts Portfolio in Q4

Insight into Oakmark Intl Small Cap (Trades, Portfolio)'s Latest Investment Moves and Top Holdings

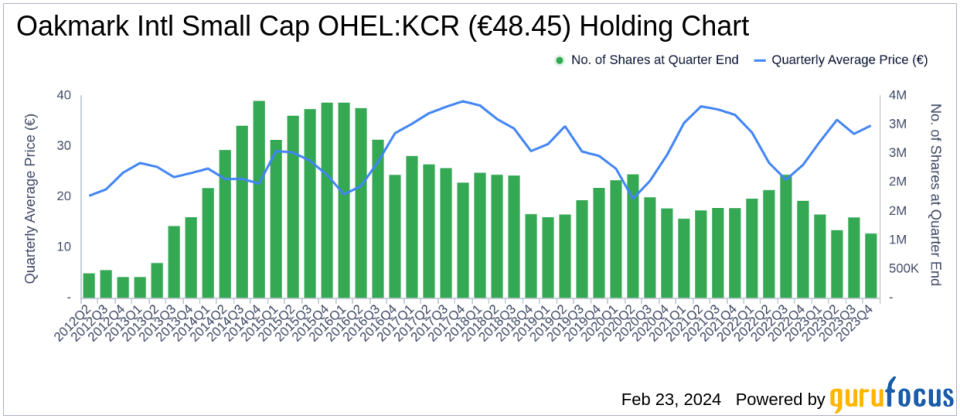

Oakmark Intl Small Cap (Trades, Portfolio), known for its strategic investments in small cap companies, has revealed its N-PORT filing for the fourth quarter of 2023. The fund, which primarily targets businesses with market capitalizations within the range of the S&P EPAC Small Cap Index, is managed with a long-term, value-oriented approach. Oakmark Intl Small Cap (Trades, Portfolio)'s investment philosophy centers on acquiring securities at prices well below their estimated intrinsic value and holding them until the market recognizes their true worth.

Summary of New Buys

Oakmark Intl Small Cap (Trades, Portfolio) expanded its portfolio with the addition of 2 new stocks:

The most significant new holding is Valmet Corp (OHEL:VALMT), with 667,300 shares, making up 1.36% of the portfolio and valued at 19.23 million.

The second addition is Lanxess AG (XTER:LXS), comprising 415,500 shares, which accounts for approximately 0.92% of the portfolio, with a total value of 13.01 million.

Key Position Increases

The fund also bolstered its stakes in 22 existing holdings, with notable increases in:

Wynn Macau Ltd (HKSE:01128), where an additional 13,576,000 shares were acquired, bringing the total to 28,087,600 shares. This represents a substantial 93.55% increase in share count and a 0.79% impact on the current portfolio, valued at HK$23.13 million.

Katitas Co Ltd (TSE:8919), with an additional 698,300 shares, resulting in a total of 983,900 shares. This adjustment marks a significant 244.5% increase in share count, with a total value of 152.75 million.

Summary of Sold Out Positions

In the fourth quarter of 2023, Oakmark Intl Small Cap (Trades, Portfolio) exited 3 holdings:

Kansai Paint Co Ltd (TSE:4613): The fund sold all 690,800 shares, impacting the portfolio by -0.77%.

Talanx AG (XTER:TLX): The complete liquidation of 95,300 shares resulted in a -0.47% portfolio impact.

Key Position Reductions

The fund also reduced its positions in 22 stocks, with significant reductions in:

Vitesco Technologies Group AG (XTER:VTSC) by 183,000 shares, leading to a -57.39% decrease in shares and a -1.17% impact on the portfolio. The stock traded at an average price of 89.85 during the quarter and has seen a -12.03% return over the past 3 months and a 5.18% year-to-date return.

Applus Services SA (XMAD:APPS) by 1,032,600 shares, resulting in a -43.73% reduction in shares and a -0.85% impact on the portfolio. The stock's average trading price was 9.92 for the quarter, with a 15.22% return over the past 3 months and a 14.30% year-to-date return.

Portfolio Overview

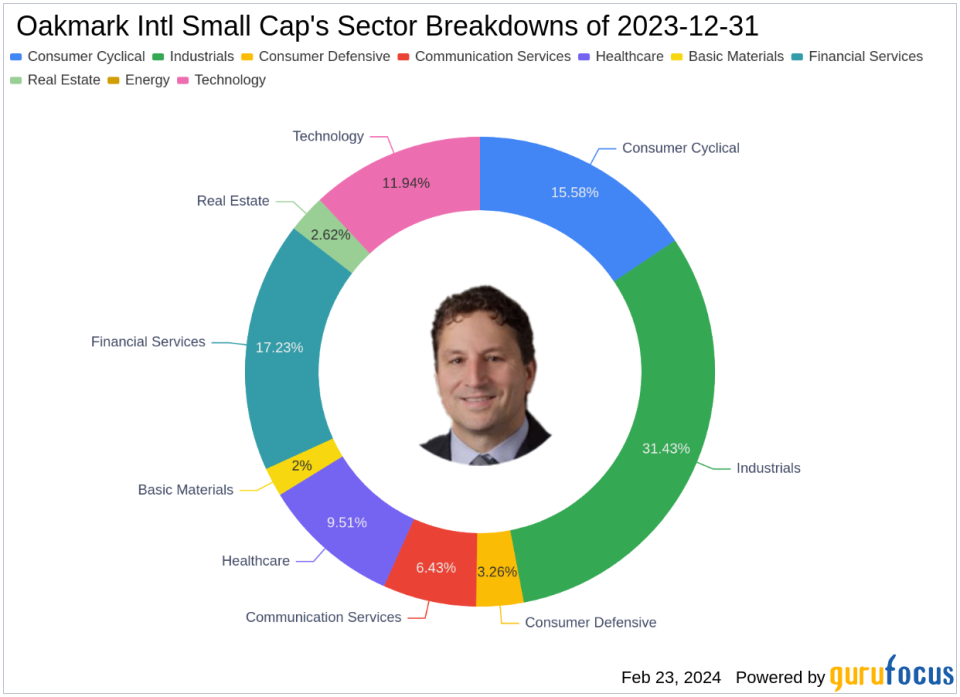

As of the fourth quarter of 2023, Oakmark Intl Small Cap (Trades, Portfolio)'s portfolio consisted of 63 stocks. The top holdings included 3.54% in Konecranes Oyj (OHEL:KCR), 3.37% in Azimut Holding SPA (MIL:AZM), 3.1% in Duerr AG (XTER:DUE), 3.06% in ISS A/S (OCSE:ISS), and 2.98% in Atea ASA (OSL:ATEA). The investments are primarily concentrated across 9 industries, including Industrials, Financial Services, Consumer Cyclical, Technology, Healthcare, Communication Services, Consumer Defensive, Real Estate, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance