Vale (VALE) Bets on Growing Steel Demand & Lower Debt Levels

On Aug 22, we issued an updated research report on Vale S.A. VALE. Rise in global steel production, demand for higher iron ore grade and increased liquidity is likely to strengthen the company’s competency, going forward.

Let’s illustrate these factors in detail.

Rise in Steel Production to Boost Top Line

Steel demand continues to be strong backed by growing global economy, strong machinery and construction sector activity. Chinese central and city governments continue to stringently implement pollution emissions control, leading to higher steel prices and steel margins. Steel-makers continue to look for higher iron ore grade and low alumina iron ore to increase productivity while lowering emissions. In this regard, Vale is well positioned as a major supplier of sinter fines combining high iron and low alumina. It is also a major supplier of pellets.

Steel production is increasing in South East Asia as mills ramp up production and new projects emerge to meet increasing regional steel consumption. Going forward, rise in global steel production will augment demand for iron ore, and in turn help boost Vale’s top-line performance.

Vale on Track to Deliver 2018 Production Target

Despite the nationwide truck drivers’ strike over rising diesel prices in Brazil, Vale achieved record iron ore production and sales in the second quarter 2018. Iron ore production totaled 96.8 million tons (Mt) in the quarter, 4.9 Mt higher than the prior-year quarter. Iron ore and pellets sales totaled 86.5 Mt in second-quarter 2018, 4.8 Mt higher year over year. The company continues to benefit from record high price premiums for its high grade iron ore fines as high grade ore accounted for 77% of its second-quarter iron ore production compared with 68% in 2017.

The company anticipates producing more than 100 Mt per quarter in the second half of 2018 to meet its full year guidance of approximately 390 Mt. The company will be able to achieve this as volumes continue to improve at its S11D mine. The company also delivered a cash cost in line with first-quarter 2018. Vale’s cash cost is projected to be lower than $13 per ton in second-half 2018, benefiting from the competitiveness of growing volumes at S11D, seasonally lower costs and higher production.

Strong Cash Flow to Drive Growth

Vale has been steadily lowering its debt, of late, through increased free cash flow generation. During the second quarter, Vale reduced net debt by $3.4 billion, closing the quarter with net debt of $11.5 billion — the lowest level since the second quarter of 2011. This was made possible by the highest second-quarter free cash flow in 10 years. Over the last 12 months, the company has managed to cut down debt levels by $10 billion. The company is close to its target of $10 billion.

Further, the company announced a share buyback program of $1 billion to be executed within the period of one year. Vale also announced $2.054 billion of shareholder remuneration to be paid in September 2018, its highest remuneration since 2014.

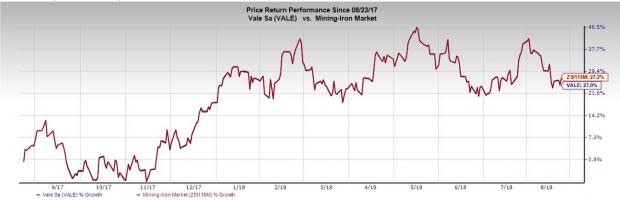

Share Price Performance

Over the past year, Vale’s shares have performed in line with its industry, as both recorded growth of around 27%.

Zacks Rank & Other Stocks to Consider

Vale carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the same sector include KapStone Paper and Packaging Corporation KS, Ingevity Corporation NGVT and Ashland Global Holdings Inc. ASH. While KapStone Paper and Ingevity sport a Zacks Rank #1, Ashland Global carries a Zacks Rank #2.

KapStone Paper and Packaging has a long-term earnings growth rate of 14%. Its shares have gained 64% in the past year.

Ingevity Corporation has a long-term earnings growth rate of 12%. The company’s shares have surged 67% over the past year.

Ashland Global has a long-term earnings growth rate of 10%. The stock has gained 39% in a year’s time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Global Holdings Inc. (ASH) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

KapStone Paper and Packaging Corporation (KS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance