USDJPY aims for the monthly highs

The new week starts for us with the analysis of the USDJPY, where we do have a nice bullish setup. That is something new in October as the 10th month of the year is so far negative for this instrument and up to date, is bringing us a strong decline.

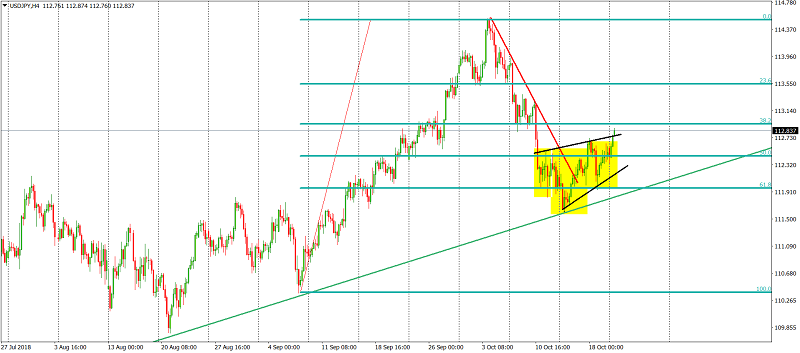

It seems that bad times are over though. First of all, in the previous week, price bounced from the long-term up trendline (green). In addition to that, USDJPY drew a bullish price formation – Inverse Head and Shoulders pattern (yellow). That formation is already active and actually, was activated today, when the price broke the neckline (upper black). Price closing a day above that life will be a confirmation of a positive sentiment on this instrument.

As for the target, well… first we should break the resistance on the 50% Fibonacci and later we should aim for the highs from the beginning of October. Chances that we will get there are quite high.

This article is written by Tomasz Wisniewski, a senior analyst at Alpari Research & Analysis

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance