USDCAD Erases Losses As Oil Price Goes Down

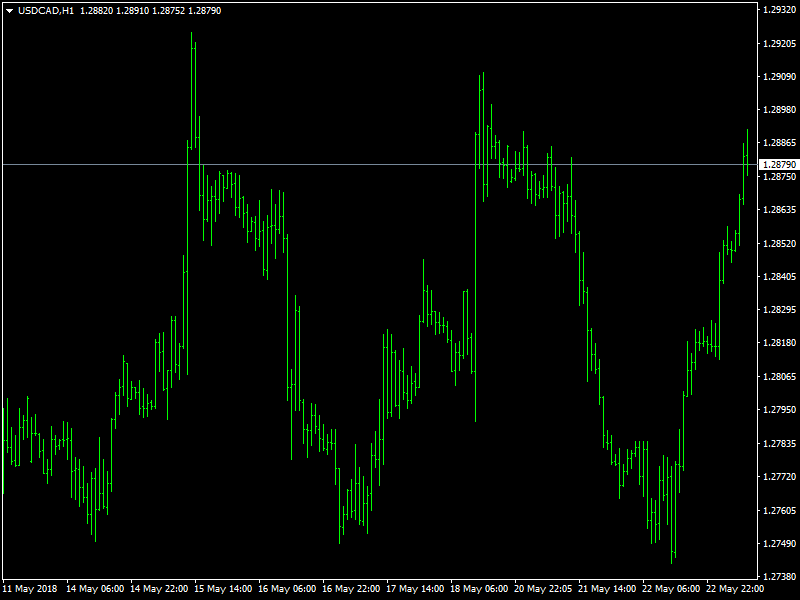

The Loonie traded down in Asia and for the most part of the European session. A couple of hours before the London close, USD/CAD found an intraday low at 1.2750 then rebounded almost 70 pips and is now trading in the 1.2810 region up 0.21% by end of Tuesday’s trading session. Loonie being a commodity linked currency (linked to Crude Oil) is highly affected by performance of Crude Oil in International market. While this change in oil price has helped USDCAD erase yesterday’s losses the intra-day bias still remains neutral. The pair continues to move locked within the wider price band range of 1.2725 to 1.2933 and is has remained within 1.28 handle for majority of today’s Asian market hours.

USDCAD Recovers

When looking at macro calendar, Tuesday saw wholesale data for Canada come out better than expected 1.1% for MOM data while the prediction was at 0.8%. On US markets, while macro calendar results were in line with expectations however they had little impact on market. Canadian calendar has no releases scheduled on Wednesday while Thursday and Friday will see Corporate Profit and Budget balance data however both are expected to have very little impact on Loonie’s momentum unless there is a drastic outcome on either of those updates.

Greenback has been gaining foothold against major global currencies since yesterday’s European session. USD saw additional increase in momentum as US treasury yields made some headway on Tuesday post flat opening on Monday. The next 48 hours is expected to see increased volatility in Greenback’s favor with positive expectations for Inflation data scheduled to release during today’s American market hours and traders are also on look out for FOMC minutes update to look for clues on inflation and economic growth. Crude Oil Inventory and EIA weekly Inventory updates are scheduled to release today and they are also expected to affect momentum for USDCAD pair. Oil price is currently influenced by news of ongoing US sanction on Venezuela, WTIUSD hit 2018 high on Asian market hours on Tuesday but has since eased down and is currently trading around $71 handle. Expected support and resistance for the pair are at 1.2783 / 1.2754 and 1.2899 / 1.2923 respectively.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Futures (GC) Technical Analysis – May 23, 2018 Forecast

E-mini S&P 500 Index (ES) Futures Technical Analysis – May 23, 2018 Forecast

SPINDLE Project Goes in High Gear, to Be Listed on FIVE Cryptocurrency Exchanges

Nobel Laureate Shiller Warns Cryptocurrencies Could Fail Like Other Older Alternative Currencies

Yahoo Finance

Yahoo Finance