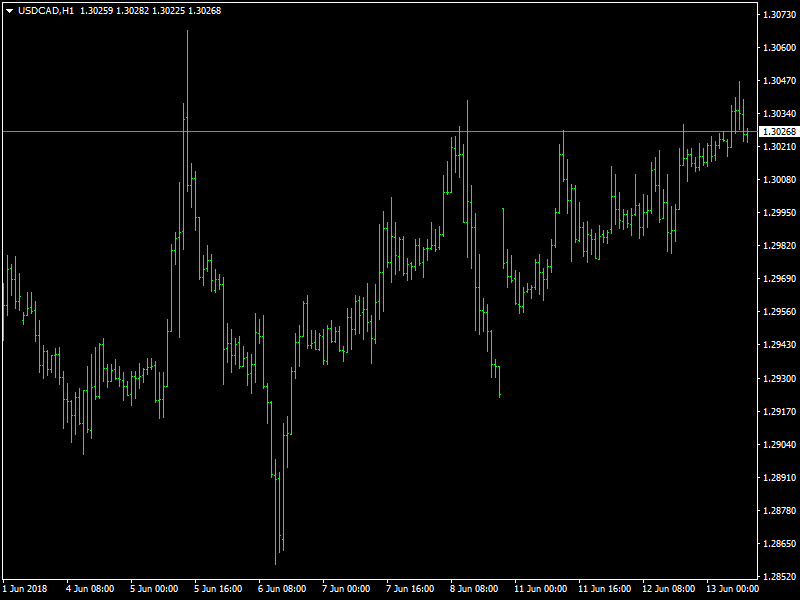

USD/CAD Price Forecast – USD/CAD Holds Fort at 1.30 Ahead of FOMC Meeting

The USDCAD pair has been trading upwards across majority of Asian market hours on Wednesday and the pair has maintained stable momentum around 1.30 price handle. This uptrend movement is strongly supported by positive market sentiment surrounding US Greenback. This positive sentiment is inspired by strong US macro data in recent times and positive outcome from U.S-North Korean summit in Singapore. The recent scuffle in G7 summit that saw U.S President Donald Trump walk out halfway through the meeting and twitter wars have added additional pressure on Canadian Dollar. In retaliation to Trump’s tariff’s on import of steel and Aluminum, Canada has levied tariff on many US goods that includes consumer and industrial products which could affect both economies gravely.

USDCAD Stays Steady

The pair is up for the third day in a row on the back of the FOMC meeting. In less than 12 hours the Fed will announce its decision. A rate hike of 25 bps is widely expected. Recently, rumors that Jerome Powell wanted a press conference on every FOMC meeting also boosted the greenback. In addition, the sideline theme around crude oil prices is collaborating with the lack of traction in CAD, in turn sustaining the up move in spot. Meanwhile CAD remains under pressure in response to uncertainties surrounding the NAFTA negotiations, while monetary policy divergence between the Bank of Canada and the Fed has also come to the fore as of late. In this regard, it is worth noting that US-CA 2-year yield spread has climbed to fresh 1-year tops above 60 pts.

Bulls build on the positive momentum further beyond the key 1.30 psychological mark, reinforcing last week’s rebound from a short-term ascending trend-line support. Short-term technical indicators hold in bullish territory and remain supportive, albeit repositioning trade ahead of today’s highly anticipated FOMC decision could negate bullish expectations. The US dollar now approaches a critical resistance price point at 1.30383 in the 60 minutes price chart and will need to break through this point to progress further up. Expected support and resistance for the pair are at 1.30097 / 1.29905 / 1.29700 and 1.302955 / 1.30383 / 1.30547 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance