USD/CAD Price Forecast – USD Struggles to Hold Fort at 1.32 Handle amid Trade War & NAFTA Talks

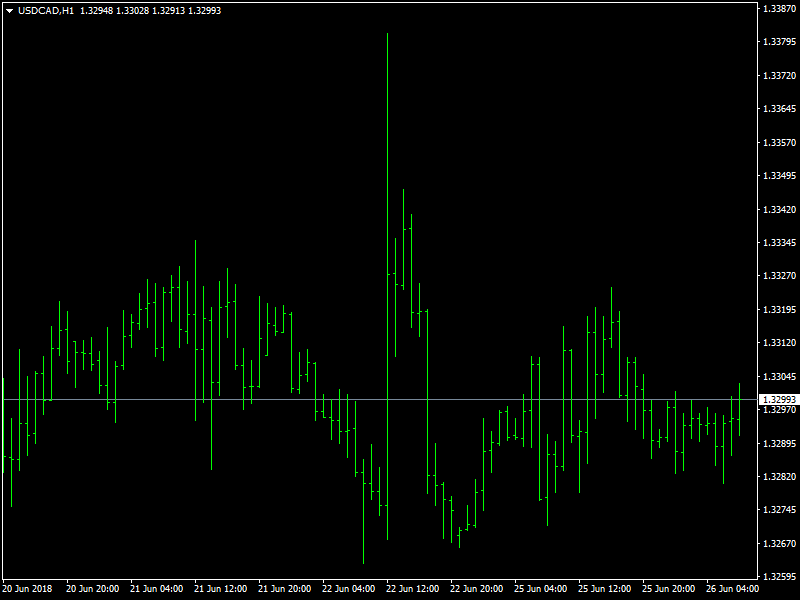

USD/CAD holds a narrow range as Bank of Canada (BoC) Governor Stephen Poloz is slated to speak at the Greater Victoria Chamber of Commerce, and the fresh batch of central bank rhetoric may sway the near-term outlook for the dollar-loonie exchange rate as market participants weigh the outlook for monetary policy. The updates to Canada’s Consumer Price Index (CPI) may push the BoC to adopt a more gradual approach in normalizing monetary policy as it falls short of expectations, and Governor Poloz may attempt to tame expectations for an imminent rate-hike as ‘the Bank will continue to assess the economy’s sensitivity to interest rate movements and the evolution of economic capacity’. Currently the pair holds steady around 1.327 to 1.330 price range with stable support around 1.325 handle. For the pair to gain stability above 1.33 handle it needs to breach resistance around 1.3324 and 1.3378 respectively.

USDCAD In Tight Range

In addition, protectionist threats will be taken even more seriously by Canadian markets and businesses, as rhetoric is now being followed up with action. Finally, the tariffs have effectively precluded a NAFTA deal by the July 1 goal. As a result, the risk of a full-blown trade war is higher, the timeline of NAFTA talks has lengthened and the risk of Article 2205 being invoked (a precursor to a unilateral exit from NAFTA) is growing higher. Despite worsening tensions on trade, we continue to expect the Bank of Canada (BoC) to proceed with a July rate hike. Although economic data has softened of late, the broader backdrop is still in line with the BoC’s forecast from April.

The dollar slipped against the yen in Asian trade on Tuesday, hovering near a two-week low, as worries about an intensifying fight between the United States and its trade partners continued to slash risk appetites. Markets were buffeted by mixed messages from Washington on its international trade stance. CAD is expected to trade soft in European session as surge in crude oil prices has run out of steam. There is a bit of a risk-off feeling this morning in the market which is pushing the U.S. dollar higher against the Canadian dollar. Moving forward CAD investors will look for speech by Stephen Poloz on Thursday and GDP data on Friday before which the pair will run based on momentum on US Greenback against major global currencies.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Analysis – June 26, 2018 Forecast

Technical Update For EUR/USD, USD/JPY, NZD/USD & USD/CHF: 26.06.2018

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – June 26, 2018 Forecast

Where is Blockchain Technology Going? An Analysis by Guy Galboiz

Stock Market Rally Today, Could Erase Monday’s Over-reactive Fears

Yahoo Finance

Yahoo Finance