USD/CAD Fundamental Analysis – week of November 20, 2017

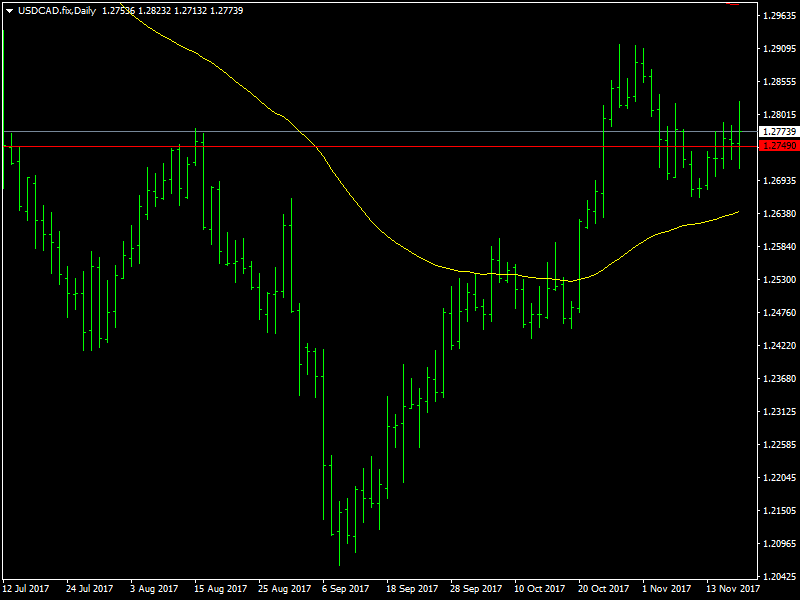

The USDCAD has been caught in a very tight range over the last couple of weeks. The support near the 1.2660 region has been seeing a lot of buying and hence even some weakness in the dollar has not been able to help the pair to break through the bottom of the range. This has been the strong support over the last couple of weeks and with both the currencies in the pair continuing to hold steady, we have had very little action in the pair during this period.

USDCAD Caught in Tight Range

The dollar has been steady at best with its strength waxing and waning over the last couple of weeks. There have not been any fundamental drivers for the movement of the dollar in any specific direction. The focus of the markets seems to be on the rate hike from the Fed in December and till now, this is something that is open to question. The incoming data from the US has been pretty choppy with no signs of stabilisation and the Fed members seem to be as confused as the rest of the market on what they need to do, come December.

On the other hand, the CAD has been helped by the steadiness of the oil prices. The prices are near the highs of the range due to the crisis in Saudi Arabia and this has been lending support to the CAD. The fact that there would not be any rate hike in Canada for the next few months has already been priced in by the markets. Last week saw the release of the inflation data from both the US and Canada and both of these data came in as per expectations thus ensuring that neither currency had anything to base its moves on.

Looking ahead to the upcoming week, we have a speech from Yellen and the FOMC minutes as far as the US data is concerned. The market would continue to watch these events closely for any signs of the impending rate hike from the US. We also have the retail sales data from Canada to be released later in the week and we expect that data to hold steady as it has been over the last few weeks. We hope that some clarity would emerge on the rate hike from the Fed in the coming week which would help the USDCAD to break through its range.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance