USD/CAD Fundamental Analysis – week of September 25, 2017

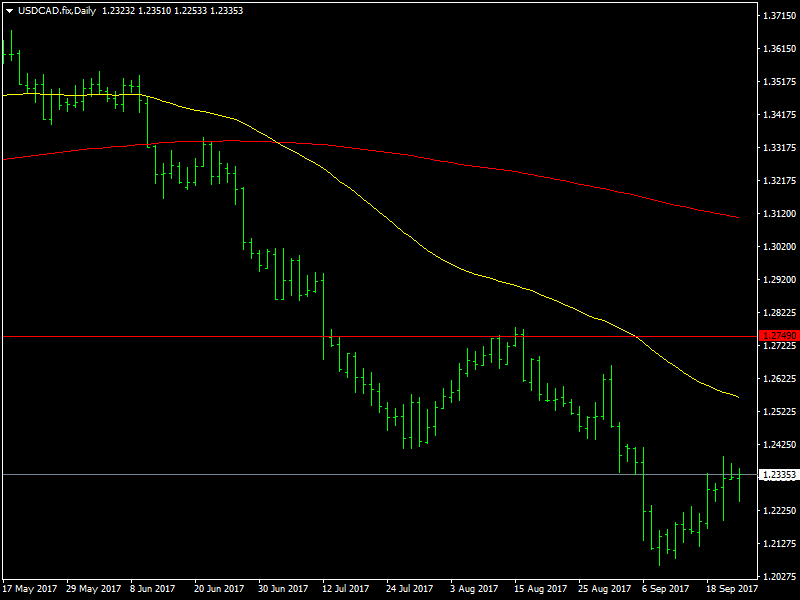

It was a kind of a breakout week for the USDCAD pair, the signs of which were seen in the week earlier and it could also be a sign of things to come. The pair has bounced positively from the lows at around the 1.2060 region and that bounce has been strong and steady so far. We had warned of a bounce from this region and we have been proved right and the resilience shown by the bounce is also something that needs to be noted.

USDCAD Has a Strong and Steady Bounce

The bounce has coincided with the strength of the dollar which has managed to hold steady across the board. The dollar finally found some help from the Fed which released a positive and hawkish dot plot as part of the FOMC announcement. The dot plot showed that more of the Fed members continue to lean towards a rate hike in December. This was a matter of uncertainty for the market as they felt that the choppy incoming data over the last few weeks would have forced the Fed to push the next rate hike to next year. But with the door for the hike still open, the dollar bulls managed to lend some support to the dollar through the week.

The CAD drew some of its own strength from the strong and steady oil prices which continued to trade above $50 for most of the week. The BOC has also been hawkish of late and it looks as though they would also hike one more time before the end of the year. This sought to neutralise the strength in the dollar and that is why the bounce has been subdued so far. The pair trades clearly above 1.2300 to close the week and the upcoming week is likely to lend even more support for the dollar.

Looking ahead at the coming week, it is the last week of the month and we have the GDP data from the US which will give an additional glimpse of how well the US economy is doing. Also, the Fed has made it clear that the rate hike would depend on the incoming data and hence each piece of incoming data would be crucial. The USDCAD is likely to continue its bounce with the next target being around the 1.2480 region. On the downside, the lows of the range at the 1.2060 region should lend some solid support.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance