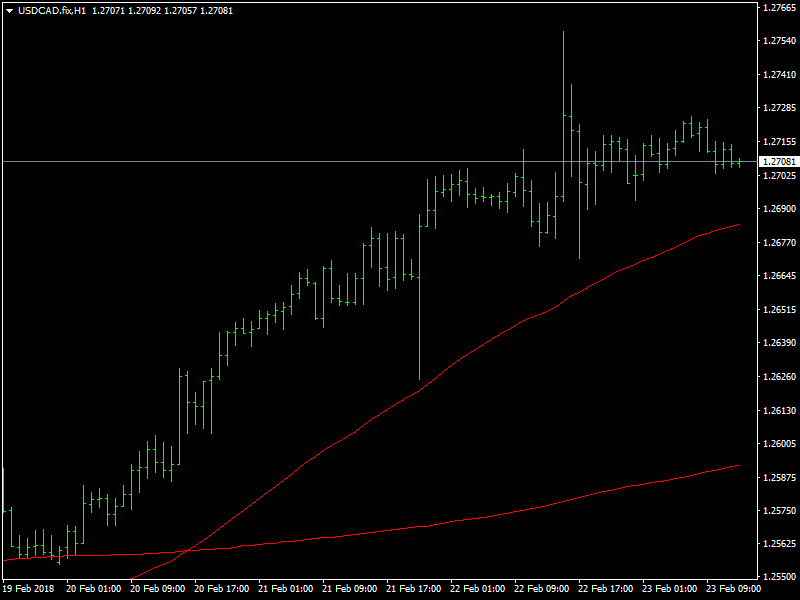

USD/CAD Daily Fundamental Forecast – February 23, 2018

The USDCAD pair it set to move towards the target of 1.28 as the combination of CAD weakness and dollar strength has been working in tandem in pushing the bull run along. The pair broke through the 1.27 region cleanly to reach as higher as 1.2760 yesterday. Though there has been a small correction since then, the pair has been able to hold above the 1.27 region as of this writing which should set it up for another assault on the 1.28 region.

USDCAD Moves Higher

The pair has been clearly buoyed by the strength in the dollar which has been the market focus since the beginning of the week. The dollar strength has come about due to a bullish Fed which gave hints in its minutes from last month that it could be looking at even more than 3 rate hikes during the course of the year as long as the incoming data continues to come in in a strong manner.

The CAD, on the other hand, has been on the backfoot over the last few weeks as the data has not been as strong as the BOC would like it to be. The BOC, on its part, has been hawkish with its outlook and has also tried to help the economy along by pushing in the rate hikes even before the market expects them to happen but for them to continue to do that, they would need the incoming data to be strong. If the data begins to become weak, then it places the BOC under pressure and hence the CAD would come under pressure as well. Yesterday, we saw the retail sales data from Canada come in much weaker than expected and this pushed back the CAD.

Looking ahead to the rest of the day, we do not have any major economic data from the US but we have the inflation data in the form of CPI from Canada today and this is also likely to bring in a lot of volatility in the pair. If it comes out to be weaker than expected, then the pair should be well on its way to 1.28 and beyond.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance